After initially launching GPT-1 in June 2018, OpenAI released ChatGPT in November 2022, gaining over a million users in five days and creating unprecedented interest in generative AI and large language models (LLMs). ChatGPT was not only popular with everyday users, reaching an estimated 180 million monthly active users as of February 2024, and becoming the fastest-growing consumer app of all time, but also embraced by businesses, with 49% of companies using the tool as of April 2023 and a further 30% planning to adopt it in the future. Interest in AI tools in general is growing amongst business leaders; 40% of C-suite executives in an August 2023 survey reported that they were planning to increase their level of investment in AI.

Customer service is one place where businesses are adopting generative AI to increase productivity. From 2020 to 2024, the proportion of customer service professionals using AI jumped from 24% to 45%. There are several ways that businesses can leverage AI in their customer service, such as building chatbots to answer customer inquiries, analyzing customer sentiment, providing personalized recommendations, and routing inquiries to the appropriate channels. Employee burnout is a major problem that affects customer service professionals. Turnover rates in places like call centers, for example, average between 30-45% annually. AI can help mitigate this by making the job less stressful and more efficient.

Ada is a company that offers an AI-powered platform designed to automate customer service interactions in order to improve customer satisfaction and reduce the workload on human customer service professionals. Its platform uses what the company calls a "Reasoning Engine" to power an AI agent that can resolve customer inquiries, answer questions, and even upsell products. The company aims to make AI-powered customer service more accessible to businesses with what it describes as its “fully stocked, AI-powered customer service automation platform”, which is a no-code platform that allows businesses to customize, train, and deploy their own AI-powered customer service chatbots. It has focused on AI and natural language processing since its founding in 2016 and has adjusted to the growth of generative AI by integrating GPT-3 and other LLMs as early as January 2023.

Founding Story

While Ada was founded in 2016, it was not the first startup experience for co-founders Mike Murchison (CEO) and David Hariri (designer/developer).

The duo had followed similar professional paths, graduating from Canadian universities and briefly working at a corporate non-tech company before fully pivoting to the startup world. Hariri worked as a designer and developer for Canadian-based startup Teehan+Lax for over a year, which was eventually acquired by Meta.

Murchison, on the other hand, began his journey into entrepreneurship as an undergraduate after surviving a traumatic brain injury during his freshman year. The initial diagnosis following the injury was that he would have limited cognitive function and short-term memory for life, which caused him to drop out of school to focus on his recovery, during which he worked with a world-class medical team. He was determined through this process to prove his diagnosis wrong.

This experience also gave him an interest in cognition, which caused him to study cognitive science, psychology, and human-computer interaction when he returned to complete his undergraduate degree at the University of Toronto. While at school, Murchison was named to The Next 36 cohort, a group of high-potential Canadian students interested in entrepreneurship, and co-founded a few startup-related ventures, including a startup incubator, a restaurant recommendation platform, and a technology consulting company for F500 clients.

In 2014, Murchison and Hariri began working together on their first startup, Volley, a social networking platform for connecting like-minded founders, developers, designers, and other creators in tech. Volley received over $500K in funding from Version One Ventures and Fastbreak Ventures. However, struggled to scale due to the high number of customer service inquiries, which became too high to keep up with.

Realizing that customer service was a universal challenge for businesses, Murchison and Hariri pivoted to customer service software. The duo spent a year conducting field research by working as customer service agents for seven different companies, holding off on developing a solution until they fully understood the challenges of working in customer service. They discovered that about 30% of customer inquiries were repetitive and that fellow agents found current customer service platforms to be “poor quality” and unable to scale.

Murchison and Hariri then began secretly running the first version of Ada software for one of the companies, giving their non-technical customer service colleagues a simple AI system to help them with their tasks. It was a success — their managers didn’t mind, their colleagues could help more customers, and customers couldn’t tell the difference between AI and manual responses. This gave Murchison and Hariri the conviction to continue building Ada (named after the world’s first programmer, Ada Lovelace) into the billion-dollar startup it is today.

Product

Ada allows large businesses to build and customize AI-powered customer service chatbots to streamline the customer experience. Its drag-and-drop interface empowers people without technical skills to create and deploy these bots, which can not only quickly resolve consumer inquiries but also increase revenue by enabling booking and payments through chat. Ada offers two types of customer service chatbots that businesses can build: a generative “AI agent” and a traditional scripted bot using natural language understanding.

