Thesis

The sales process is moving online, with 80% of B2B sales interactions between suppliers and buyers projected to take place digitally by 2025. The new status quo leaves a huge digital footprint. In response, Chief Sales Officers (CSOs) are prioritizing improving sales analytics capabilities and investing in AI to improve seller effectiveness. Additionally, the number of people and channels involved in B2B buying decisions is growing; up to ten individuals across an average of ten channels are involved in most B2B buying decisions, creating a need for AI to help capture, analyze, and act on a high volume of digital signals for any given deal.

Despite the fact that 89% of sales organizations have adopted a CRM, only 39% of CSOs are satisfied with their tech stacks. Many sales organizations struggle to capture a complete view of deal and account data from manually-entered front-line data. Gartner predicts that by 2025, 70% of all B2B seller-buyer interactions will be recorded or analyzed using AI/ML, and 75% of B2B sales organizations will replace traditional sales playbooks with AI-based solutions.

People.ai helps sales, marketing, and customer success teams uncover every revenue opportunity from every customer by capturing all customer contacts, activity, and engagement to drive actionable insights. People.ai’s product empowers sales leaders to be more effective at managing their teams and growing revenue by giving them a complete picture of sales activities and leveraging AI to deliver sales performance analytics, personalized coaching, one-on-one feedback, and pipeline reviews. Customers can use the insights from persona analysis, opportunity health, and engagement in their preferred BI solution to improve forecast predictability. People.ai has positioned itself in the enterprise revenue intelligence market by building data infrastructure that integrates with other sales tech solutions rather than seeking to replace them.

Founding Story

People.ai was founded in 2016 by Oleg Rogynskyy. He was born in Dnipro, Ukraine. He moved to the United States to attend Boston University, where he founded his first company, a photo-sharing app. Soon after graduating, he moved to Canada and became the first salesperson at Nstein Technologies, a text mining and content analytics company. There he worked with Dr. Yoshua Bengio, who is credited as one of the people who invented deep learning.

At Nstein, the COO grounded the sales team for a week to clean up every record in Salesforce because the data was unorganized and incomplete. Rogynskyy got early exposure to how issues with a company’s CRM data can inhibit the business. Nstein was acquired in 2010, and in 2011, Rogynskyy started his own company called Semantria. Both at Semantria, and again as the VP of Sales at H2O.ai after he sold Semantria in 2014, Rogynskyy continued to experience this same limitation with CRM data errors.

In February 2016, after almost a decade of being hampered by the same CRM pain points, Rogynskyy got a call from an investor in one of his previous companies. He describes the interaction this way:

“We go for a coffee on third street in San Francisco at the Creamery and he's like, ‘Hey, look, are you happy not having your own company after you had success?’ I'm like, ‘not really’. And he literally pulls out a $150,000 check, gives it to me and says, ‘Why don't you go start a company today? Here's your first investment.’”

To address the problems he experienced in previous roles, Rogynskyy’s initial goal was to develop software that would use AI to automate the MEDDIC sales framework developed by John McMahon at PTC. Rogynskyy was accepted into Y Combinator 2016 summer batch, and credits his experience in YC with helping him define the problem he was addressing and better articulate his go-to-market strategy. After speaking with more than 40 potential customers, it became clear that they were still managing their employees based on manual processes and not much data.

Product

Source: People.ai

Data Platform

People.ai’s core product is its data platform, which automatically captures sales activity data from email, calendars, phone calls, virtual conference platforms, and other places where sales reps are engaging with customers digitally. The product then uses patented AI algorithms trained on over 350 million sales activities, 40 million contacts, and $100 billion in closed deals to match the data to the corresponding accounts or opportunities in Salesforce, where it continuously enriches contact records to make sure they are up to date.

