Thesis

Software has become a pervasive part of most people’s lives every day. The average consumer interacts with 130 different websites each day, and 76% of adults in the US are shopping online. Whether it's for work, school, entertainment, shopping, or social interactions—consumers have digital relationships with dozens of different companies. As a result, 82% of customers expect near-instant responses and personalized assistance. Meanwhile, businesses are under pressure to meet these evolving expectations while keeping costs low.

The average business will get 578 customer service tickets per day, with each request taking somewhere between 250-500 seconds to handle. That represents an average of 60 hours worth of working time for customer service representatives every day. And even then, only ~76% of customer interactions will be addressed satisfactorily. That represents a significant gap for most companies attempting to maximize customer satisfaction.

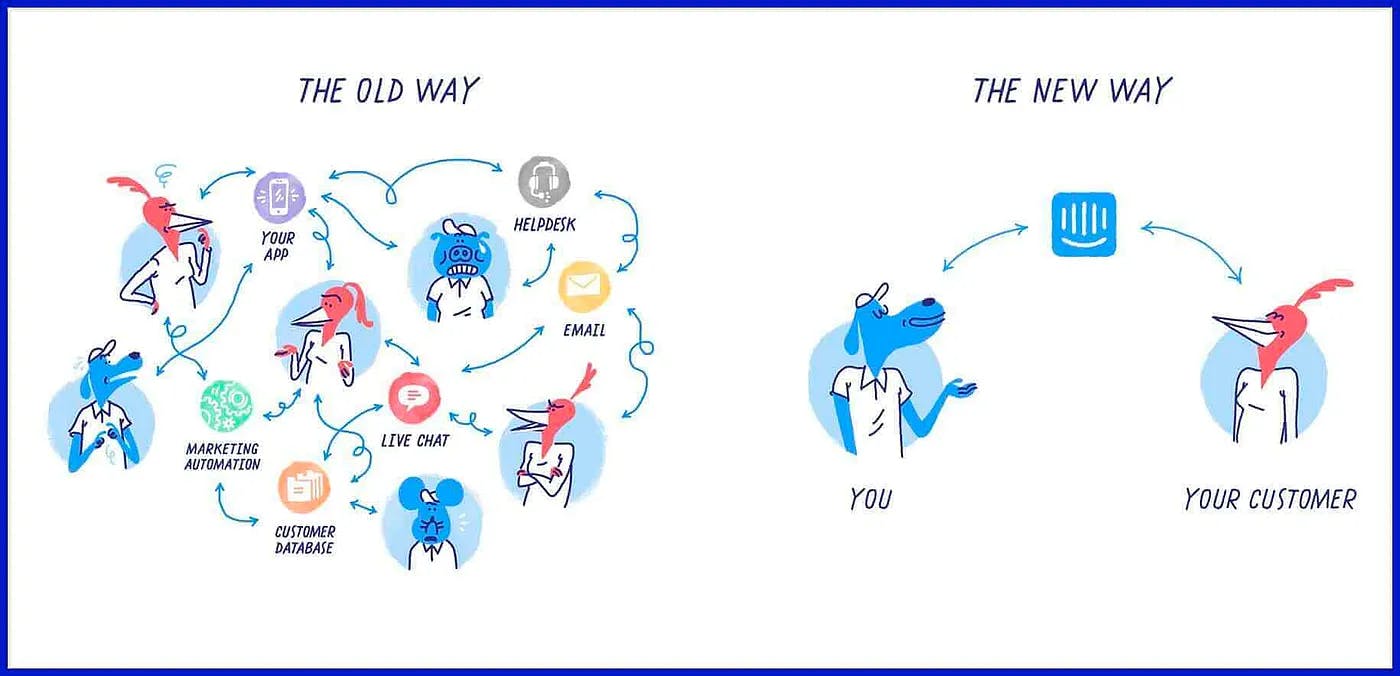

That’s where Intercom comes in. Intercom is a customer interaction platform that includes chatbots, messaging, and automation for customers to engage with users both for support and marketing purposes. Increasingly, Intercom has rolled out AI features to further automate the customer interaction process.

Founding Story

Intercom was founded in August 2011 by Eoghan McCabe (CEO & Chairman), Des Traynor (Chief Strategy Officer), David Barrett, and Ciaran Lee (former CTO).

The founders were inspired by a coffee shop owner in Dublin, who was scaling his business by establishing personal connections with his customers. At the time, the co-founders were building a bug-tracking software company called Exceptional. The team noticed a related problem with Exceptional—they couldn’t chat with customers. So, the team built one-way chat messaging for business owners to contact their users. Although this was just one feature of Exceptional, the team used this as inspiration later to build Intercom. After selling Exceptional to Rackspace in 2011, the group used their acquisition funds to build a company with the core vision to “make internet business personal.”

Source: Intercom

Intercom started selling their customer chat integration to small businesses after launching on Hacker News. The team onboarded customers one by one over Skype as they developed their sign-up flow. As Intercom continued to welcome early adopters, Des Traynor, the Chief Strategy Officer, wrote ~90 blog articles based on startup advice, with the anthem “content first and marketing second.” The pieces would be general-interest startup writing, followed by small mentions of Intercom updates.

In May 2019, when Intercom was 8 years old, news broke that Eoghan McCabe, Intercom’s CEO, had previously been accused of sexual harassment. The company claimed that the issue had been investigated by both Intercom’s board of directors and an independent law firm, both of which cleared McCabe of any wrongdoing. The company had previously hired Karen Peacock as COO in 2017, who had previously been an SVP at Intuit. In July 2020, ten months after the allegations against McCabe came out, the company announced that McCabe would step back into a chairman role, with Peacock stepping into the position as CEO.

In October 2022, Intercom announced that McCabe would be returning as CEO with Peacock stepping into an advisory role. At that time, McCabe reinforced that the accusations of harassment and McCabe’s prior departure were unrelated and that he had been planning to step down since 2017.