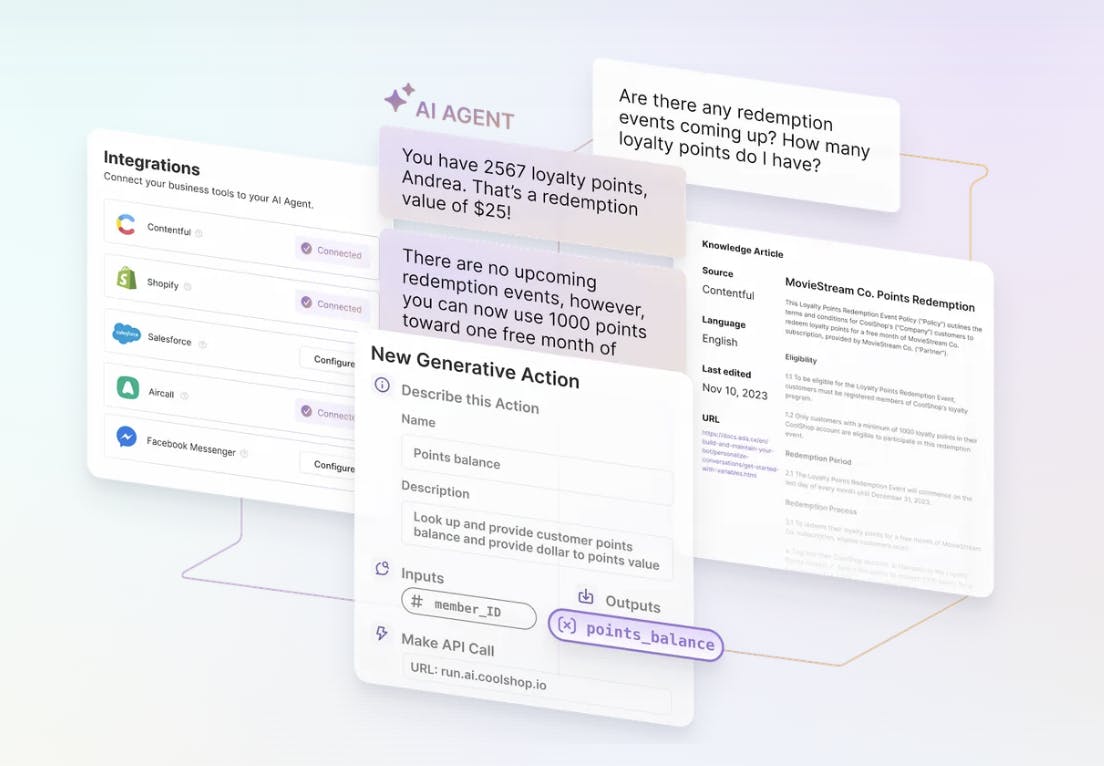

AI Agent

Source: Ada

Ada’s AI agent uses models from OpenAI and its proprietary Reasoning Engine to generate customized responses to customer inquiries, with key enhancements that differentiate it from simple, general-purpose LLMs like ChatGPT. For instance, Ada’s AI agents can be customized to a business’s specific needs, as they can be directed to use a certain tone and company-specific terms to match its brand persona. Responses are drawn from custom knowledge bases provided by each business, ensuring that responses can accurately answer customer queries. Businesses can also provide feedback to further train their custom AI agents, measure their performance and accuracy, and identify common conversation topics.

Another key differentiator is that Ada has safety mechanisms, such as Reasoning Logs, which allow businesses to trace the data, actions, and guidance that the AI agent uses to resolve an inquiry, and proprietary safety and accuracy checks run by its Customer Service LLM. These checks prevent toxic inquiries from being answered and prevent responses that do not meet Ada’s bar for safety, relevancy, and accuracy from reaching customers. Finally, Ada’s AI bots are simple to build through its drag-and-drop platform and support for low-code or no-code integrations.

Scripted Chatbot

Ada also offers traditional, scripted chatbots that use Ada’s proprietary Natural Language Understanding (NLU) to determine how to answer customer inquiries. Its drag-and-drop platform makes it accessible for customer service staff without technical experience to “hard code” these bots, which still include API integration and quality assurance capabilities. Additionally, businesses can perform A/B testing by testing different versions of responses and their resulting performance. While the responses themselves are not generated by LLMs, the scripted chatbots can be used with generative AI, which may suggest further training questions, increasing builder efficiency, and auto-complete suggested inquiries as customers type, making the customer experience more efficient.

