Thesis

Labor can represent up to 70% of the cost of operating a business. But despite the criticality of managing people in any organization, employee turnover is increasingly a massive drag on most companies. In 2021, 47% of employees turned over, while in 2024, 33% of hiring managers expected to see even higher employee turnover. Unfortunately for most companies, over 70% of turnover is voluntary. Each employee that turns over can cost a business 1.5-2x the employee’s annual salary. Over 40% of employees that turn over cite increased benefits and career advancement as reasons they might have been retained.

The process of providing opportunities for career advancement often comes in the form of upskilling employees and providing learning experiences for employees to develop new skills. Companies that offer comprehensive training programs typically perform better than those that do not, reporting 24% higher profits and a 218% higher income per employee. As a result, employee upskilling was a top five leadership focus for employers in 2024.

The cost of providing upskilling opportunities is typically fairly expensive with in-person training opportunities requiring significant resources and time. Instead, providing online learning resources can be 3x cheaper. Typically those types of online learning experiences are provided through a learning management system (LMS).

That’s where Go1 comes in. Go1 provides a curated online learning library comprised of content from training providers across dozens of categories, such as industrial skills, health & safety, legal, mental health, time management, and more. The goal is to allow customers to more easily integrate Go1 with platforms they already use, such as Workday, Rippling, and ADP in order to deliver training programs to their employees.

Founding Story

Source: Madrona

Go1 was founded in 2015 in Brisbane, Australia by four friends: Vu Tran, Andrew Barnes (Director), Chris Eigeland (CEO), and Chris Hood.

Go1's journey began when high school classmates and best friends Barnes and Tran were looking for a job during high school. Rather than working in retail, they opted to build a software business called Busy Links in 2006. Eigeland joined the two as they were working to create websites for companies like ANZ Bank and News Corp.

After high school, the team split to pursue separate paths. Eigeland identifies this split as the “crucial diversification” that allowed the team to circle back and create Go1. Eigeland went off to study law and founded a nonprofit focused on delivery education hardware, Vu became a general practitioner, and Barnes studied economics and earned his master's in educational technology as a Rhodes scholar at Oxford. Barnes met Hood, the final addition to the Go1 founding team, at a tech conference.

This varied set of experiences across different fields allowed them to understand how difficult the process of accessing professional education can be. The idea for a company was born out of the desire to unify educational content for upskilling employees. The team applied and was accepted to Y Combinator in 2015. After that program, the team returned home to Australia to work on Go1 full-time.

In 2021, the company elected to have Eigeland serve alongside Barnes as Co-CEO. Then, in August 2024, Barnes stepped down from his role as Co-CEO with Eigeland becoming the sole CEO. As of August 2024, the company was preparing for an IPO which Barnes indicated would require simplicity in its leadership. Barnes stated that “by having a single CEO, we will be able to move faster on the day-to-day decisions, and I will continue to be able to focus on the long-term landscape for the company.”