Product

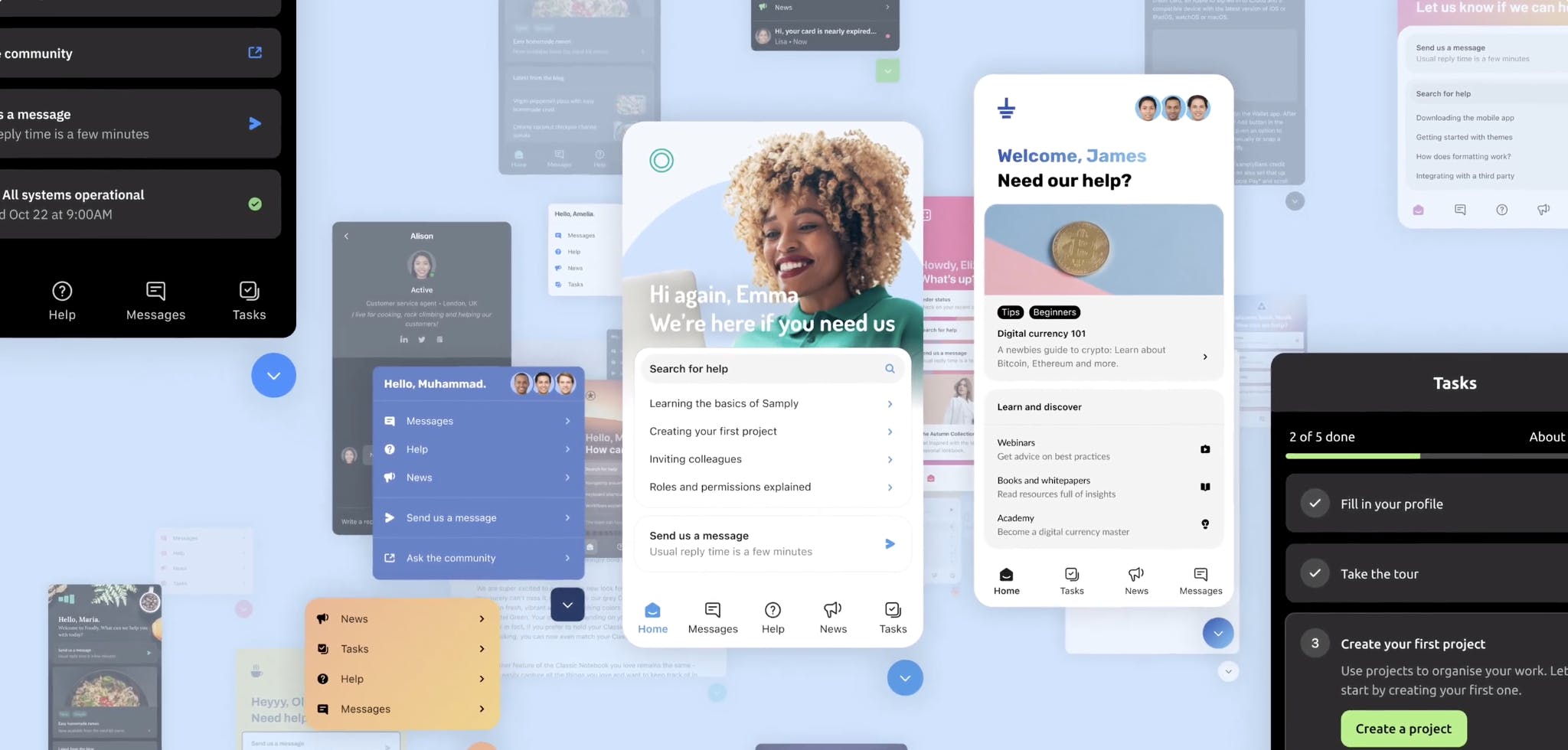

Intercom’s product is focused on enabling personalized customer interactions across three capabilities: (1) customer conversations, (2) proactive support & marketing, and (3) AI & automation. The goal of the product is to create one unified channel for all customer interactions.

In a July 2023 interview with Contrary Research, when asked about the way the Intercom product has evolved over time, CEO Eoghan McCabe responded:

"We started from a simple messenger for sales marketing support, now we're building an AI-first customer service platform for customer service teams."

Source: Medium

Customer Conversations

Messenger: Intercom’s Messenger is the hub for customer conversations. Businesses can customize the messenger and conversation data syncs across devices, user apps, SMS and email as well as WhatsApp and other social media channels. Having one hub for customer communications reduces duplicate tickets from support teams. In addition to standard live chat, the Messenger window also connects users to Help Centers, product tours, and Intercom’s other support features.