People.ai’s data platform analyzes all ingested data against the company’s historical trends and industry standards so that reps can direct their attention to the places in their pipeline that need it most. The platform may also identify high-risk scenarios including deals with low buyer engagement, missing executive management engagement, and single-threaded deals. Tracking deal outcomes gives a sense of what a company’s best sales reps are doing and can suggest ways for those lagging behind to improve. It also serves as a unified source of truth by providing data visualizations natively within CRM through enterprise APIs or pre-built business intelligence connectors.

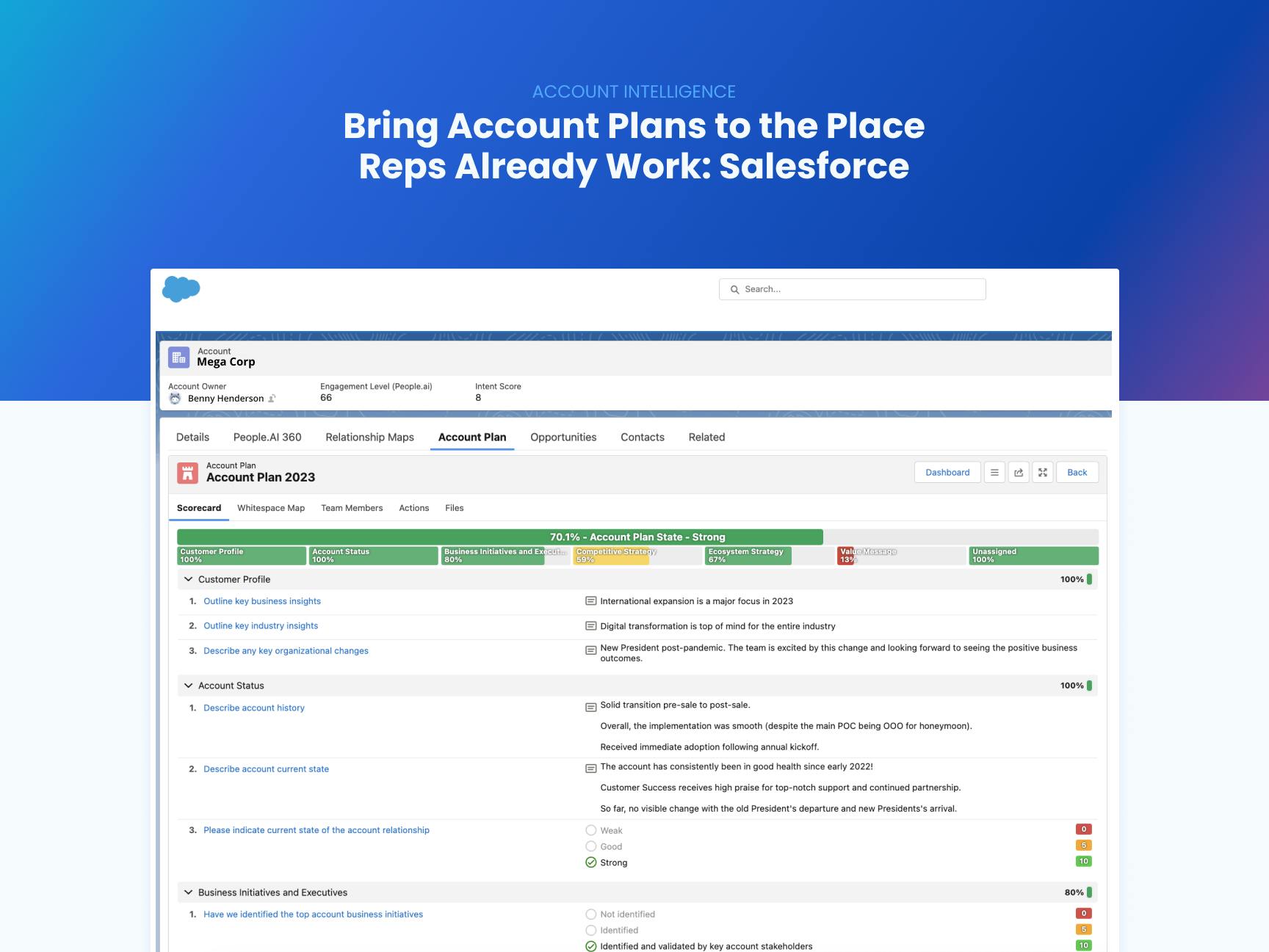

Account Intelligence

Source: G2

People.ai combines its data platform with Salesforce-native account management capabilities. These features are built on top of ClosePlan, a Salesforce app that People.ai acquired in October 2020. Within Salesforce, People.ai’s customizable account scorecards capture the health of prospects and customers and help reps surface and reengage dormant or at-risk accounts that may be ready to churn. They can also be a tool for sales leaders during coaching sessions.

Whitespace maps help reps visualize addressable spend across customers and market segments and make it easier for GTM teams to spot cross-sell or upsell opportunities and what accounts are owned by competitors. Auto-populating relationship maps replace org charts that are difficult to keep up-to-date manually, allowing reps to understand the role a contact plays in a deal, visualize the influence they have across teams and departments, and identify healthy (or unhealthy) relationships among key influencers.

