Thesis

Short message service (SMS) texting has been around for nearly four decades but became a permanent place in daily life in 2007 with Apple’s release of the iPhone, what many consider to be the first true mobile smartphone. Creating a smartphone with mass market appeal helped push texting to surpass mobile phone calls by volume in 2008. By 2010, 63 million consumers in the US had smartphones, and, with the rise of unlimited cellular data plans, that number grew to over 250 million consumers by 2020. Today, there are 7.3 billion mobile phone users, and, according to one study, consumers opened 90% of texts within 30 minutes.

Smartphones have become people’s de facto personal command centers. Smartphone ownership and texting coincided with rise of online shopping. By 2018, 50% of consumers were shopping more on mobile than in stores. As of 2019, at least 80% of Americans said they regularly shopped online. Even regular in-store purchases are no longer conducted in a silo, with 77% of consumers using a mobile device to search for products in 2022. As mobile became a primary channel for consumer shopping, brands took notice and set out to connect with consumers in that channel.

With 70% of millennials in 2022 spending 6+ hours per week shopping on their smartphones, SMS has become the fastest-growing marketing channel for brands globally. 49% of consumers have agreed to sign up to receive SMS messages from specific brands. SMS marketing has proven effective, with some estimates indicating 8x higher engagement via SMS compared to email. That’s where Postscript comes in.

Postscript is an SMS marketing platform that works with ecommerce companies. Originally, the company focused on Shopify stores, but has since expanded to other platforms. Initially, Postscript’s product facilitated mostly one-way communication to help brands broadcast products and deals. The product now helps brands use SMS as a two-way platform to engage with customers in sales and customer service use cases. Traditional digital marketing channels like email, Facebook, and Google ads have become more expensive. SMS marketing has presented itself as a cheaper path for brands to acquire high-value customers.

Founding Story

Postscript was founded in 2018 by Adam Turner (CEO), Colin Turner (COO), and Alex Beller (President). Adam and Alex met while working together at StackCommerce, a company that runs white-labeled e-commerce stores for publishers. At StackCommerce, they saw a decline in click-through rates on email for their ecommerce clients while simultaneously seeing engagement rates increase for mobile.

This led Adam and Alex to recruit Colin to join the team as the first hire, and apply to the Winter 2019 batch of Y-Combinator as they started to build out the product.

Source: Y Combinator

Product

Initially marketing itself as Mailchimp for texting, Postscript started by targeting individual Shopify stores and continued to focus on independent sellers as it scaled its suite of products. Postscript's original focus was to help Shopify stores broadcast messages to existing customers with product updates and launch details. As of July 2023, Postscript has begun to expand into offering two-way interactions, enabling customers to do things like re-orders, subscription management, and reviews through SMS. The average Shopify store uses six apps to help with things like marketing, and customer service. In an effort to embed itself as a more valuable service, Postscript is building deeper integrations into other popular Shopify apps.

Customer Acquisition

Postscript has several marketing features for brands to leverage to acquire customers. By better engaging with customers via SMS, brands can grow subscriber lists, develop and test messaging strategies, provide customer service, and drive purchases and loyalty. Postscript's SMS marketing offering enables brands to create touch points at each stage of the subscriber journey. Postscript has been able to help brands increase their ROI 34x and has driven over $3 billion in attributable revenue by inserting messaging at crucial points in a customer’s journey from discovery to support.

Postscript’s marketing product includes several features including:

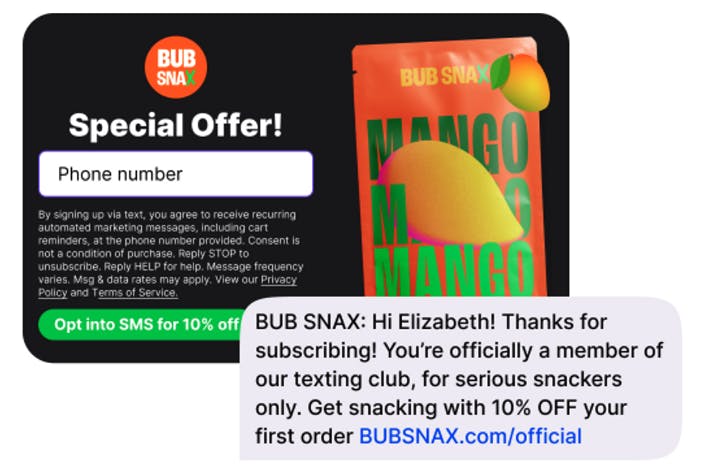

Desktop & Mobile Popups: Postscript creates brand-matching popups that incentivize consumers to input their phone numbers.