Product

Source: Go1

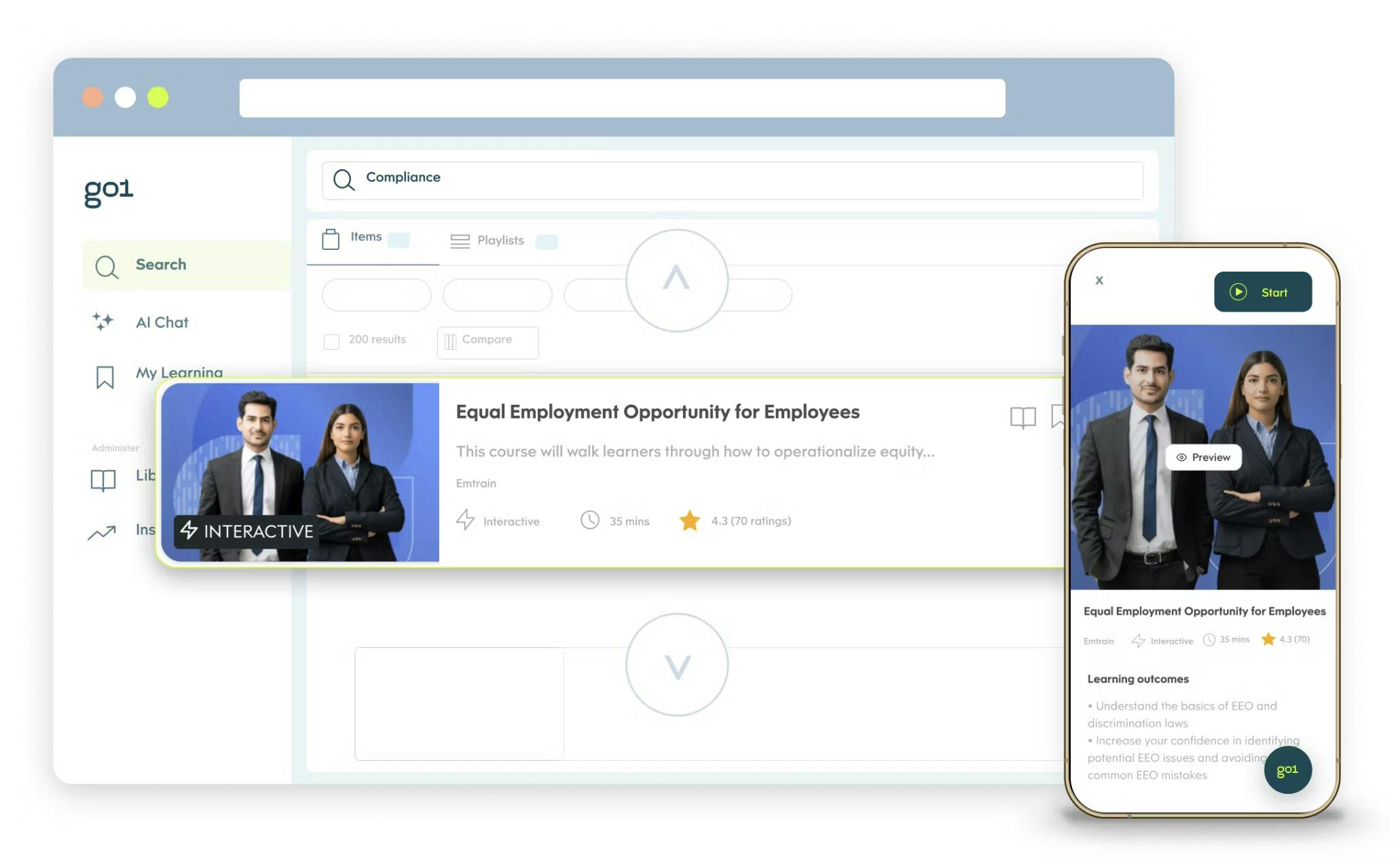

The core components of Go1’s platform are (1) content and (2) integrations:

Go1’s content library includes training from third-party providers across a wide variety of topics. Rather than having to negotiate with a number of content providers across different disciplines, customers can gain access to an entire library through Go1.

Go1’s integrations are focused on making its LMS as usable as possible within a company’s existing HR platforms.