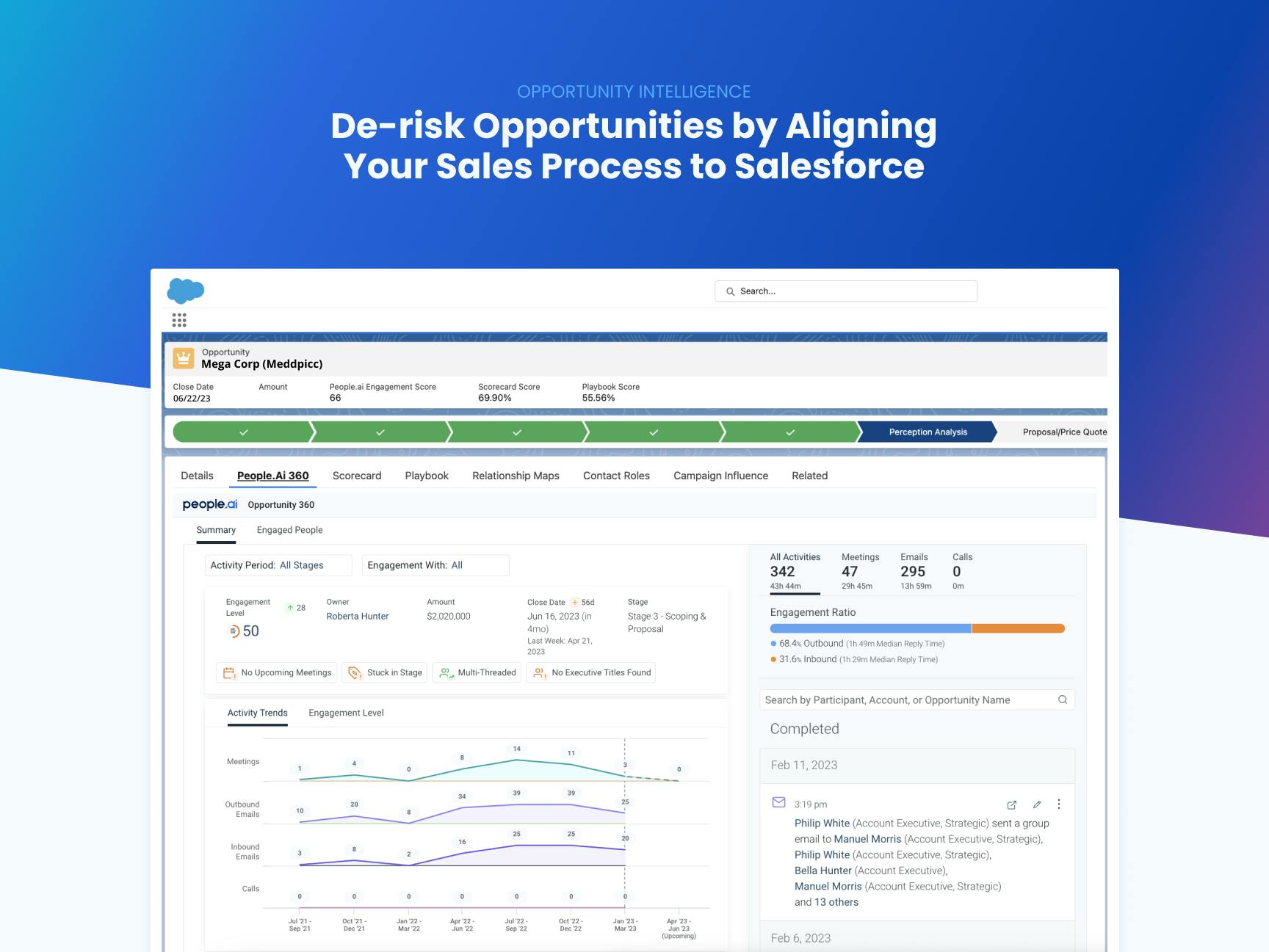

Opportunity Intelligence

Source: G2

People.ai also comes with various opportunity intelligence features that help sales organizations execute their sales strategy within Salesforce. One such feature is opportunity qualification scorecards that unify a team around a common methodology, like MEDDICC, Force Management Command, BANT, and more, while providing AI recommendations on what deals are worth pursuing the most.

Another feature is opportunity playbooks, repeatable procedures to bring deals to close. They can be customized for different deal types, including enterprise sales, renewals, cross-sells/upsell, or professional services. People.ai automates the Salesforce sales stage progression to reflect the current state of deals and provides reps with the best course of action at any deal stage.

Relationship Maps

Users can build maps natively in Salesforce with auto-populated, easy-to-use, drag-and-drop functionality in order to clarify a path to revenue by building better relationships with the buyers who matter most. Relationship maps help sales reps stay fully up-to-date on their buyer groups with limited maintenance required.

MEDDICC Opportunity Management

Users can visualize your MEDDICC qualification sales process with People.ai's native Salesforce app. Sales reps can effectively qualify and execute deals by leveraging a common framework and language. Using AI-based recommendations, they can use out-of-the-box MEDDICC scorecard templates and pinpoint champions and economic buyers.