Source: Intercom

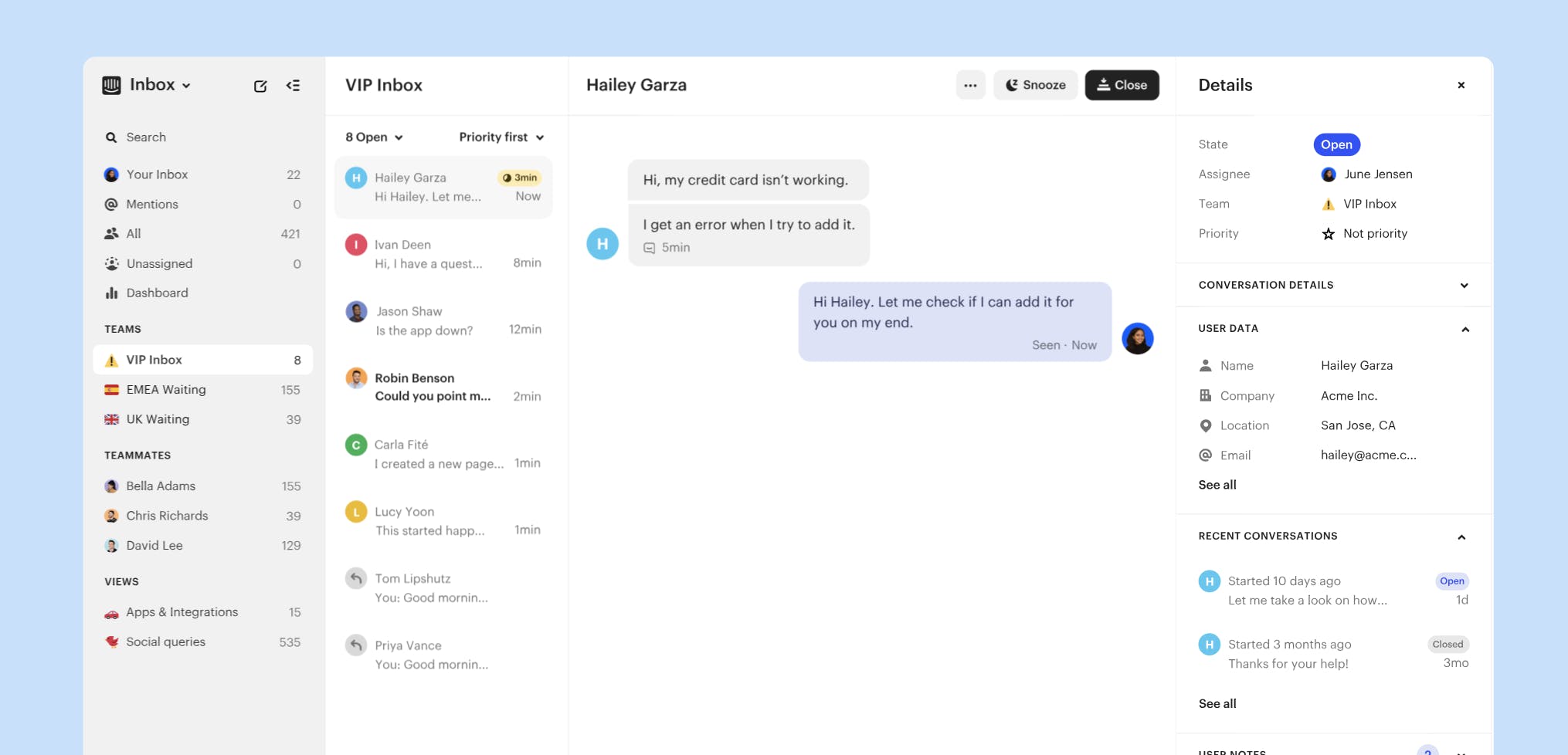

Inbox: On the receiving side of the Messenger, Intercom’s Inbox allows agents to collaborate and message customers across email, chat, or other communication integrations. Companies can sync other customer data with Intercom, so agents can find user context in one place.

Source: Intercom

The Inbox connects to over 400 services like Jira, Salesforce, Stripe, or Slack, allowing the team to create engineering tickets and take action without leaving Intercom. Other features include trigger-based personalized responses, service-level agreements (SLA) to prioritize urgent conversations and high-priority customers, routing automation to automate manual tasks, and workload management to achieve quick response times.

Management Dashboard: Management tools are also part of the Inbox, providing a view of the conversations agents are having, agent reports for response time and ticket load, and a real-time dashboard to monitor total support volume, team capacity, and key KPIs.

Proactive Support & Marketing

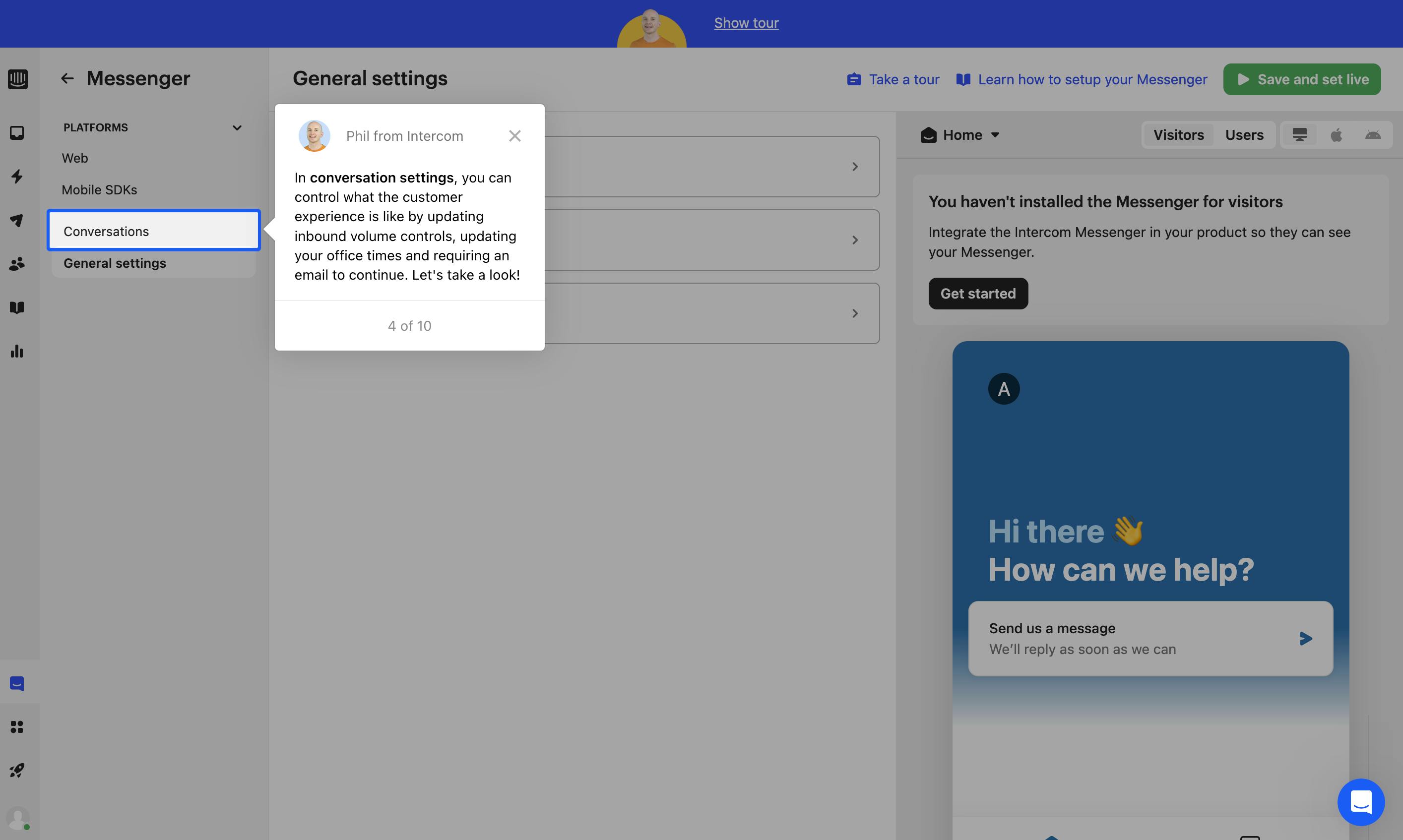

Product Tours: Intercom provides user guides to walk new users through an application, hopefully supporting a customer in their usage even before they have an issue. The product tour feature is a no-code workflow builder that offers event tracking and analytics to monitor usage. The product can highlight key features, embed videos of how-to guides, and wait for users to interact with input fields to complete the setup process. The feature is also optional for users who prefer to explore a product on their own.