Content Aggregation

Source: Go1

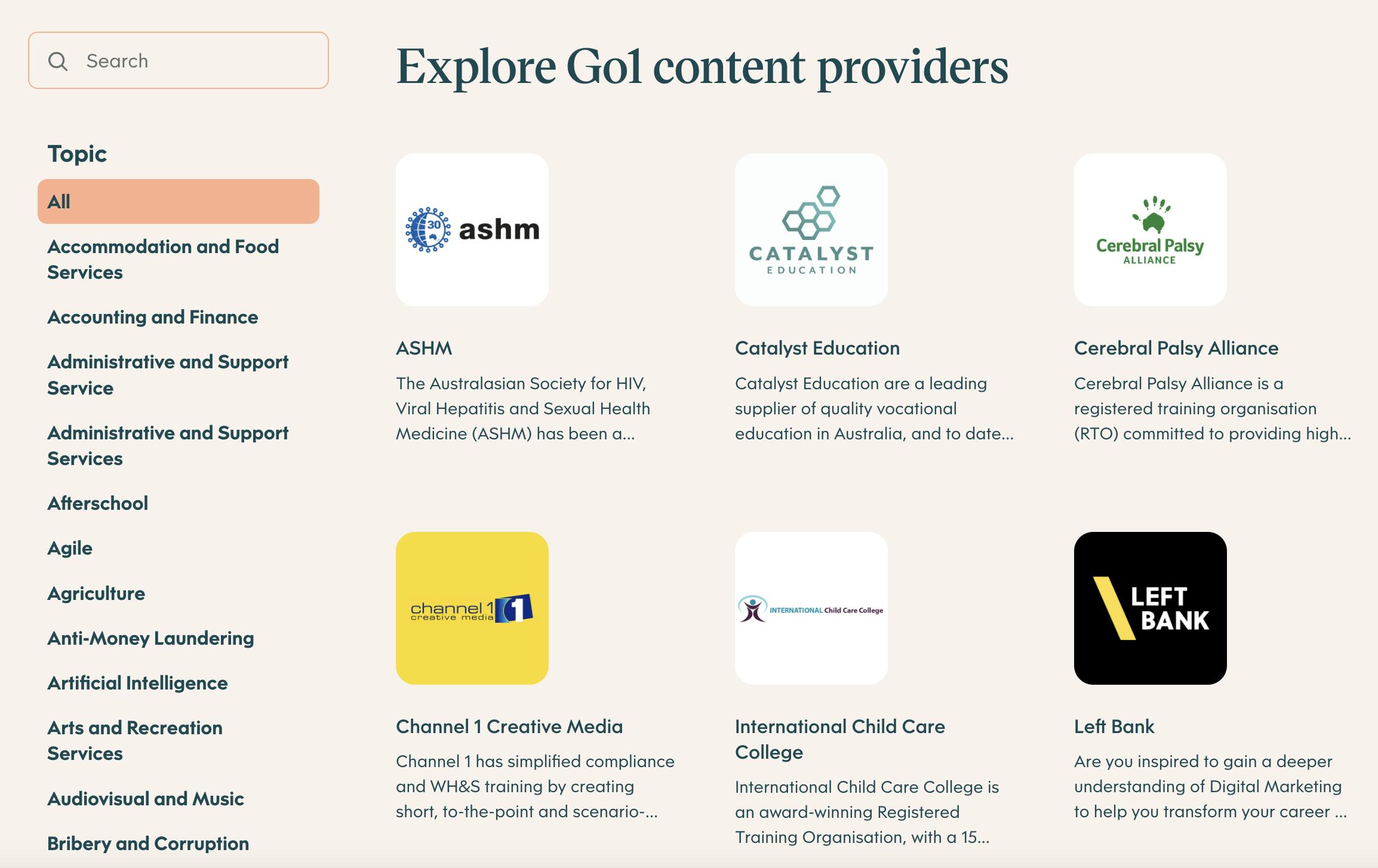

Go1 operates on a content aggregation model; it centralizes ~150K courses from over 250 providers, such as Harvard Business School, Coursera, EdX, Blinkist, and more. The content spans a range of subjects, from human resources to marketing to mental health, and comes in various formats, including immersive courses, podcasts, and practice labs. In addition, the content is available in 14 different languages.

The company can be thought of as the Spotify of upskilling content: it consolidates and distributes all content on a single platform while also allowing its content creators to earn royalties. The amount of royalties that a provider earns is based on how much of their content is consumed. Providers can also negotiate the visibility and availability of their content on Go1, reserving the right to maintain paywalls or set specific access restrictions as needed.

The Spotify analogy can be extended further to the way Go1 arranges its content and allows it to be accessed by users. Users can filter content and search via keywords based on specific topics. Go1 also offers curated playlists that can be saved, or used to track progress in order to provide a clear picture of each user’s learning experience. Additionally, Go1 makes recommendations for learners based on the content they tend to focus on while on the platform.

Companies’ administrations can also create content playlists themselves, add more modules to a course such as an extra quiz or survey, and view insights on employees’ learning progress. Go1 allows administrators to award certifications for employees who complete certain courses. They also have the option to partner with Go1’s content consultants for advisory on strategizing their workforce’s development.