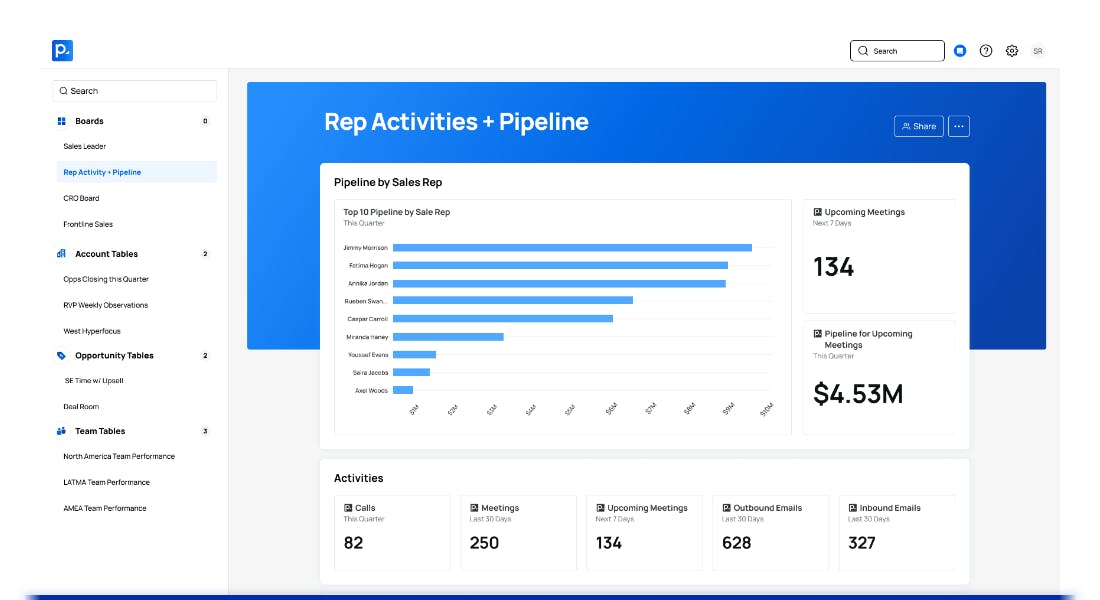

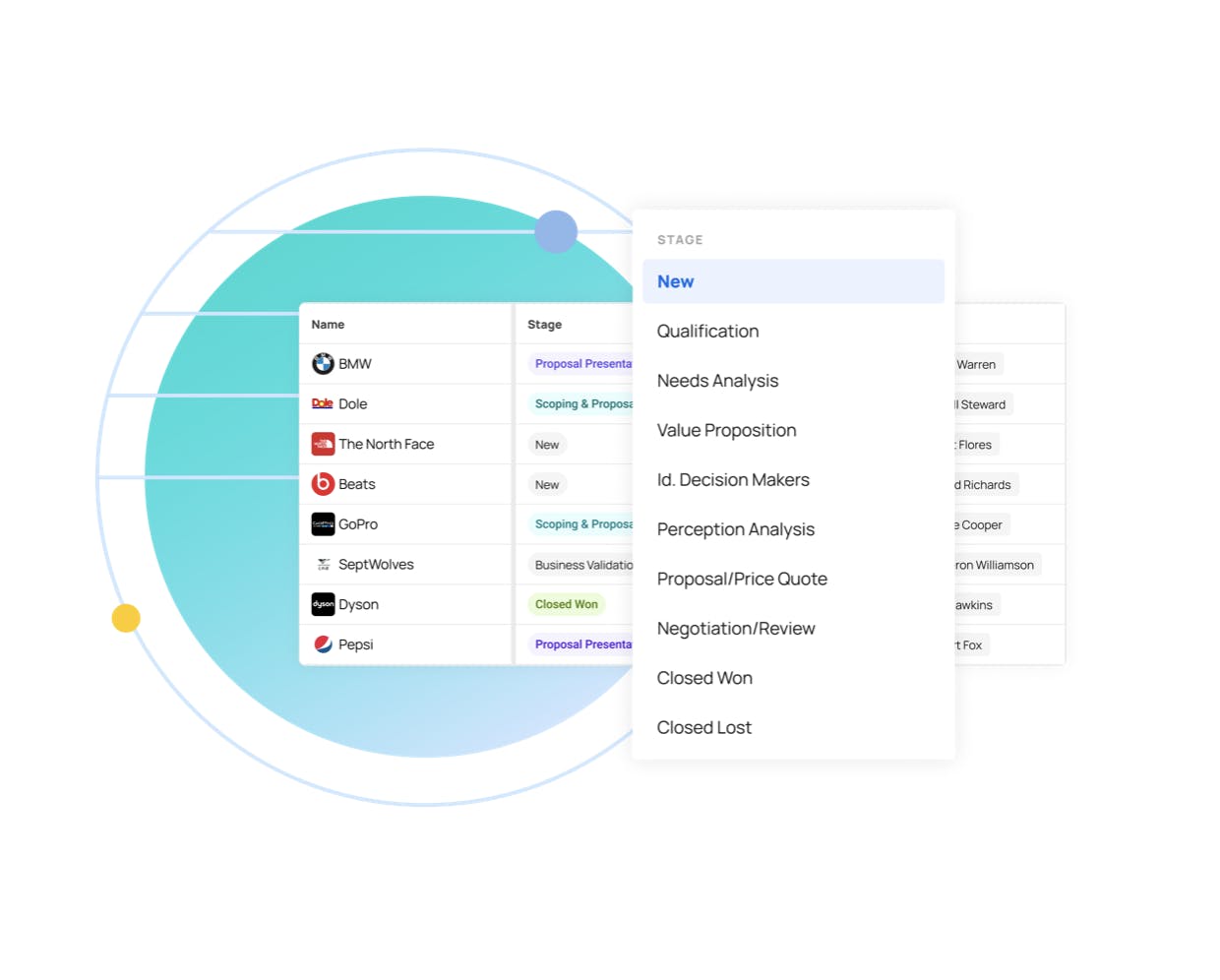

PeopleGlass

People.ai enables users to visualize all the opportunities in one view. They can create custom dashboards in seconds. With PeopleGlass, sellers can update opportunity records, including all notes and required fields. It offers easily customizable views that let managers put everything that matters most front and center, so their teams always know what’s actively being worked on, what’s not, and what’s missing.

Source: People.ai

Market

Customer

People.ai serves sales, marketing, revenue operations, and customer success teams, primarily at B2B tech companies. For sales teams, People.ai frees reps up from time-consuming manual data entry, benchmarks top performers, and helps managers deliver more actionable advice during coaching sessions. Marketing teams can use the visibility it provides to optimize their ABM strategy. It helps RevOps teams increase GTM efficiency and ROI, and its account and opportunity management features ensure customer success teams maximize expansion within existing accounts. Within sales teams, which is the primary team that People.ai serves, the company targets sales leaders as opposed to sales reps.