Source: Postscript

Keywords: Postscript helps create text-to-join keywords which allow brands to track opt-ins and attribute revenue generated from different campaigns and sources

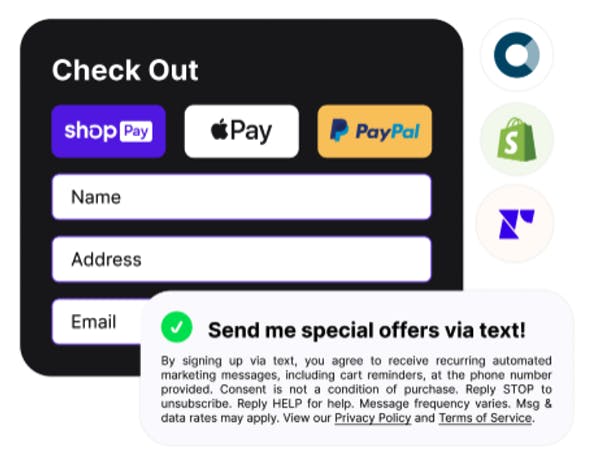

Checkout Collection: When customers check out, Postscript creates a flow that incentivizes customers to input their phone numbers.

Source: Postscript

Landing Page & Opt-In Form: Postscript creates custom landing pages with SMS opt-in forms that can be linked from anywhere, including emails and social media posts.

QR Codes: Brands can utilize the physical world by placing QR codes that will lead users to an opportunity to input their phone numbers.

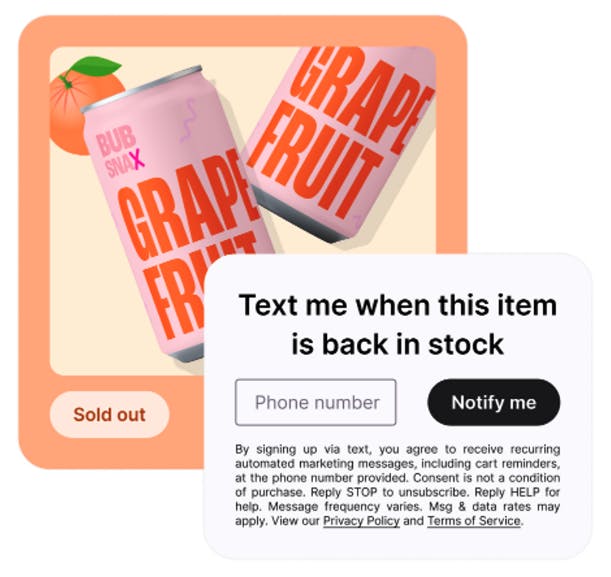

Back in Stock: When items go out of stock, it is an opportunity to acquire high-intent subscribers by giving them an opportunity to offer their phone number so they can be notified when their desired item is back.

Source: Postscript

Data, Segmentation, and Targeting

Postscript offers analytics tools to help brands utilize valuable information about customers that Postscript collects. These tools include the ability to segment and target customers based on attributes and real-time behavior. Having more rich customer data enables brands to segment users based on buyer behavior and other characteristics.

Postscript’s data platform includes several different features:

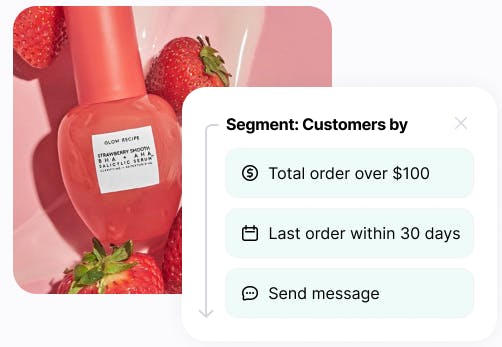

Segments: Brands can segment customers by 45+ different attributes including historical Shopify data, SMS activity, data from app integrations, area codes, and more.