Integration Capabilities

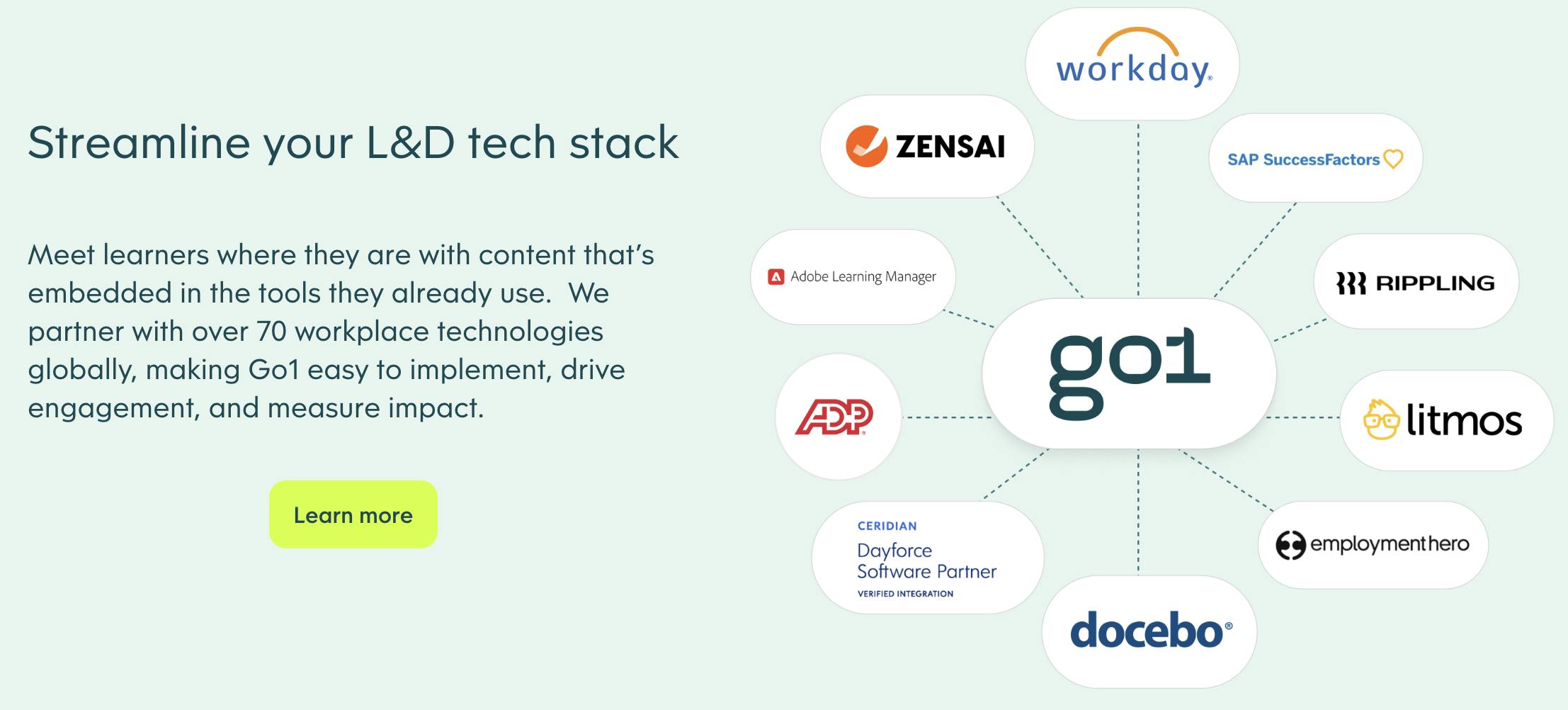

Source: Go1

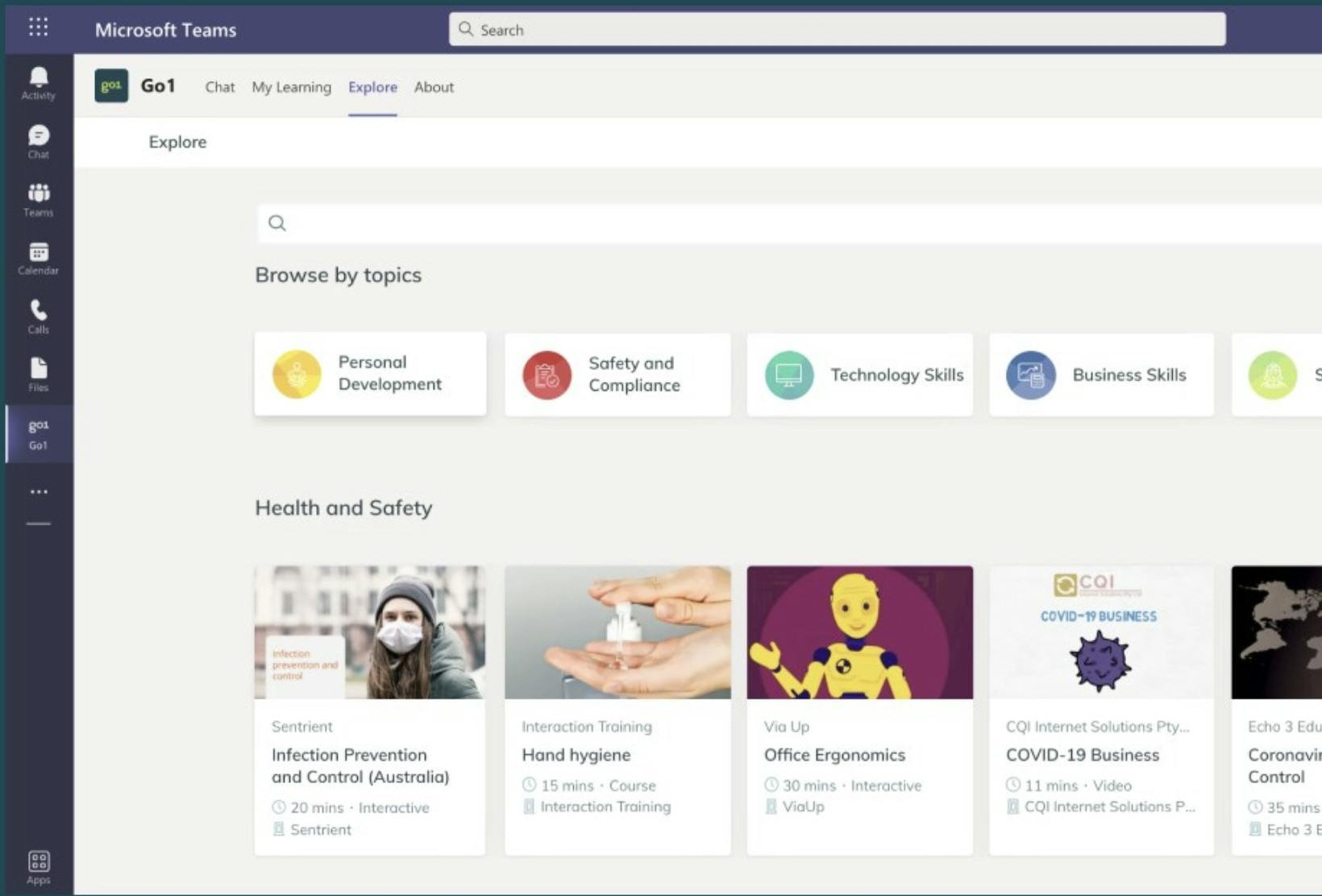

The second key aspect of Go1’s product is its integrations with over 70 LMS and workplace technology platforms that companies already rely on, such as Microsoft Teams, ADP, and Slack. These integrations allow companies to automatically upload content through these platforms instead of manually transferring it, which allows for increased flexibility in content creation. For continued education efforts, employees can access content and track it through these existing platforms.

Specific platforms, such as Microsoft Teams, provide the option to download the Go1 App or access Go1 directly through the Microsoft Teams platform. For example, the Go1 for Microsoft Teams allows team owners to create “Learning Tabs” within specific Teams channels and add Go1 content directly to the channel. Users can even access and share learning content within Teams video calls.

Source: Microsoft

For companies that do not have an LMS or HR platform that they regularly use, Go1 also enables users to access the Go1 platform directly for employee learning experiences.

Market

Customer

Go1 serves a variety of customers, from small and midsize businesses to nonprofits or even large enterprises. Over 10K organizations are using Go1, including Microsoft, Delta, Warner Brothers, TikTok, and more. Across Go1’s platform, the company reportedly had 50 million registered users who have completed courses on the platform as of August 2024.

Individuals generally spend anywhere between two and six hours per month while actively engaging with content on Go1. Go1 also targets creators of learning content themselves in order to continue expanding its content database, offering data analytics on user behavior and a global reach for creators in return

Market Size

Go1 targets the learning and development market, encompassing the types of platforms that work to deliver professional development resources to organizations and their employees. Propelled by the transition to e-learning, the learning and development market has experienced significant growth since the 1990s leading to the creation of LMS and other corporate learning tools. The market was valued at $361.5 billion in 2023 and is expected to reach a value of $805.6 billion in 2035, growing at a CAGR of 7%.

Within the broader learning and development market, Go1 also operates in the LMS submarket due to its integration partnerships with different LMS platforms as well as its own portal for employee access. This submarket in particular was valued at $20.3 billion in 2023 and is expected to reach $82.0 billion in 2032, growing at a CAGR of 17%.

Competition

LinkedIn Learning: LinkedIn Learning was launched after LinkedIn acquired Lynda.com in April 2015. LinkedIn Learning is an expansive e-learning platform that leverages the professional network's vast user base to deliver personalized course recommendations. The platform offers over 23K courses across business, technology, and creative content as of January 2025.