Performance Analytics

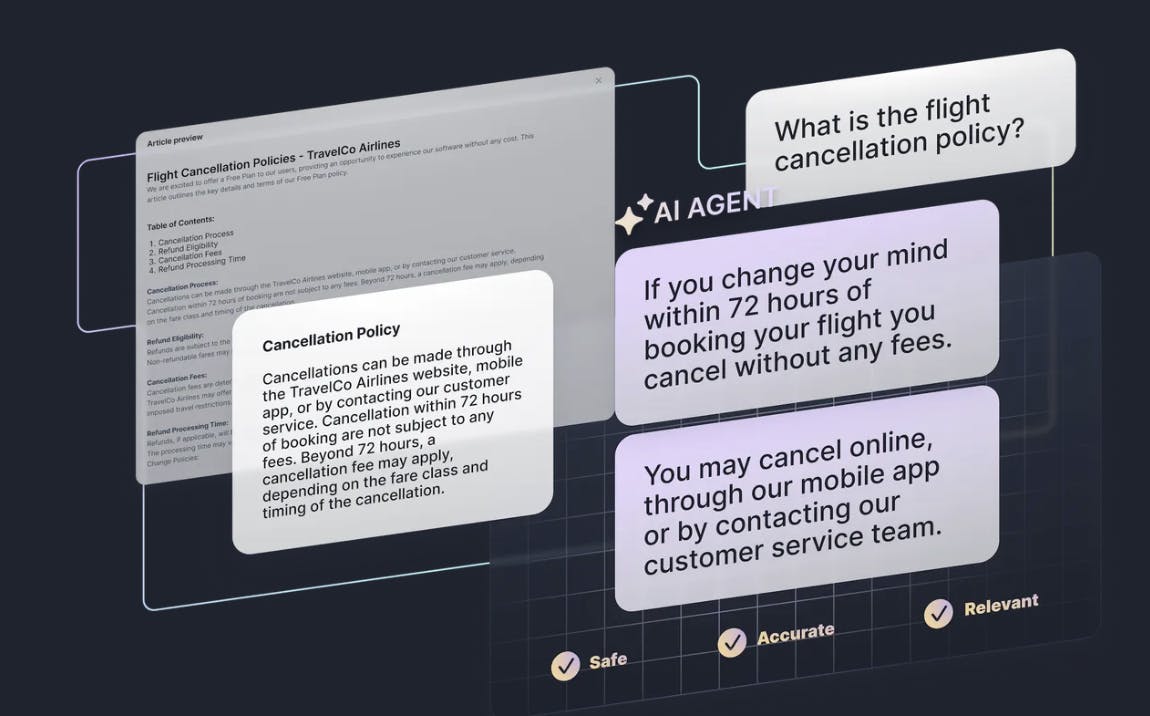

Source: Ada

Both the AI agent and scripted chatbot come with AI-powered quality assurance (QA) and analytics tools. They use Ada’s proprietary Automated Resolution measurement system to assess responses on three metrics: accuracy, relevancy, and safety. The system can also detect whether responses were successfully resolved by the chatbot, identify topics that are currently the most difficult to resolve, and track the impact of the chatbots on important metrics.