Source: Postscript

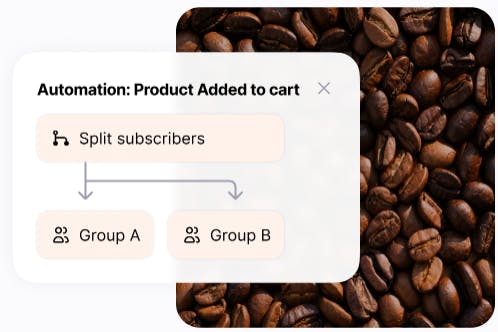

Automation Triggers: Based on customer behavior, brands can set up automatic triggers that split customers into groups that allow the brand to intervene with the right customized communication at the right time.

Source: Postscript

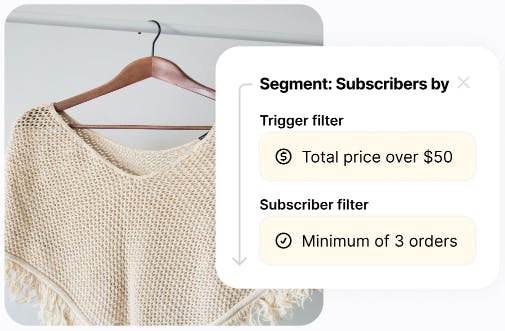

Trigger & User Filters: This allows brands to layer information about their customers on top of their behavior to create even more precise interventions and messaging.

Source: Postscript

Two-Way Messaging

Brands can build deeper relationships with customers when they engage in dialogue. Not only does this allow Postscript and its customers to collect more relevant information about consumers, but it also enables the consumer to have a personalized messaging experience. Consumers are more likely to engage with a text from a person than they are with a generic text message.

Postscript’s two-way messaging platform includes several different features:

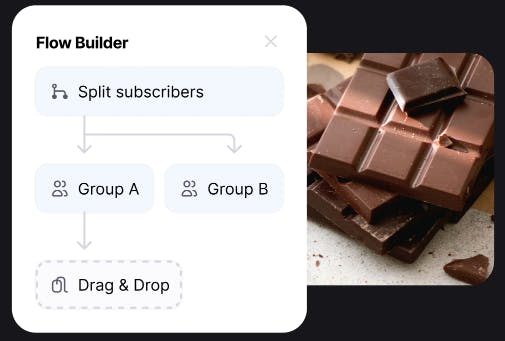

Flow Builder: Allows brands to scale one-to-one conversations with customers by helping them build, visualize, and manage SMS campaigns and automations using an intuitive drag-and-drop interface. Brands can create different follow-up responses based on how their subscribers reply or what actions they take.

Source: Postscript

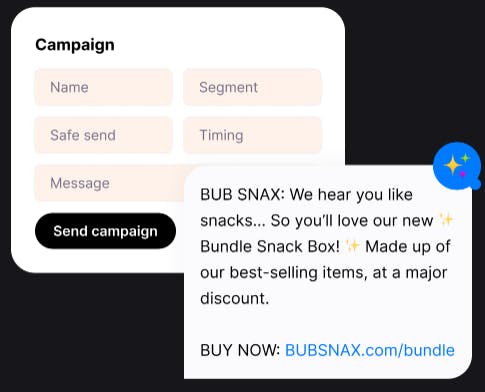

Campaigns: Allows brands to create flash sale announcements, holiday promotions, educational content, interactive content, or conversational message flows. Brands can pair campaigns with strategic segmentation and engage different parts of their subscriber base with the message content that’s most likely to appeal to them. This drives higher click through rates, conversions, and overall earnings.