Some notable customers include Zoom, Okta, Zendesk, Pluralsight, and AppDynamics. Their customers are mostly large enterprises with sales teams of 100 or more people. The company also has a presence in some life sciences, manufacturing, and telecommunications companies.

Market Size

The revenue intelligence industry was estimated at $2.8 billion in 2020, and is projected to grow to $7.4 billion by 2030 at CAGR of 10.6%. As other industries outside of B2B tech mature to embrace revenue intelligence tools, People.ai’s addressable market has the potential to expand significantly. People.ai also competes in the broader customer revenue optimization (CRO) market, projected to grow from $8.6 billion in 2021 to $18.2 billion in 2032.

Competition

Gong: Gong is a revenue intelligence platform that ingests data from sales interactions. The company started primarily with ingesting calls, but have expanded to include email and calendar data. Gong then leverages AI to provide actionable insights for users. Sales leaders primarily appreciate its call-recording features. Gong’s long-term goal seems to be positioning itself as a platform, whereas People.ai has taken a more back-end infrastructure approach by integrating with Salesforce. Gong was founded in 2015 and has raised $583 million in total funding. In June 2021, Gong raised a $250 million Series E led by Franklin Templeton Investments with participation from Sequoia, Salesforce Ventures, and Coatue.

Chorus.ai: Chorus.ai is a conversation intelligence platform that generates actionable call notes and insights from sales conversations. It was acquired by ZoomInfo for $575 million in July 2021, which has given the platform a direct on-ramp to the larger enterprises that ZoomInfo serves. Chorus.ai was founded in 2015 and has raised $100 million in total funding.

Clari: Clari is a revenue operations company that began in sales forecasting, but has expanded to manage an entire revenue cycle for a company. Clari was founded in 2013 and has raised $496 million in total funding. The company raised a $225 million Series F in January 2022 led by Blackstone Group, with Sequoia, Silver Lake, and Madrona also participating.

Outreach: Outreach is a sales engagement platform, which has expanded to provide integrated conversation intelligence and revenue intelligence features. It was founded in 2014 and has raised $489 million in total funding. The company raised a $200 million Series G in June 2021, led by Steadfast Financial, Steadfast Capital Management, and PremjiInvest, with participation from Vista Equity Partners.