Source: Intercom

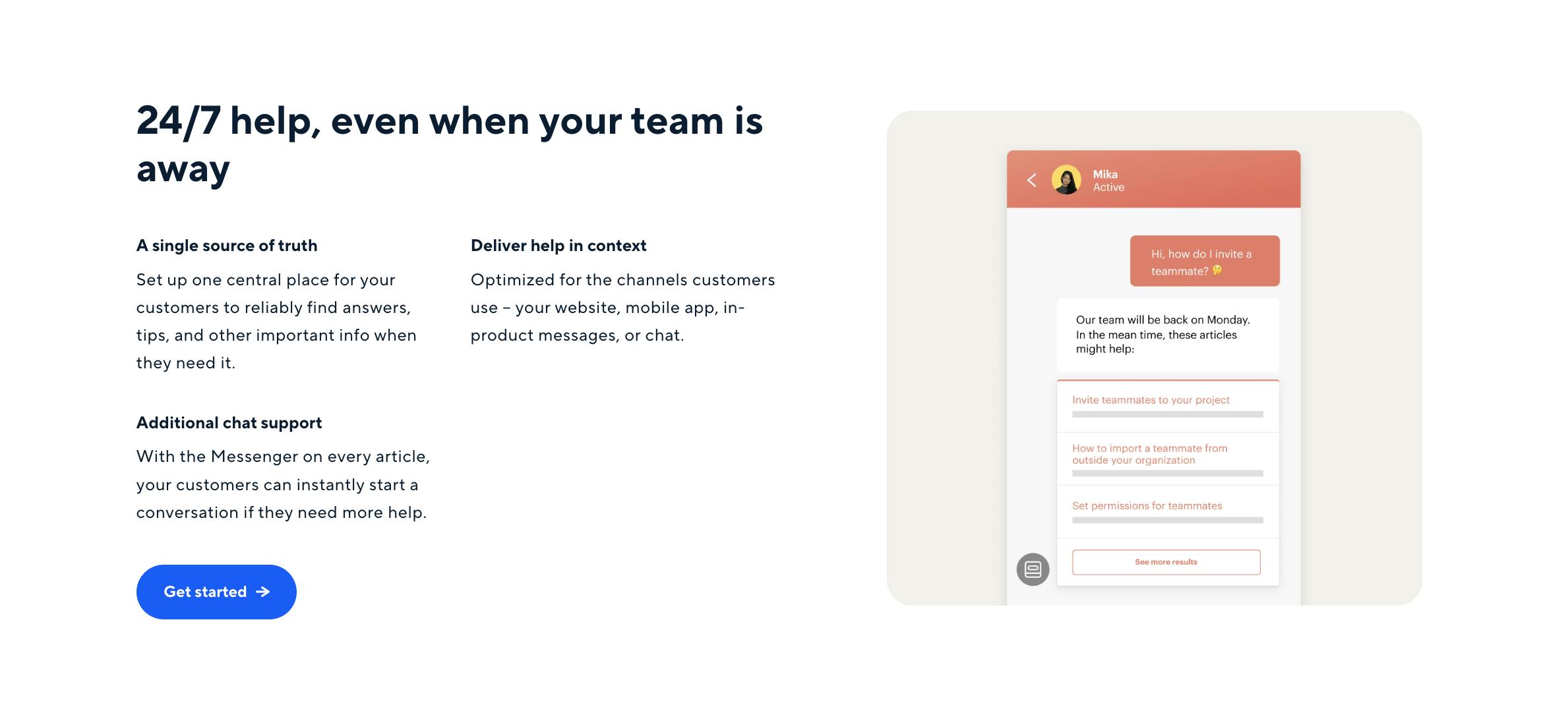

Help Center Articles: Intercom provides customers with a content hub where they can publish, organize, and monitor support articles. By giving companies an organized and detailed FAQ center, Intercom hopes to reduce the number of repetitive questions for support teams, while also giving customers answers 24/7. The Help Center is linked on every Intercom popup. Teams can also require a customer to search before opening a ticket. All articles are automatically translated into 47 languages, with support for brand customization and videos.

Source: Intercom

AI & Automation

Fin: Powered by GPT-4, Fin is designed to use existing macros, past customer conversations, and Help Center articles to instantly and accurately answer support questions. Intercom predicts that it will solve 50% of customer queries, reducing the workload for support teams. Each Fin response cites relevant sources, giving customers an additional source of truth. Fin is also designed to hand off any tickets it cannot handle to reduce incorrect responses.

Source: Intercom

Although Intercom advertises no training required, support teams can still customize the bot and train it before letting it interact with customers. Support teams can set up conversation rules, resolution limits, audience targeting, and handoff options to support teams or other bots. As Intercom CEO Eoghan McCabe told Contrary Research in a July 2023 interview:

"The future quite clearly in customer service is going to be built around AI. We built, to our knowledge, the very first AI bot for customer service called Fin. It can do up to 50% of your support requests without much work if any work at all. We've got some of the biggest names in tech, including some of the biggest names in AI, using it for their customer service. At Intercom it does 31% of our inbound support."