Source: Postscript

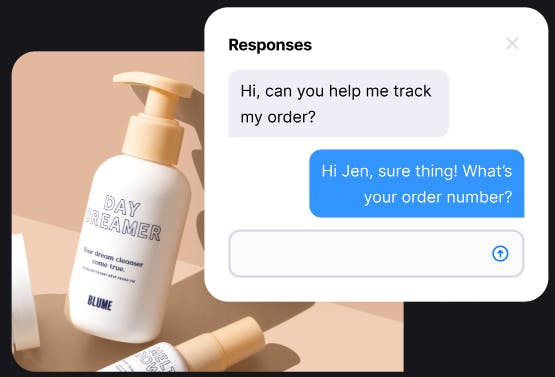

Responses: Postscript uses machine learning to help brands filter and prioritize conversations based on the sentiment or the topic. Brands can also forward subscriber replies to their support email, integrate with Slack, or connect Postscript to a brand’s help desk of choice—including Gorgias, Zendesk, and others.

Source: Postscript

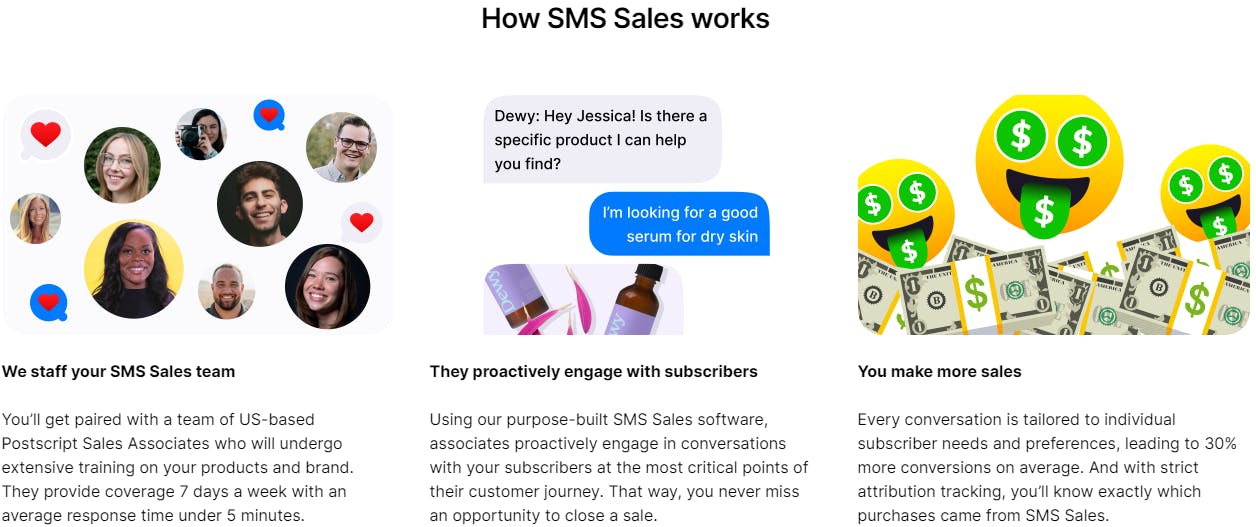

SMS Sales

In May 2023, Postscript launched Postscript Sales for customers that lack bandwidth on their sales teams. While the initial product launch was a beta offering, Postscript intends to provide a dedicated team that acts as a brand’s SMS sales team. This outsourced team of SMS sales experts proactively communicates to customers in that brand’s voice. As Postscript President, Alex Beller, said:

“We pair a team of expertly-trained sales associates with our purpose-built SMS Sales software to proactively engage with your subscribers and convert more of them into satisfied customers.”

Source: Postscript

Postscript Plus

Postscript Plus is an in-house SMS marketing service for ecommerce brands and agencies. Postscript offers different tiers depending on the needs of the customer. This managed service comes in three different tiers: launch, essentials, and enterprise.

Launch: Built for smaller companies who want to scale early. Meant for brands that have just started on Postscript. Postscript has a dedicated team of “textperts" who provide strategic campaign and copywriting support to a brand’s in-house SMS point-person.