Salesloft: Salesloft is another sales engagement platform with sales call tracking, transcription, analysis, and coaching functionality. To complement its core offering, the company released a revenue intelligence product that competes directly with People.ai. Salesloft was founded in 2011 and has raised $246 million in total funding. Salesloft’s raised a $100 million Series E led by Owl Rock Capital in January 2021, with Insight Partners, HarbourVest Partners, and Emergence participating. The company was then acquired by Vista Equity in January 2022.

IntroHive: IntroHive is a customer intelligence platform that helps B2B organizations capture sales data. It is one of the more vertically specialized of People.ai’s competitors, focusing on the professional services industries. It was founded in 2012 and has raised $125 million in total funding. IntroHive raised a $121 million Series C in June 2021 led by Providence Strategic Growth (PSG), with MAVAN Capital Partners and Evergreen Coast Capital participating.

Business Model

People.ai operates on a subscription model that is priced per user. According to a former strategic account executive, its base offering is its data capture tool, which costs $500 to $1K per user. Customers can then pay more for dashboards and account planning functionality. The company’s PeopleGlass product is free of charge. Since the company typically sells to large enterprises, its average contract value (ACV) is typically around the $50K -$100K range.

Traction

Source: People.ai

People.ai reported a 245% YoY increase in customers in February 2021 and a 260% YoY increase in August 2021, with large brands such as Verizon Connect, Okta, and Palo Alto Networks as customers. In 2022, People.ai ranked in the top 20% on the Inc. 5000 list. Since its founding in 2016, People.ai says it has trained its AI on $239 billion in closed/won enterprise deals and 1.1 billion unique sales activities, with 14 billion AI insights extracted from those activities. Third-party research puts its 2022 revenue estimate at $38 million.

Valuation

In August 2021, People.ai raised a $100 million Series D funding round led by Akkadian Ventures and Mubadala Capital Ventures at a $1.1 billion valuation — twice its Series C round in 2019. The round brought its total funding to $200 million. Other notable investors include UpVentures Capital, ICONIQ Capital, Andreessen Horowitz, and Lightspeed Venture Partners. Assuming People.ai’s valuation hasn’t changed, that $1.1 billion valuation represents a ~29x revenue multiple on 2022’s estimated revenue of $38 million.

One of People.ai’s competitors, Gong, is valued at $7.3 billion in 2021, representing a 41x revenue multiple. Chorus.ai, another revenue intelligence company, was bought by ZoomInfo in July 2021 for $575 million.

Key Opportunities

Enterprise Growth

While the company has several large customers, including Zoom and Okta, People.ai has the potential to expand its addressable market by targeting larger enterprises more directly. In addition, other verticals like manufacturing or banking could represent large potential enterprise contracts. People.ai could help client-facing parts of banks, like wealth management, by automatically inputting client profiles into the company’s CRM.

Conversation Intelligence

PeopIe.ai may not be as comprehensive as many competitors, but the company’s ability to generate revenue from customers could come through adding modules to their product into functionality like conversation intelligence. The company has made steps in this direction through its partnership with Zoom to provide its Zoom IQ for Sales product. It enriches Zoom’s conversation intelligence product with buyer and relationship intelligence from its data platform.