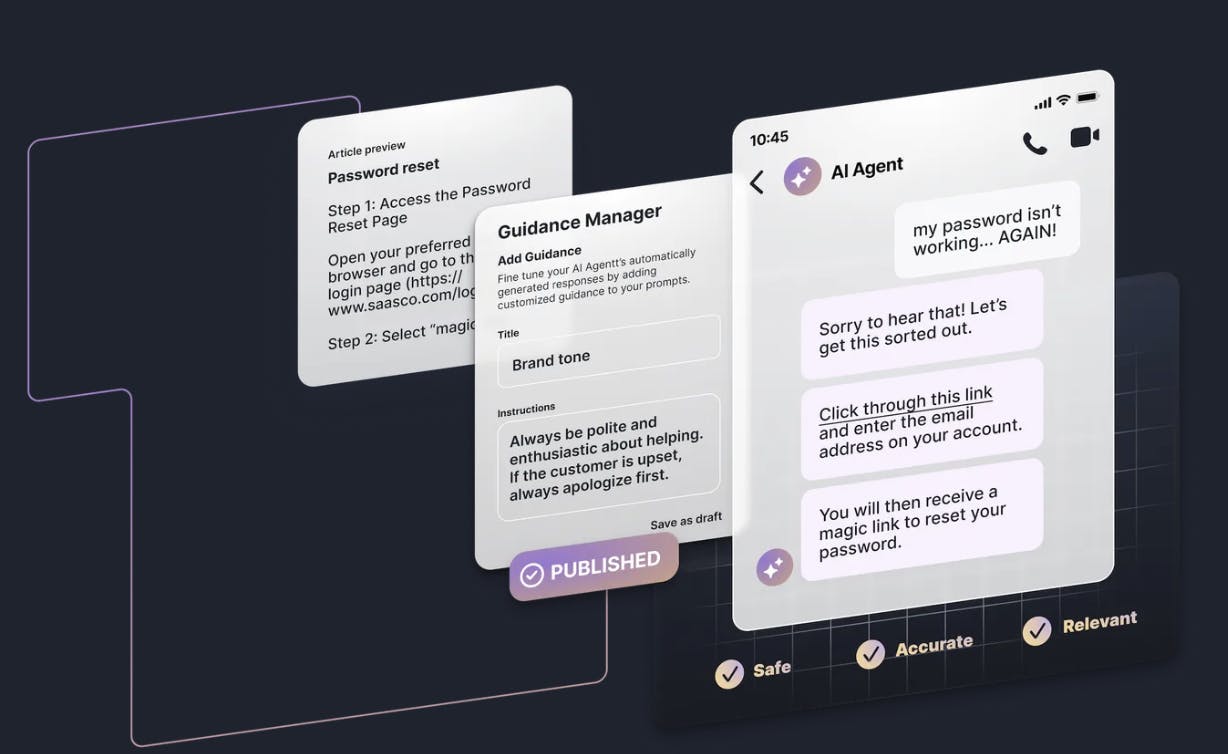

Coaching

Source: Ada

Businesses can also “coach” or finetune the AI agent to meet their individual needs, as they can write custom guidances for the model. They can also add manual rules to help guide responses, read through a Reasoning Log that shows the steps the model took to produce a response, and provide the model with feedback on whether it properly resolved a conversation. In late 2023, Murchison predicted that this coaching capability may even eventually become the most valuable aspect of Ada.

Multi-Channel Support

Both types of chatbots offer support through both digital and voice channels. Additionally, businesses can embed Ada in their web chat and mobile apps, as well as deploy Ada in social media platforms like Facebook Messenger, WhatsApp, Instagram, and Twitter. Ada is also supported via SMS and Voice, and email integrations are also currently in the works. Both chatbot types also allow conversations to be handed off, or escalated, to human agents, as well as create tickets for future support.

Market

Customer

As of April 2024, Ada served over 350 businesses and has automated 4.2 billion conversations with customers. According to its website, notable customers include companies like Meta, Square, Mailchimp, Verizon, Shopify, Canva, Yeti, and Afterpay.

Source: Ada

Ada says it has been able to resolve up to 77% of conversations with automation, thereby significantly reducing the need for human customer service support. Some customers have estimated that they have been able to achieve significant savings by using Ada; BFA, for instance, reports $2.7 million in annual savings.

While many of Ada’s key customers are large companies that deal with a large volume of service requests, Ada’s “pay-per-resolved-conversation” pricing model makes it accessible to smaller companies as well. Additionally, Ada’s no-code interface allows customer service teams to deploy their own chatbots without any technical resources, which also increases its ease of use for smaller companies.

Market Size

Generative AI is proving to be a growth driver in the global customer experience management market, which was valued at $12 billion in 2023 and is projected to grow at a CAGR of 15.4% to reach $32.9 billion by 2030. AI is disrupting traditional customer service software, in which companies use rudimentary bots that result in a low-resolution rate and often require costly human intervention.

The quality of these chatbots has created a largely unsatisfying customer experience; a 2023 survey found that 90% of customers prefer to interact with human customer service agents than these bots. AI-powered automation helps bridge this gap, especially given a potential shortage of customer agents in recent years, and high turnover rates of up to 45% for agents working at inbound customer service call centers in 2024.

Competition

There are already several players in the customer service space, which largely fall under three categories: other AI startups, incumbent big tech companies with chatbot products, and contact center as a service (CCaaS) platforms.

Other AI Startups

Intercom: Founded in 2011 and backed by investors like Kleiner Perkins, Bessemer Venture Partners, Index Ventures, Jack Dorsey, and Mark Zuckerberg, Intercom is an AI customer service solution that centralizes major features, such as a support chatbot, help desk/ticket inbox, customer onboarding program, and an agent support platform. Intercom raised a $125 million Series D in March 2018 from Kleiner Perkins at a $1.3 billion valuation and the company has raised $240.8 million in total funding as of April 2024.