Essentials: Built for teams who want to offload some portions but continue owning part of SMS marketing efforts. For example, a brand could decide to own and manage its automations and popups while delegating strategic segmentation and campaign execution to Postscript’s messaging strategists.

Enterprise: Built for lean teams that want to fully offload their SMS programs. Postscript’s team will execute campaigns, write copy, build targeted segmentation, and integrate SMS into a brand’s existing marketing calendar and strategy.

Market

Customer

Postscript’s customers are ecommerce brands, historically ones that were hosted on Shopify. The company has since expanded slowly to other platforms. Ecommerce brands rely on a tech stack of apps to manage aspects of their business like customer service, logistics, and marketing, all of which are plugged into their Shopify storefront. Postscript is the common module for SMS marketing within each customer’s stack. Some of Postscript’s notable customers include Feastables, Dr. Squatch, Brooklinen, and Tower Records.

Source: Postscript

Market Size

The global market for ecommerce is $5.7 trillion. Specifically, the SMS marketing software segment was estimated at $8.2 billion in 2022 and is expected to grow at a CAGR of 21.3% to $38.4 billion by 2030.

While 66.7% of the top 1K brands on Shopify use SMS, only 11.7% of the top 150K do. One benefit is that Postscript is positioned to support top brands, meanwhile the expansion of its platform to other ecommerce providers enables the company to address the long-tail of ecommerce merchants who are currently operating on alternative platforms.

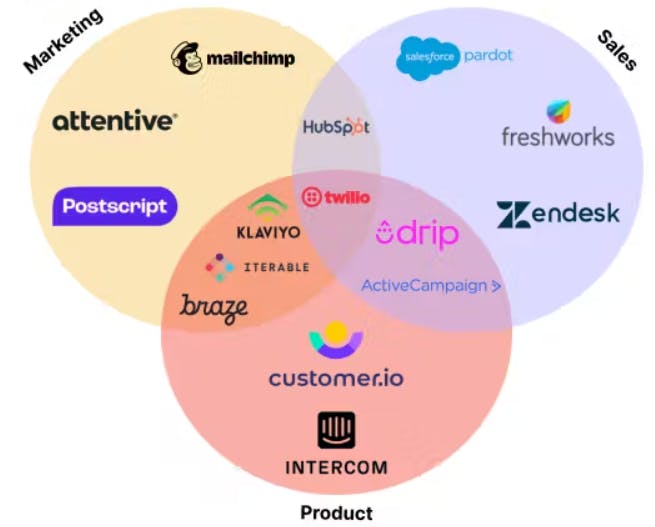

Competition

A core aspect of Postscript’s competition is a brand’s broader marketing budget, and the other channels vying for that budget. Brands have a number of different channels that they can dedicate spend towards. SMS marketing has proven to be an effective channel for brands, but solutions like Postscript will have to continue to demonstrate ROI in order to compete for marketing budget being dedicated to other more established channels. In addition, Postscript has a number of direct competitors.

Attentive: An SMS messaging marketing startup that builds software that integrates customer service and email software such as Zendesk or MailChimp. It helps retail and ecommerce brands acquire, retain, and interact with mobile shoppers. In many ways, this is Postscript’s most direct competitor. Attentive announced a $470 million Series E in March 2021, at a valuation of $7 billion, bringing the company’s total funding to $863 million.

Klayvio: While Klaviyo competes with Postscript on the SMS font, it offers marketing services through more channels including email. It has raised $778 million to date and reportedly has plans to go public in late 2023. It was last valued at $9.5 billion in May 2021.

Emotive: Emotive offers a similar suite of products to Postscript. Some of its early differentiators from Postscript were managed services and sales over text. Postscript has now beefed up its offering to compete. It has raised $78 million to date, with a February 2021 Series B round of $50 million which valued the company at $400 million.

Yotpo: Yotpo is a full-service ecommerce marketing company. It was planning to go public in 2021, but never ended up listing, opting to stay private. It entered the SMS marketing channel with the acquisition of a startup, SMSBump, in early 2020. This put it directly in competition with Klaviyo.