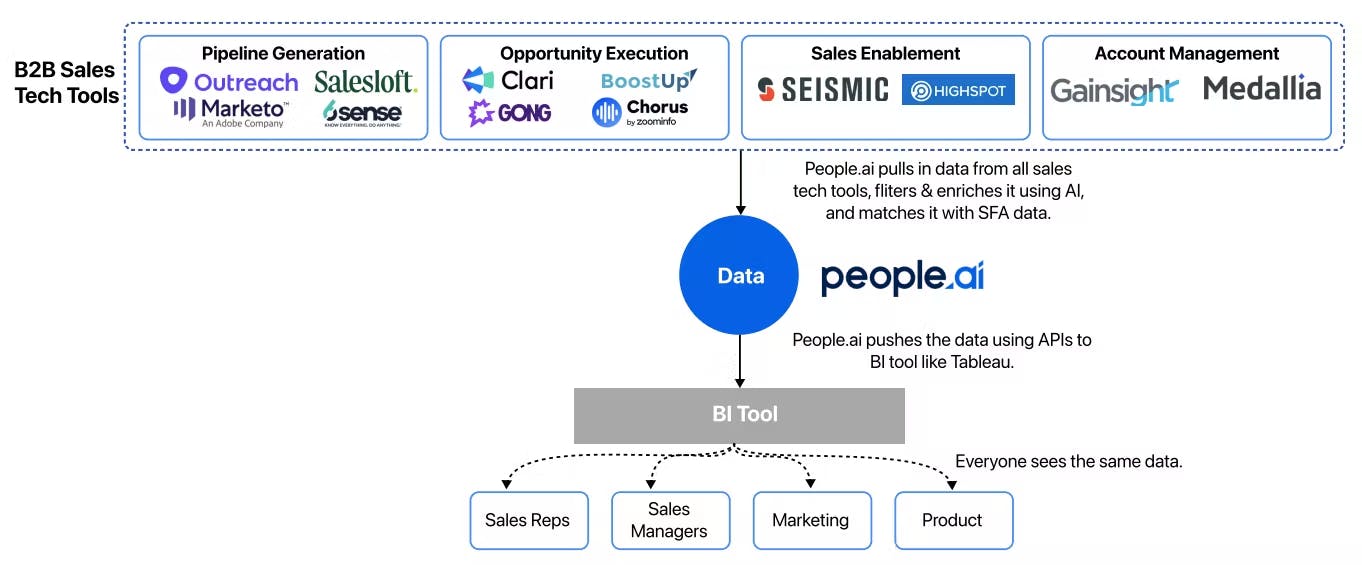

Data Infrastructure

Source: Sacra

The average enterprise sales rep uses 5-10 sales tech tools, and the sales data is split across silos. People.ai is betting on the fact that salespeople don’t need another source of data. Rather than serving as another platform that users have to spend time in, People.ai hopes to build a data infrastructure that works in the background to aggregate the existing sales tech stack. In theory, this will allow it to capture a much larger market as it becomes more than a revenue intelligence tool. Their focus on creating an embedded Salesforce experience and efforts to integrate with other platforms, like Oracle CRM, has indicated the likelihood of this direction.

Key Risks

Privacy

People.ai’s product relies on unrestricted access to email, calendars, phones, and other customer touch points. These often contain personal or confidential information. While People.ai tries to filter out sensitive information using machine learning, prospects might decide that the product isn’t worth the potential security or compliance risks. Sales leaders in more traditional industries may be reluctant to launch a revenue intelligence tool because they are less receptive to the idea that all of their emails and phone calls are being tracked. On the other hand, People.ai is not as exposed as companies like Gong and Chorus.ai, who rely more on conversation intelligence and deal with the even larger legal challenge of recording client calls.

Commoditization

Over the past few years, companies specializing in revenue operations and sales engagement have introduced numerous revenue intelligence features with the goal of becoming an all-in-one solution for sales teams. For example, Chorus.ai was recently acquired by ZoomInfo and gained easy cross-selling opportunities and a direct on-ramp into its proprietary information and tools. As revenue intelligence continues to be bundled into products as a feature, the value that People.ai adds as a standalone tool may be at risk.

Summary

People.ai is a sales intelligence product that processes significant amounts of sales engagement data, and provides actionable insights, touting the principle that sales teams should be driven by data rather than intuition. People.ai’s early focus on developing and training proprietary machine learning models has put its focus on building infrastructure to manage a wide variety of data sets, and integrations with front-end platforms like Salesforce. However, as competitors converge on revenue intelligence from all sides, each looking to become the all-in-one sales intelligence solution for sales teams, the biggest question now is whether or not People.ai’s data layer approach is sustainable long-term.