LinkedIn Learning integrates directly with users’ LinkedIn profiles, allowing them to display completed courses and earned certificates directly on their professional profiles, enhancing their visibility to potential employers and connections. The courses are designed to help professionals advance in their current roles or pivot to new careers, with features that cater to both individual learners and corporate training needs. Unlike more general platforms, LinkedIn Learning also emphasizes soft skills and provides insights into industry trends, leveraging LinkedIn's extensive data on job roles and skill requirements.

Degreed: Degreed was founded in 2012 to “jailbreak” the college degree. The platform provides upskilling content to employees to help them grow their careers and allows companies to understand where the skill gaps are in their workforces. Degreed also allows employees to track learning that happens outside of its platform, such as listening to podcasts. Users can preserve their Degreed profiles even after they leave their current employers.

One key point of differentiation between Degreed and Go1 is that Degreed has a proprietary scoring system that collectively analyzes all the content an employee has learned and attributes a single score to quantify their skill. As of January 2025, Degreed had raised a total funding amount of $462.7 million and, as of April 2021, was valued at $1.4 billion.

Edcast by Cornerstone: Founded in 2014, Edcast is a learning experience platform (LXP) that focuses on aggregating, curating, and delivering a personalized learning experience for employees trying to develop corporate skills. Whereas an LMS is typically more focused on delivering structured content and typically implemented top-down by management, LXPs are more learner-focused, creating a self-driven, highly personalized, and more social learning experience for the user.

One of Edcast’s key features is its AI-powered Open Skills Platform, which utilizes AI to automatically match skills and roles to its content library. It also has its Knowledge Cloud, which provides companies with tools to assess their employees’ skill comprehension. Like Go1, Edcast also has integration capabilities with a number of HR platforms. In March 2022, Edcast was acquired by Cornerstone, a software company focused on delivering HR solutions. ****

Udemy Business: Udemy Business is a subscription-based learning content platform that is selectively curated based on criteria such as instructor reputation, high learner satisfaction, and market demand. It offers more than 28K online learning courses that span topics from engineering and HR to IT operations and data science. Udemy Business also has a generative AI component that can create interactive learning tools, construct learning pathways, and create certificates and badges to validate learning progress.

Coursera For Business: Coursera For Business is another subscription-based content platform. Like Udemy for Business, it is also specialized for companies looking to upskill their employees. The platform includes 8.4K+ courses, 3.5K+ guided projects, and 55+ professional certificates. Companies can construct their own courses based on their specific objectives. Coursera offers two subscription plans, one for teams of 5-125 employees and another for enterprises of 125+ employees. The enterprise subscription comes with all the benefits of the team subscription as well as features such as job-based content recommendations and LMS integrations.

Pluralsight: Pluralsight is an online learning platform founded in 2004 focused on training for tech professions such as security development and IT operations. The platform has two separate paths: Skills and Flow. The Skills path targets individuals, software development, security teams, and IT ops, and allows learners to move through content at their own pace. The Flow path focuses on engineers and their workflow, providing resources for engineering teams to compare new code with old, fix bugs in projects, and visualize pull requests. Compared to other upskilling content creators like Udemy, Pluralsight has a narrower, more specialized range of courses offering a library of 7K courses.

Business Model

Source: Go1

Go1 operates on a subscription-based model called Go1 Premium. Companies that subscribe get access to all of the content on Go1’s practice through a single subscription.