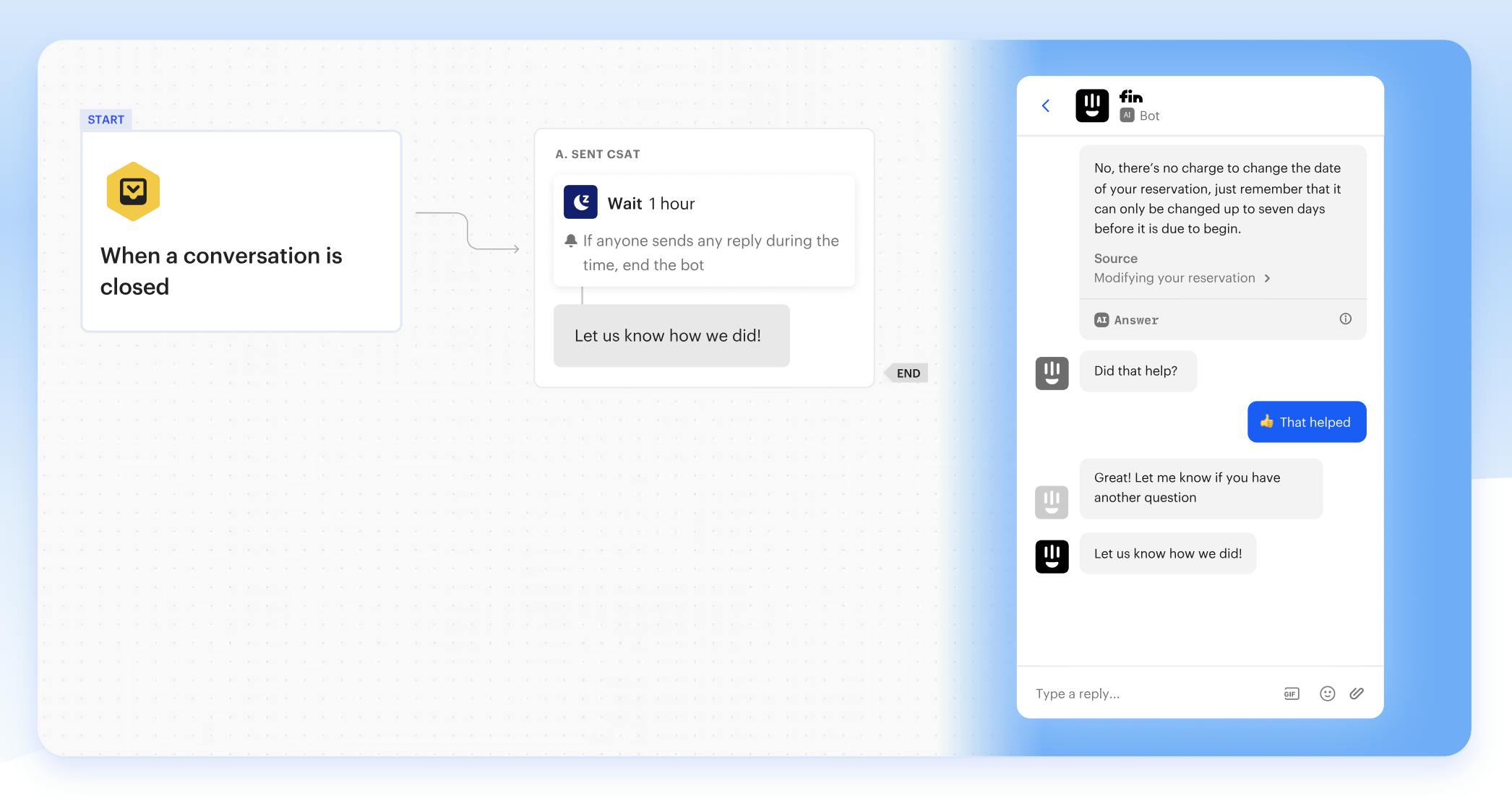

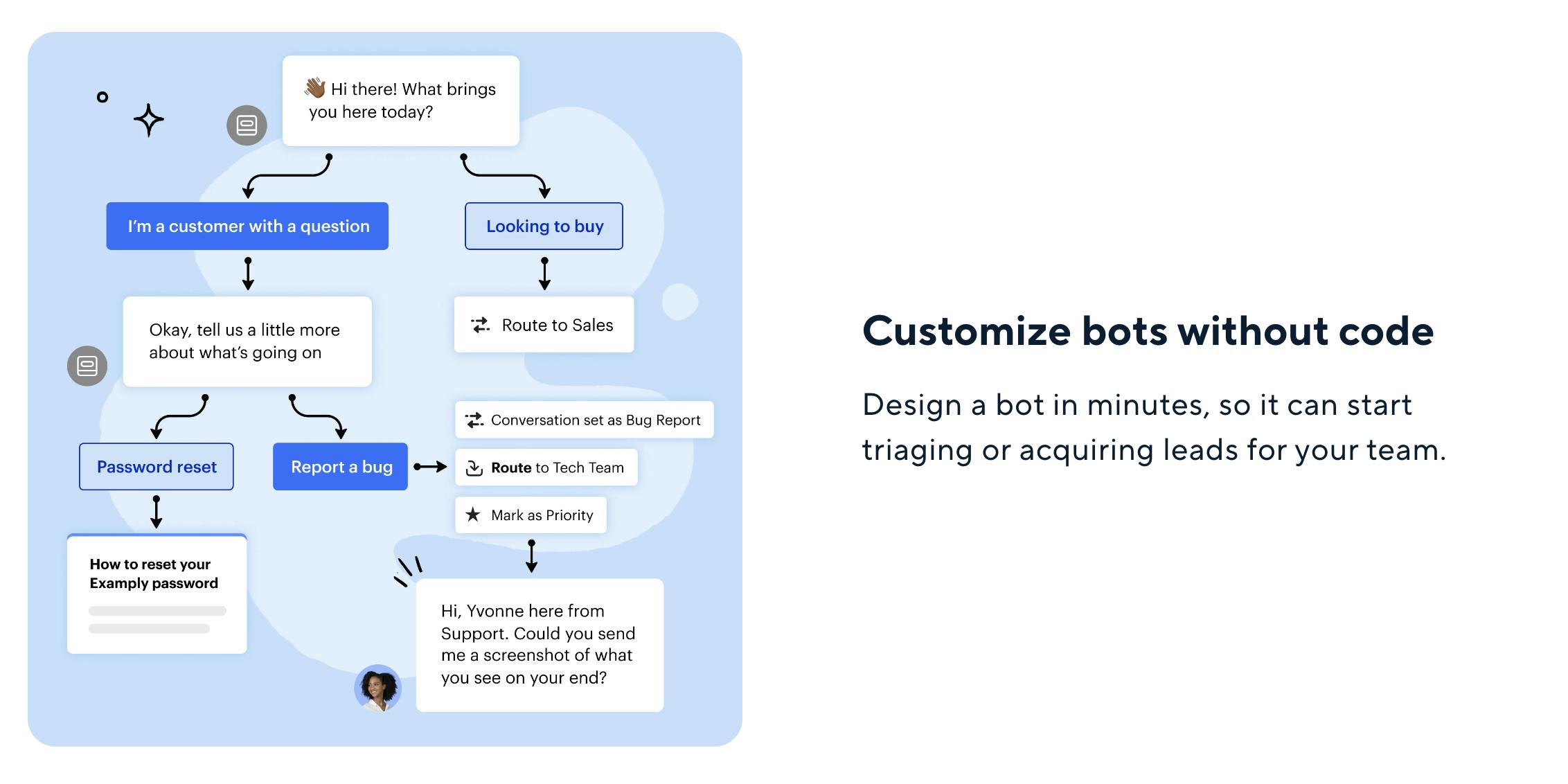

No Code Automated Bots: Intercom’s custom bots are designed to sort conversations, engage leads, and direct customers to help center articles automatically. They function as interactive forms with buttons to collect upfront information and identify a user’s intent.

Source: Intercom

A support team can customize the bots' design and manually creates each intent and workflow. Intercom’s custom bots were a precursor to Fin, since the design process, although no-code, requires manually mapping out as many user interactions and intents as possible. Still, Intercom’s custom bots continue to support more rigid customer journeys, like lead generation, or basic help desk redirection.

Market

Customer

Early Stage: Intercom’s original growth strategy focused on publishing content for software founders. As a result, many of its early adopters were YC companies and according to Intercom, 84% of new YC companies that use customer support software chose Intercom. Intercom extends a 95% discount to participants in Intercom Academy, Intercom’s onboarding courses, and an Early Stage Program with $100K worth of credits on other popular tools for startups that meet its criteria. A startup must have under $1 million in funding, be less than two years old, and have fewer than five employees. Intercom emphasizes its “frictionless conversations” for early customer feedback.

