Thesis

Enterprises increasingly face challenges attracting and retaining talent. 40% of employees were reported to be at least likely to leave their jobs within six months in September 2022. Average employee tenure has slowly dropped from 4.6 years in 2012 to 4.1 years in 2022. The pandemic appears to have accelerated this trend. Before COVID-19, voluntary turnover rates were around 20%, but going forward from 2022 this could increase to as high as 24% according to an April 2022 report. This increase is driven by changing employee expectations and the effects of hybrid and remote work. In a 2023 survey, 53% of surveyed employees were either “very” (15%) or “somewhat” (28%) likely to leave their jobs by the end of 2024.

For employers, this is expensive; a lost employee can cost on average 1-2x the employee's salary as of July 2023. Retaining talent is therefore a growing priority for employers. Meanwhile, a July 2023 analysis reported that 61% of employers struggled with retention. One critical retention tool for companies in the past has been providing reskilling and upskilling opportunities, like tuition assistance. A 2021 analysis found that, although 80% of employees say they’re interested in going to school while working, only 2% of employees used tuition assistance programs when available.

Guild, formerly Guild Education, is an education-as-a-benefit company that gives employers access to a marketplace of vetted degree programs and certificates to help employees upskill and reskill. Additionally, Guild facilitates payments between the employer and learning provider so that employees don’t have to pay for education upfront. According to the December 2020 Guild report, this has led to a 200% higher adoption rate of reskilling and upskilling opportunities among frontline workers, allowing them to more easily progress in their careers without leaving their jobs or incurring student debt.

Founding Story

Guild was founded in June 2015 by Rachel Romer (CEO), Brittany Stich (Senior Advisor), and Chris Romer (former SVP of University Partnerships).

Before founding Guild, Rachel Romer received an MBA and MA in education at Stanford. While pursuing her MBA, Rachel Romer was focused on identifying 300 low-cost and high-quality schools, and wondering why they weren’t serving the cohort of 88 million working adults at the time. College presidents told her numerous times that targeting adults through digital ad campaigns was too expensive. This led her to come up with the idea behind Guild: connecting employees in need of upskilling and reskilling with schools that can provide it.

The Romer family has a history of working within the education industry. Roy Romer, Rachel Romer’s grandfather, was Governor of Colorado from 1987 to 1999 and helped found Western Governor’s University in 1997. Additionally, Rachel Romer’s father and co-founder Chris Romer is a former Colorado State Senator. He was elected to serve from 2007 to 2011 but left office in December 2010 to run for mayor of Denver. Chris Romer has worked on multiple education initiatives including the Colorado “I Have A Dream Foundation”, which partners with youth and their families as they successfully navigate school, college, and career. In October 2008, he left J.P. Morgan to serve as President of the Knowledge is Power Program, consisting of multiple charter schools in Denver. In 2014, Rachel Romer founded Student Blueprint, an EdTech startup providing college students and schools with academic and career planning tools. She served as its CEO until 2016. The company was acquired by Viridis Learning in December 2015.

In April 2023, Guild Education was rebranded to Guild to broaden its brand scope beyond education. On the rebrand, Rachel Romer was quoted saying:

“Since day one at Guild, we’ve talked about education and skilling as the means of opportunity creation, and economic mobility as the ends […] With our new product, Career Accelerator, and our expanding career coaching, we're thrilled to be advancing our mission of unlocking opportunity to serve millions more U.S. employees seeking to advance their careers. Alongside innovative employer partners who recognize their responsibility to support the advancement of their employees, we are building a movement that lifts up the moral imperative to accelerate access to opportunity for America’s workforce.”

As of September 2023, former Chief Experience and Head of Platform Bijal Shah listed her role as Interim CEO. As of January 2024 in company press releases, Shah was also referred to as “Interim CEO.” The company has not publicly announced the reason behind this as of February 2024. However, as of February 2024 on both Romer’s Linkedin profile and the company’s website, Romer continues to be listed as CEO.

In January 2024, former Chief Product Officer (CPO) at Data Axle Rohan Chandran was appointed as Guild’s Chief Product & Technology Officer.