Source: Sacra

Business Model

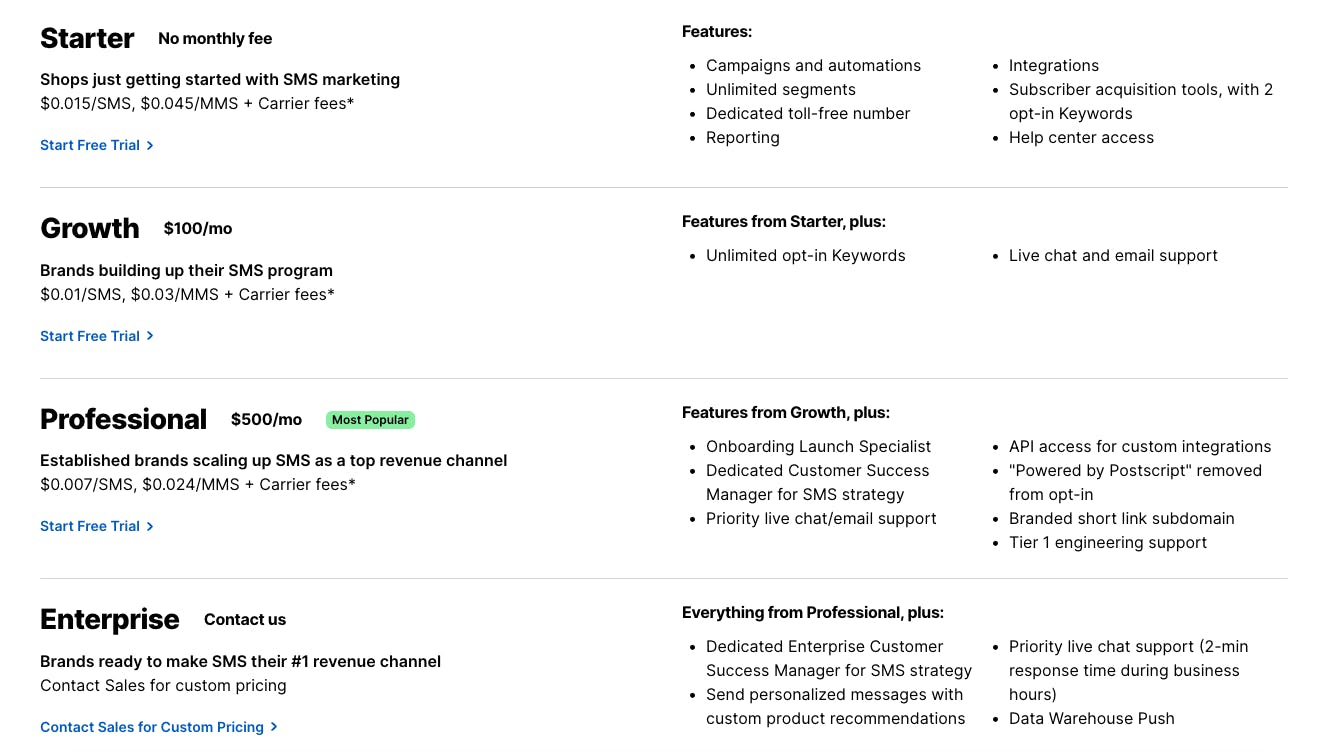

SMS marketing companies typically operate on a per SMS or per month revenue model with variations in price among competitors. There are a limited amount of competitors which charge clients based on the revenue they garner using their SMS marketing. Postscript operates on a per-month fee and a per SMS fee. It offers four tiers: Starter, Growth, Professional, and Enterprise.

Source: Postscript

Traction

Postscript launched in 2019 and has achieved 400% YoY growth through 2022. It has been able to acquire customers such as Olipop, Hydrant, Kopari, Native, and Dr. Squatch; companies that have generated $500 million in revenue attributed to Postscript. Postscript is currently installed on 16K Shopify brands, up from 8.5K in January 2023. It seems to have achieved high rates of customer satisfaction as evidenced by its 1.8K 5-star reviews on Shopify App store.