One difference between Ada and Intercom is that the latter’s focus on AI is relatively new—it experimented with some AI features beginning in 2018, but it wasn’t until 2023 that Intercom released an AI-powered customer service chatbot, Fin. Its chatbot, Fin, was only launched after the release of GPT-4 in early 2023 after the team was confident that the new iteration of the large-language model was powerful enough to minimize hallucinations. However, some Intercom employees have even been critical of how Intercom has navigated its pivot to AI, claiming that it’s de-prioritized resources like employee support groups.

Netomi: Y Combinator-backed startup Netomi has been focused on AI-powered chat since its founding in 2015. Netomi offers an integrated customer service platform that uses machine learning to send personalized messages to customers, determine potential areas of automation, and provide comprehensive analytics. It can also leverage a customer’s previous history and loyalty to personalize their messages. Netomi has raised a total of $52 million in funding as of April 2024 and was valued at $210 million at the time of its $30 million Series B in November 2021.

Big Tech Companies

While customer service assistants are only one of the many products they offer, larger incumbents have the resources to develop in-house AI chatbots that compete with chatbot-focused startups. Notably, Oracle, IBM, and Salesforce offer their own AI-powered customer service suites.

Oracle: In 2018, Oracle launched its Digital Assistant, which, like Ada, allows companies to build AI-powered customer service agents and examine insights. Oracle Digital Assistant is just one of the many tools under the larger umbrella of Oracle Cloud Infrastructure. Its pay-per-service request model requires customers to use general OCI credits, which is convenient for attracting customers who already use other OCI tools. However, one downside of Oracle Digital Assistant is it appears to lack advanced LLM training and customization abilities, and only has limited few-shot learning training support.

IBM: While IBM has notably had a strong focus on AI, given its launch of Watson in 2011, it wasn’t until 2021 that it launched watsonx Assistant, a sophisticated no-code tool for building AI voice agents and chatbots. One key feature of the watsonX Assistant is that it provides retrieval-augmented generation capabilities for citing company webpages and resources in its chat responses to promote accuracy and trustworthiness. Similar to other AI customer service tools, it offers detailed analytics, classifies inquiries by category, and identifies common blockers. However, its pricing model is unique in that companies are not charged per interaction or request but per “monthly active user,” and in its middle tier, each active user costs up to $0.14. Therefore, this model may be less ideal for companies with customers who only occasionally contact customer support, such as airlines, but a better fit for others whose customers frequently utilize support resources.

Salesforce: Salesforce has always focused largely on customer service, as its Service Cloud, a suite of customer service tools, was first launched in 2009. In 2016, Salesforce launched Einstein, its AI model for customer relationship management (CRM), which now powers Service Cloud’s AI tools, which include chatbots that draw on custom knowledge bases to form answers, case-routing, and search functionality. While Salesforce has the advantage of being a leader in CRM technologies, its pricing model is relatively complex and pricy, bundling its AI chatbots with other CRM features and charging per user. However, Salesforce also serves as one of Ada’s partners, and Ada customers can use Salesforce integrations to help resolve inquiries.

CCaaS Companies

The final category of competitors is CCaaS companies, which offer all-in-one, cloud-based platforms to replace traditional call centers. These platforms often support common channels of communication, like phone calls, texts, emails, and web chats. In 2023, NICE, AWS, and Genesys were market leaders in CCaS, and also notably adopted new AI and cloud technologies. While CCaaS companies do not solely focus on customer service chatbots or integrating AI, they still compete with more chatbot-focused companies like Ada for customers who need more modern customer service technologies.

Business Model

Ada has historically charged its customers per customer service conversation. However, as of October 2023, it was charging per resolved conversation, which it describes as “outcome-based pricing”. Ada uses automated resolution to detect whether a customer conversation was successfully resolved by the chatbot, and other conversations that require agent assistance will not be charged. CEO Mike Murchison describes the pricing model as a testament to Ada’s long-term vision for prioritizing performance and customer value over short-term profitability.

However, with a conversation or resolution-based model, business performance is dependent on two major factors: first, the state of the overall market, and, second, the pricing of API calls. Therefore, Ada’s profitability is highly sensitive to its customers’ success. Because Ada relies on third-party AI APIs from OpenAI and Google, in which request incurs a small cost, its profits also depend on the price of API calls, as well as, how many messages customers must send a chatbot to resolve their conversations.