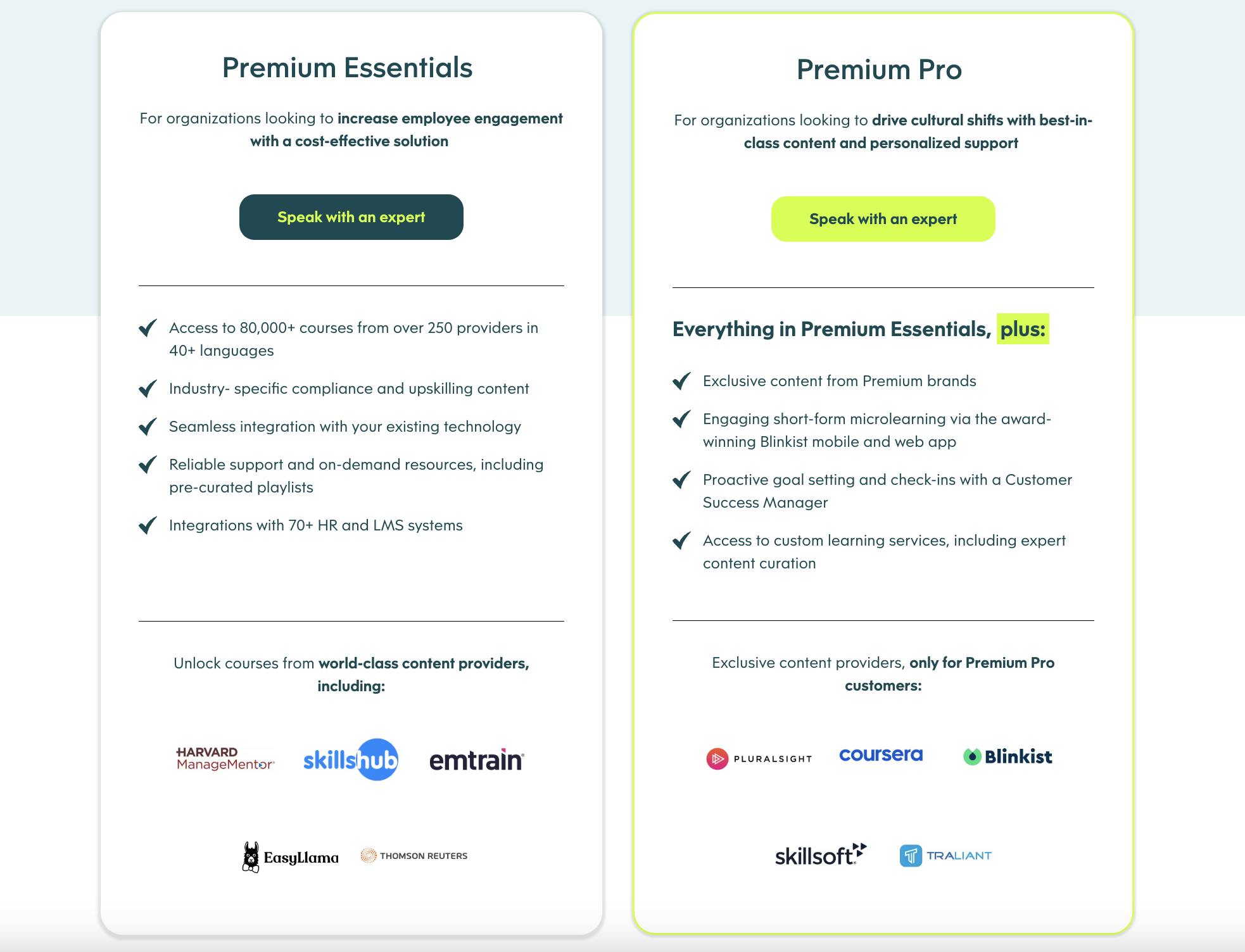

There are two versions of Go1 Premium: Premium Essentials and Premium Pro. Premium Essentials includes access to all the learning content and pre-curated playlists available on Go1 as well as integration capabilities with 70+ platforms that may already be in use by an organization. Premium Pro includes everything offered in the Premium Essentials subscription as well as exclusive content from premium brands, short-form microlearning offered by the mobile app Blinkist, connection to a Customer Success Manager, and access to other custom learning services such as expert content creation.

The pricing varies depending on the size and specific needs of each customer. If companies want access to Go1’s content hub, which is transferrable to their LMS, the subscription starts at $10 per user per month for teams with less than 20 members. If the team is 21 members or greater, the subscription is increased to $12 per user per month. Teams that simply want direct access to Go1’s learning platform can do so free of cost; for larger enterprises, the plan’s cost depends on the enterprise’s specific needs.

The revenue share model that is used to pay Go1’s content creators works by forming a revenue pool from all of the subscription revenue from a particular month, which is then divided among content creators based on how much time users spend on their content.

Traction

Since its founding, Go1 has grown to a team of ~600 spanning 19 countries. As of August 2024, around 50 million registered users across more than 10K organizations rely on Go1, with learners completing a “course or other resource on Go1 about 3 times every second,” according to Barnes. One unverified estimate indicated the company reportedly had revenue of $94.2 million in 2024.

Go1 has made a series of key partnerships and acquisitions, such as its acquisition of Coorpacademy, a French-Swiss B2B edtech startup, in April 2022. The acquisition was focused on expanding Go1’s presence in Europe and augmenting existing content libraries and products. In May 2023, Go1 also acquired Blinkist, a mobile learning app that summarizes professional books and podcasts, in order to further engage learners in their day-to-day lives outside of traditional workplace settings.