Enterprise and Mid-Market: Intercom also attracts large businesses, such as Atlassian, Amazon, and Lyft Business, who are looking for scalable and high-quality interactions with customers. Intercom’s proactive support and onboarding features are particularly attractive, helping large companies avoid excessive hiring, with Intercom featuring a support agent vs. an Intercom cost calculator. Intercom supports data encryption, regional data hosting & storage, and is also compliant with privacy laws including GDPR and SOC 2. Intercom’s inbox dashboard lets support team managers keep an eye on larger teams as well.

Market Size

Some estimates indicate that the global customer service software market in 2021 was valued at $10 billion, and predicted to grow to $58 billion by 2030. Gartner estimates the market may already represent $24 billion in spend as of 2020. Some estimates indicate that there are ~2.8 million customer service representatives. During COVID, the industry experienced a 25% reduction in the number of call center agents. At one point, Delta alone was trying unsuccessfully to hire 5K support agents.

The shortage and turnover of customer service representatives is costing ~$13 billion per year in the US in order to hire, train, and onboard new agents. In July 2022, customer support leaders at a number of companies said one of their top priorities over the next 12-24 months in customer support was “retaining and developing the best people.” The increased pressure on customer support headcount expands the opportunity for customer communication platforms like Intercom to further impact the efficiency of each existing rep.

Competition

Drift: Founded in 2015, Drift helps businesses connect with their customers through real-time chatbots and live chat. Drift has raised a total of $107 million in funding as of July 2023. In April 2018, Drift raised a $60 million Series C. Like Intercom, Drift uses chatbots to automate customer interactions, but its primary focus is on marketing and sales, whereas Intercom focuses on customer support tools.

Ada: Founded in 2016, Ada is a conversational intelligence platform that provides users with a no-code conversation tool where users can manage common lines of customer questioning, and build response logic into the product. The company has raised $190 million in total funding and has customers like Meta, Square, and Shopify. Similar to Intercom, Ada has been able to leverage generative AI to impact its product, making the process of building chat responses more automated.

Zendesk: Founded in 2007 in Denmark, Zendesk is a customer service software company that offers a support inbox, sales CRM, and chat integrations. Zendesk raised a total of $85 million in funding before going public in 2014. In June 2022, Zendesk was acquired for $10 billion led by Hellman & Friedman and Permira. Zendesk's focus is on providing a unified customer service ticketing platform, while Intercom emphasizes real-time communication and personalized customer experiences.

LiveChat: LiveChat is a publicly-traded company founded in 2002. LiveChat provides a number of products including its core customer communication product, ChatBot, an intelligent communications platform, and HelpDesk, launched as a ticketing prioritization engine for the various customer interactions that come through the platform.

HubSpot: Founded in 2006, HubSpot is a publicly-traded marketing, sales, CRM, and customer service platform. Its Service Hub includes tools for customer support, feedback, and service ticketing. Both HubSpot and Intercom offer customer service tools as part of their product suites, but HubSpot's Service Hub is integrated with its broader inbound marketing and sales platform, while Intercom's tools are focused on real-time, personalized customer communication.

Salesforce Support Suite: In March 2023, Salesforce released its Support Suite with a range of customer service tools, including AI support with GPT, case management, automation, and self-service options. Salesforce is a publicly-traded company with a market cap of ~$200 billion as of June 2023. While both Salesforce and Intercom offer customer service solutions, Salesforce's Support Suite is part of a larger CRM ecosystem, whereas Intercom focuses on providing a standalone, integrated customer communication platform.

IBM Watson: IBM launched Watson in 2011. The product is an AI-powered customer support platform. Watson identifies a user’s intent and recognizes “entities” such as fields like name, phone number, and email to better understand customers in context and transfer them to a human agent when needed. IBM reports that its Watson Assistant is 15% more accurate than competitive solutions and achieves the same or better accuracy 50 times faster on average.

Business Model

Intercom offers a range of subscription plans with additional costs for add-on features, such as its Fin bot.

Starter: Priced at $74 per month and designed for small businesses or early-stage startups who are just beginning their customer engagement efforts. The plan doesn’t support features like Macros (saved responses) or proactive support features beyond help center tickets.

Pro & Premium Plans: The pricing for Intercom’s other plans is undisclosed and partially based on seats. These plans unlock the rest of Intercom’s product suite with incremental charging based on customer outbound. For communicating with 30K customers, clients have reported monthly costs of $1.2K, without any add-on features.

In addition to the core plans, Intercom offers additional products that can be added to any subscription. These include Intercom’s proactive support features with Product Tours for $199 per month, the Fin bot, though pricing is undisclosed, WhatsApp messaging support for $9 per month, and Surveys for $49 per month.

Traction

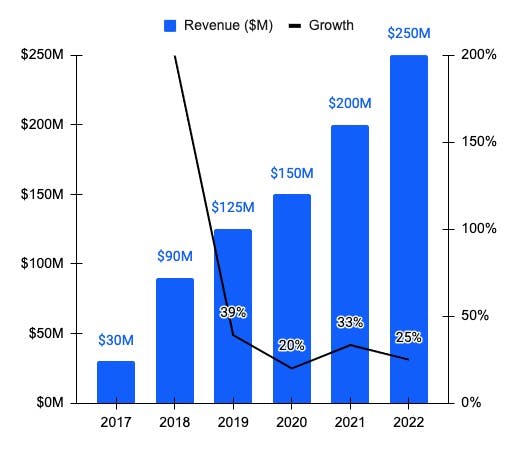

From 2013 to 2017, the company's annual recurring revenue grew from $50 million to $250 million. As of 2022, Intercom serves over 25K customers, including Atlassian, Amazon, and Lyft Business. Those customers generate 500M+ messages per month across 600M monthly active end users.

Source: Sacra

Intercom’s CEO, Eoghan McCabe, has also said the company has been “’on and off’ cashflow positive status since [2018].”