Traction

In 2018, Ada reportedly generated $4 million in the past fiscal year with just 100 clients. As of April 2024, the company has over 350 customers. In 2020, Ada was not yet profitable but experienced annual recurring revenue growth (ARR), with its ARR tripling in 2018 and 2019. In 2023, Ada was listed on the 2023 Deloitte North America Technology Fast 500 list for achieving revenue growth of 528% from 2019 to 2022. Ada was also named as a finalist for the 2023 CX Award’s Best Use of AI category.

Valuation

In May 2021, Ada raised a $130 million Series C led by Spark Capital, with participation from Tiger Global. This round brought its overall valuation to $1.2 billion and its total funding to $190.6 million. Notable investors in Ada from previous rounds include Accel and Bessemer.

Key Opportunities

LLM Advancements

Ada can increase its growth by leveraging new advances in LLM technology. For instance, retrieval-augmented generation (RAG) is a novel technique for improving accuracy, increasing trustworthiness, and reducing hallucinations by grounding model-generated responses on information from external sources. While Ada already uses RAG to extract information from companies’ unique knowledge bases, it could extend its use of RAG to incorporate citations in its chat responses, pointing customers to the companies’ links and websites with relevant information and allowing them to cross-check the AI-generated responses. This could increase the resolution rate, and thus, ROI for companies and profits for Ada. Besides further using RAG, Ada could also introduce more powerful fine-tuning capabilities that allow companies to tailor their chatbots to their specific needs.

Diversifying Revenue

In a 2019 interview, Murchison noted that Ada’s AI-powered chatbot also suggests products and services that can be purchased inside the conversation. By handling payments and bookings with integrations, Ada empowers businesses to use customer support chats to even increase their revenues. Therefore, Ada could potentially leverage this capability as a source of additional revenue, potentially taking a small portion of each successful interaction. As of October 2023, based on how Ada describes its pricing plan, it seems that clients are only charged based on resolved conversations, so this could be a potential way for Ada to increase its own revenue and offset the cost of expensive API calls.

Key Risks

Competitive Landscape

The AI-powered customer service management industry is crowded, with several key players at different stages and scales. Besides formal companies that offer customizable, trainable AI chatbots as a product, AI companies themselves are making it easier to develop smart assistants and chatbots with their models. For instance, OpenAI’s GPT Store, launched in January 2024, allows developers to deploy and offer GPT-powered applications to the public. As of April 2024, there are over 1K user-created GPTs tagged as customer service. This points to a future in which companies could potentially develop their own customer service applications or rely on cheaper options instead of going through a more established middleman like Ada. Therefore, Ada must focus on key differentiating factors, such as ease of use, ease of integration into company sites, and advanced training capabilities, to stay competitive.

Macroeconomic Environment

Ada’s success depends on the volume of customer service requests its chatbots receive, and therefore also depends on the success of its clients. In periods of economic volatility or contraction, Ada could be at risk of slowed growth or decreased revenue. Furthermore, large tech companies like Google and Amazon are trimming their voice assistant departments. This could point to decreased demand for voice AI tools, which Ada has significantly invested in with its voice features.

Technological Risks

As with any application built on LLMs, Ada chatbots are at risk of hallucinations and may occasionally produce incorrect responses. The co-founders acknowledge that the generative nature of LLMs prevents them from always answering accurately in the same way that a pre-determined, rules-based bot would. While even human customer service agents make mistakes, it remains important for Ada to minimize the hallucinations and errors produced by chatbots. Considering how Ada’s chatbots can use integrations that allow customers to make purchases and account changes, mistakes could prove costly to individual customers and harm the reputation of their clients.

Summary

With the sheer number and diversity of companies providing LLM-powered, automated tools for customer service inquiries, Ada must differentiate itself from its competitors. Though its AI agent includes several key features, such as a customizable knowledge base, multi-channel support, performance analytics, and advanced model training, many of Ada’s competitors also offer a large subset of them, on top of their own unique features. However, Ada has the opportunity to leverage key AI advancements, such as retrieval augmented generation to increase trustworthiness and natural language understanding for payment and order-related integrations. Therefore, while the rapid adoption of LLMs may empower Ada’s competitors, it simultaneously provides Ada with growth opportunities to push the boundaries of reliable and profitable AI for customer service.