Valuation

Postscript raised $65 million in a Series C in June 2022, led by 01 Advisors, Expanding Capital, and Twilio Ventures. Postscript has not publicly released its valuation. However, valuations have significantly come down in the space since 2020. For example, one of the best public comparisons for Postscript is Braze, whose market cap at IPO in November 2021 was $9 billion but has dropped by 65% down to $3 billion. Another competitor, Klaviyo, is expected to IPO this year, last valued at $9.5 billion in May 2021.

Key Opportunities

Text-Based Sales

Though it is only in beta, the fact that the company has prioritized the rollout of Postscript Sales indicates that Postscript sees an opportunity in moving beyond marketing campaigns into text-based sales. Postscript has helped brands see positive ROI on outbound SMS marketing campaigns, but beta testing with a few customers has shown that having customized conversations via text can drive significant conversion. Though it may add costs to have a salesperson spend time texting customers, even a mature CPG (consumer packaged goods) brand like Dr. Squatch saw a 30% increase in new subscriber growth when they tried out Postscripts sales product. This shows that texting can be more than just a performance and brand campaign channel. SMS can actually be an efficient leveraging function for traditional corporate functions like sales and prospecting.

Moving Upmarket

Postscript works with some of the largest and most well-known ecommerce brands, but legacy retailers that are moving into ecommerce would open the door for more business. Even premium and luxury brands have begun to see the value of SMS. According to a 2017 study conducted by UBS, millennials contributed 85% to growth in the luxury market and will represent 45% of total high-end spending by 2025. As these luxury brands see their own management tier increasingly filled by millennials, there will likely be more of an appetite for data-driven acquisition and retention. Millennials and GenZers are already powerful consumer groups and will eventually overtake Baby Boomers. Luxury brands know they will have to meet their new majority customer base where they are and that is on their mobile phones.

Key Risks

Regulation

SMS marketing is highly regulated. Businesses must get permission from customers before sending messages, hence the all-important “opt-in.” Possible fines can be up to $1.5K per message, so a lot of brands are understandably hesitant to even risk it. As the business grows, it may become more difficult to manage and present more opportunities to violate the strict texting consent laws in the US.

Growing Concerns Over Spam

There is a psychological factor beyond regulation that getting texts from “random” numbers is annoying. When email was nascent, any given person would’ve been hard-pressed to imagine the world today where people get dozens of spam emails per day. However, as texting encroaches into email’s once-exclusive zone, there is a risk that non-personal texts will get filtered and sent into spam purgatory.

Personal mobile phone numbers have been shared so widely that spam calling has become a real problem. This problem has gotten so bad that in 2019, the Trump Administration passed the TRACED Act, which put into effect rules and requirements to deter criminal robocall violations, but many scammers are working around this bill by sending out text messages instead.

In 2020, the average number of spam texts received by an individual was 14.7. That number grew by 15% in 2021 to 16.9. With spam texts on the rise, authorities, carriers, and communication services have taken measures to crack down. One of these measures is the requirement that all toll-free numbers be registered. However this shakes out, it's clear that Postscript and the brands it works with must take extra measures to make their text communications relevant and non-intrusive.

In-Store Retail Sales

So far, Postscript has focused on its growth on digitally native ecommerce up-and-comers. However, in order to maintain growth, Postscript may have to serve industries outside of ecommerce to less tech literate legacy retail. Though online shopping has grown significantly as a share of all shopping, in-store retail purchases still made up 84% of the mix in 2022. Much of Postscript’s success has been in driving online behavior and acquisition, but inserting itself into the flow of a customer’s physical journey is a much tougher ask. It has addressed this somewhat with out-of-home touchpoints such as having QR codes that lead to text opt-in landing pages, but the risk remains of in-store retail limiting the company’s growth.

Summary

Postscript was an early mover into the SMS marketing space, which gave it favorable economics and allowed it to establish a strong foothold. Though it has been able to achieve significant traction, legacy players and newcomers alike are jumping in to the market. SMS is still a small portion of ecommerce marketing strategy, so there should be plenty of room to grow within the market as a leading player. However, Postscript will need to continue to add features and services to keep up with evolving needs of their customers.