Valuation

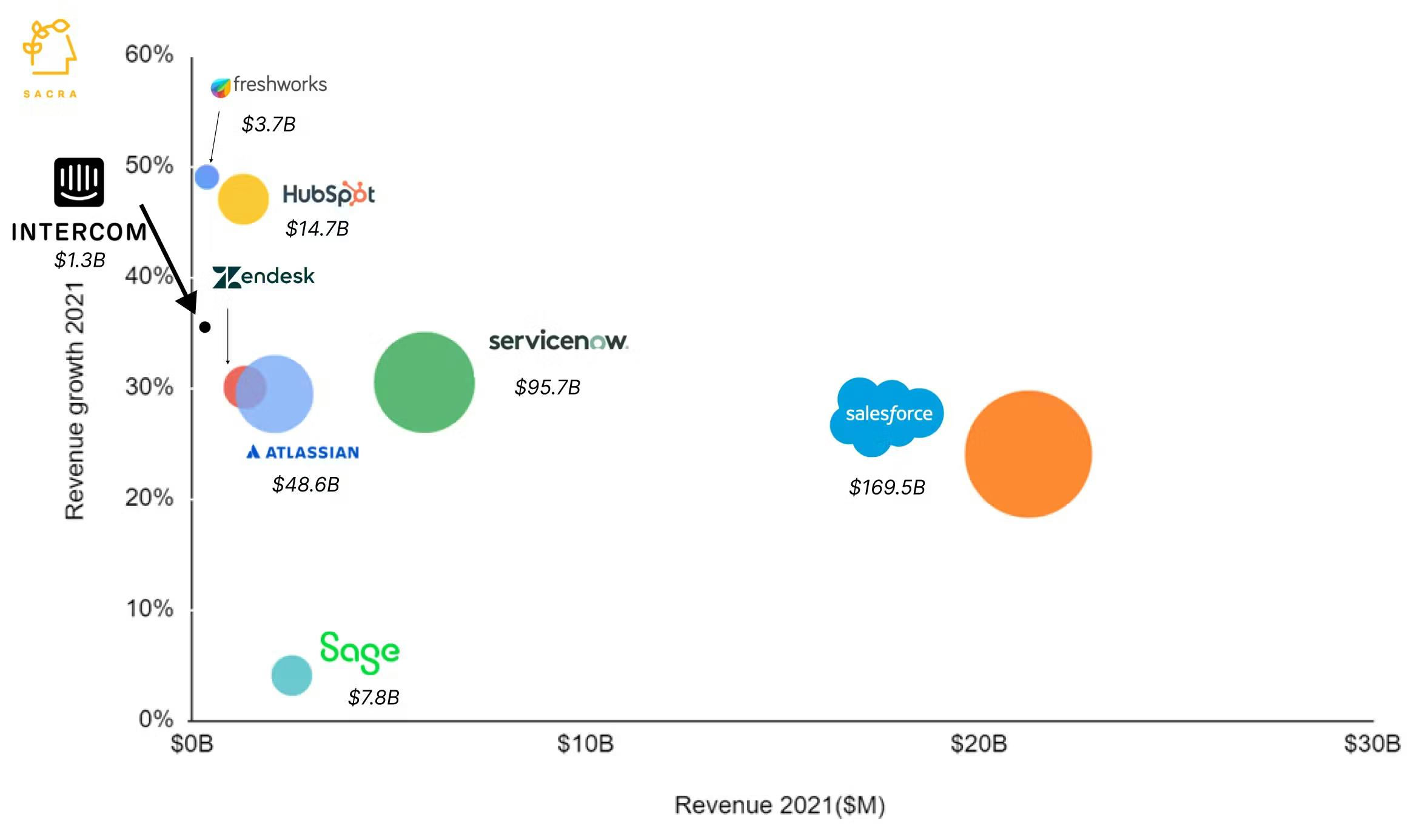

Intercom raised a $125 million Series D in March 2018 from Kleiner Perkins at a $1.3 billion valuation. In total, the company has raised $240 million of funding. Based on estimates of Intercom’s 2022 revenue at $250 million, the company’s $1.3 billion valuation would represent a 4.3x current revenue multiple. Zendesk, a service-first CRM company, was acquired in 2022 for $10 billion, representing a 6.6x revenue multiple.