Valuation

Go1 raised a $30 million funding round led by Insight Partners in May 2023. As of June 2022, Go1 was valued at ~$2 billion after raising a $100 million Series D led by Airtree Ventures and Five Sigma. Since its founding, the company has raised a total amount of $413.7 million from investors such as Microsoft’s M12 Ventures, AirTree Ventures, Salesforce Venture, and Larsen Ventures.

Go1 has no plans to raise additional capital and is in the process of appointing independent board members for a potential ASX or US listing as of August 2024 according to Eigeland. He also said that there was no set timeframe for when Go1 plans to make its IPO. As Eigeland explains:

“We’re building and running the business at an increasing level of maturity around governance and all the standards that are required to become IPO ready. There’s not a time frame on that. We just believe the right thing to do is to build a business – in the current environment – in a responsible way.”

Go1 is also determining how to provide liquidity to early investors and employees, which could lead to secondary share sales through a pre-IPO round.

Key Opportunities

Direct-To-Consumer Acquisition

As of June 2022, Go1 said it was focused on acquiring learners through companies and their employees. However, the company is looking into how it can also extend its platform beyond just corporate learning. As Barnes explained:

“Internally, we are considering how to provide education to everyone without pricing them out. If we do something in consumer, we would want to make that a target. It would be quite a different product.”

With 78% of employees feeling as though they lack the skills necessary to advance their careers as of 2022, many employees face barriers when pursuing new roles or work opportunities. By expanding Go1’s services to individuals outside corporate sponsorship it could be a larger addressable audience of users. The key question is how effectively Go1 can monetize those users without corporate support.

New Forms of Content

Go1 has also expressed interest in expanding the types of content it has to offer, such as VR-based learning or adding a synchronous live-streaming component. Technological innovations such as VR-based learning have demonstrated some potential to enhance motivation and attention, as well as improve the deficiencies of conventional methods. However, there are major costs and usability issues that could be associated with incorporating advanced technology with employee training.

Career Certifications

Vu Tran, one of Go1’s co-founders, had firsthand experience with how difficult it was to demonstrate mastery of skills in new roles while he was training to become a doctor. This led Go1 to set a goal of increasing the ability of its learners to get credentials awarded to them that are recognized by subsequent employers.

Certifying employees for certain skills is proven to have positive benefits. For example, according to one 2023 study, 92% of IT professionals reported that certifications gave them more confidence in their abilities and 81% have more confidence when exploring new job opportunities. That type of skill achievement is exactly the kind of professional progress that most corporate learning users are focused on.

Expanding the range of certifications Go1 awards to its learners could also align well with its goal of reaching individual learners. By offering certifications that validate newly acquired skills, Go1 could attract individuals to its platform who are willing to pay for access to learning resources if they know they’ll walk away from the platform with a certified credential that may aid them in seeking employment.

Key Risks

Maintaining Learner Productivity

According to one study from Deloitte, one key obstacle to employee learning is an overwhelming amount of content that prevents them from finding what is most valuable. Given the size and breadth of Go1’s content, there will increasingly be a requirement to better support users in identifying the ideal content and learning journey that is best suited for their goals.

Dependence on Third-Party Content Providers

As of January 2025, Go1 does not produce original learning content, making it dependent on third-party content creators to supply resources for its users. This could pose a risk to Go1 if its relationship with the platforms becomes more complicated. For instance, if a major content provider like Harvard Business School or Skillsoft were to withdraw their content from Go1’s platform, it could lead users who rely on those platforms’ offerings to leave Go1.

Go1’s dependency on third-party platforms also places it at a higher risk of cybersecurity threats. Cyberattacks on companies through third parties increased in 2024, from 44% to 61% over the course of a few years. The data obtained from such attacks can be used to conduct account abuse, fraud, and more, which could not only harm Go1 internally but also damage its external reputation. So, while Go1’s many partnerships with third-party platforms allow it to have a large content hub, it also poses potential issues regarding Go1’s security and reputation.

Summary

Founded in 2015, Go1 has evolved into a large global e-learning aggregator by providing businesses with access to a large library of training resources sourced from over 250 providers. As of January 2025, Go1 has grown to service over 50 million users across 10K businesses. However, Go1 faces certain challenges such as competing against other aggregators and direct content creators as well as mitigating potential productivity, reputation, and cybersecurity risks stemming from its growing content hub and relationships with third-party platforms.

With a dual focus on scalability and content diversity, Go1’s ability to manage its third-party dependencies and address user experience issues will be crucial to maintaining its leadership in an increasingly competitive corporate learning environment. As Go1 looks to the future, it may consider new ways to expand its platform beyond corporate learning, while exploring innovative content formats to continue driving its growth.