Source: Sacra

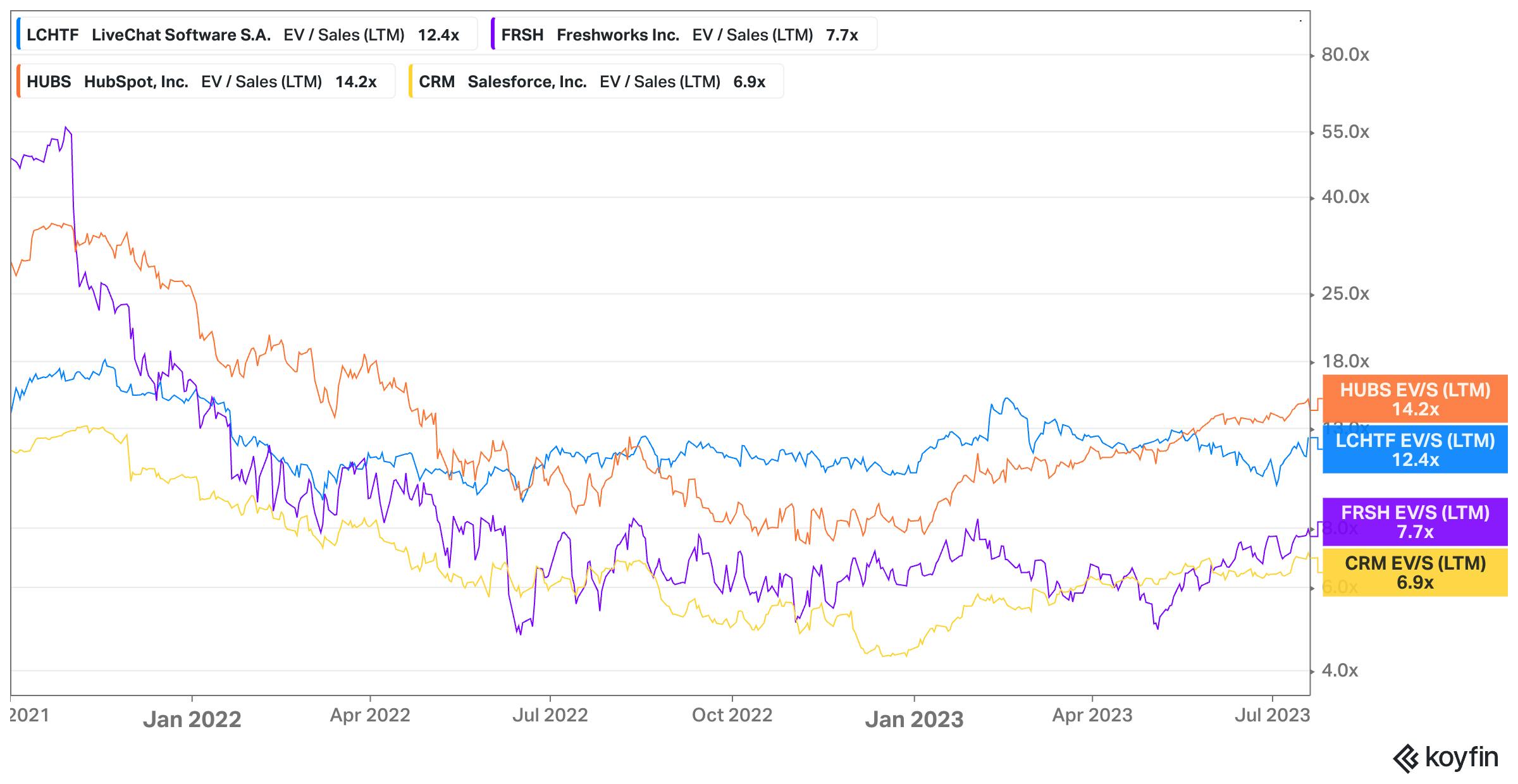

Similar publicly traded companies, like Salesforce, HubSpot, Freshworks, and LiveChat, trade at a range of multiples of LTM revenue from ~7x to ~14x. A close comparable company, like LiveChat, is trading at ~12.4x LTM revenues of $315 million, growing ~41% year-over-year. Intercom is estimated to have ended 2022 at $250 million of revenue, growing ~25% year-over-year. Given the lower growth rate, Intercom would likely trade as a public company at ~6-9x LTM revenue representing a current valuation of $1.5-2.3 billion.

Source: Koyfin

Key Opportunities

Accessible AI & Automation

The introduction of GPT-4 has enabled a number of businesses to leverage AI in their existing products. Intercom is no exception. In an interview, Des Traynor described the company’s vision for Fin this way:

“We wanted to build a superior, more established version of our resolution bot that could hold all types of conversations but also had the capacity to get specific. We also needed to withhold hallucinations as much as possible – they’re quite dangerous for customer support… It’s funny, but a lot of the work we did on Fin was getting it to not do things. The capabilities of a lot of AI models are great, but they have an inflated sense of their knowledge. We needed to tame that tendency so that Fin understood its confidence level when answering. Sometimes it should say, 'I’m not sure, but here are two articles that might help,” other times, it should say, “I know the answer – here you go.' Most crucial was getting Fin to learn when to say, 'I have no clue, I’m going to pass you over to a human agent and they’ll take it from here.' Most of the research we did focused on helping it make that hand-off.”

One of the benefits of Fin’s ability to leverage GPT-4 over Intercom’s previous resolution bot is the fact that Fin requires zero training, compared to the extensive training and fine-tuning that other bots have required in the past. Intercom’s established position could be an effective way to distribute AI-enabled conversations to users more quickly than earlier-stage competitors. As Intercom CEO Eoghan McCabe told Contrary Research in a July 2023 interview:

"Customer service heretofore has been humans reacting to problems. That sucks for the humans and it sucks for the customer. The humans are just doing this menial, repetitive work. The customer often has to wait days for replies. It's atrocious. We're going to change all of that through our next-generation platform. AI will be at the center. We will do not just reactive but also proactive support, with not just bots but also humans. A perfect symbiosis. And with our proactive human and bot approach, we're gonna onboard people into products and help them discover functionality and solve issues before they actually become issues. And when they do become issues, make sure that they can get fast, helpful replies from bots, and when they need to talk to humans they can get an opportunity to connect with them too."

Scalability Through Improved Onboarding

Migrating support channels to a new platform can be a daunting task for businesses. Intercom's current setup course takes an estimated 30 minutes or less, but mastering the platform takes longer. By making the transfer and sign-up process more intuitive, especially through integrations with other platforms like Stripe, Intercom could attract more customers and facilitate their transition to its platform. This would not only enhance the user experience but also contribute to the scalability of Intercom's business by reducing the need for support staff.

Industry-Specific Solutions

Intercom has recently started offering industry-specific solutions. By providing templates for onboarding and specific sales funnels tailored to different industries, Intercom can cater to the unique needs of businesses in various sectors. This approach can enhance the relevance and effectiveness of Intercom's platform for these businesses, thereby increasing its appeal and market penetration. An example of this initiative can be seen in Intercom's solutions for the financial services industry.

Key Risks

Conversion Friction

One of the key risks for Intercom is the friction associated with converting to a new tool. Migrating to a new platform can be a complex and time-consuming process for businesses, which may deter them from switching from their existing solutions, even if they are subpar. Moreover, the customer communication and engagement market is highly saturated, with numerous competitors vying for market share. This intense competition could lead to pricing pressures, making it more challenging for Intercom to acquire new customers and retain its existing ones.

Limited Defensibility for AI Tools

Intercom relies on GPT-4 and has limited defensibility over its AI customer support services. Although all agents require some tweaking, more AI customer support companies will be able to enter the market, with over 40% of Y Combinator’s summer 2023 batch working in AI. Meanwhile, Fin is still in private beta as of June 2023 and its performance remains to be seen. If Fin fails to meet expectations or if other AI solutions prove to be superior, Intercom could lose its competitive edge.

Moreover, as a larger company with multiple products to manage, Intercom may not be able to compete with the budget of larger companies or those with more specialized expertise in AI. As Intercom CEO Eoghan McCabe told Contrary Research in a July 2023 interview:

"An extrinsic risk is the thing you don't know... a company that is building a new type of AI and raises $100 million and goes nuts and doesn't care about revenue growth for three or four years. Maybe that never happens, maybe it does happen and it fails, maybe we do that, but there's always a risk of the unknown."

Path to Profitability

While the company's annual recurring revenue (ARR) now exceeds its total funding, it still faces the challenge of balancing growth and profitability. According to a report from The Irish Times, Intercom's losses more than doubled in 2020 despite a 47% increase in revenue. However, in October 2022, Intercom’s CEO, Eoghan McCabe, said the company has been “’on and off’ cashflow positive status since [2018].” Intercom’s profitability is unclear, but given the company’s revenue growth is estimated at <30%, the ability to generate a profit will be a meaningful part of Intercom’s future valuation.

Summary

Intercom offers a suite of customer support tools designed for personalized communication and proactive support. Intercom was founded before live chat was commonplace, but continues to operate with the mission to make internet business personal. Intercom has achieved organic growth through content blogging, attracting both startup and enterprise customers. However, Intercom faces intense competition ranging from mid-market focused companies, like Zendesk, to enterprise-level companies such Salesforce. By leaning into AI support and continuing to offer a wide variety of customer communications tools for every step in a customer’s journey, Intercom hopes to scale by fostering better business-customer relationships.