Product

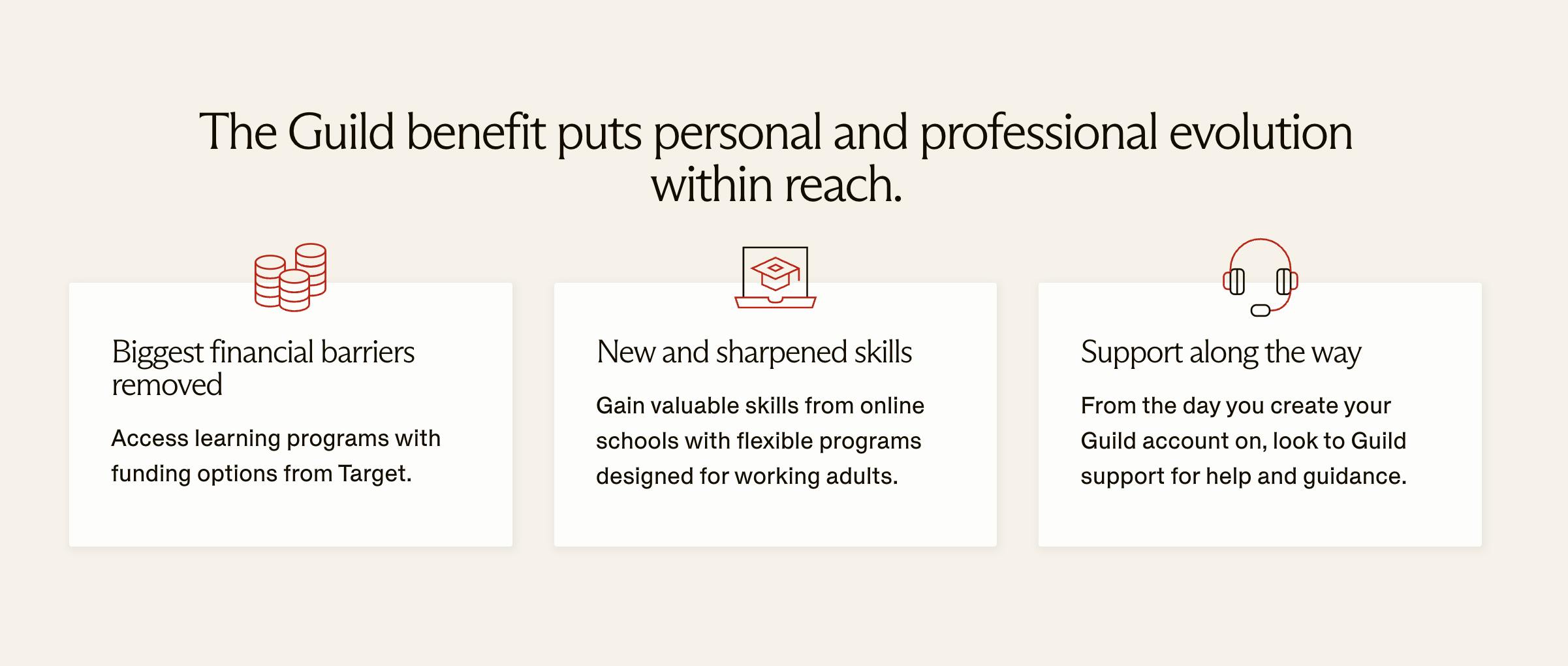

Guild enables companies to expand their talent pools by facilitating access to education and career advancement opportunities while eliminating financial obstacles through direct transactions between employers and educational institutions. For its Career Opportunity Platform, Guild works with three key stakeholders: employers, employees, and learning partners such as universities, high schools, master’s programs, and certificate programs.

Education

Source: Guild

An employer’s journey with Guild begins in the design and strategy phase. The company helps employers produce custom education-to-career pathways that align with the business’s priorities. Since Guild works with many employers, every incremental employer partner can get off the ground running with access to one of Guild’s learning programs vetted for quality in its Learning Marketplace. Partners range from public universities to short-form credential providers.

Once the design and strategy phase is complete, Guild creates an end-to-end portal for the employees of the company in question to help maximize the adoption of the overall program. Employees are paired with a Guild Coach and, once having completed a program, receive career discovery tools to help turn their learnings into new job opportunities.

Guild also facilitates payments between the employer and learning providers so that employees do not have to cover the cost upfront or at all. According to internal data, in 2022 more than 90% of Guild learners incurred no cost from tuition, textbooks, or fees. The company also handles employee eligibility, invoicing, and compliance to reduce the burden on employers to run the education benefits program.

Every Guild portal is different since programs are tailored to the particular employer. Target’s “Dream to Be” education benefits portal is one example: through its partnership with Guild, Target employees can select between 250+ undergraduate, master’s, and high school programs — and have their tuition covered partially or in its totality.

Source: Target

Outside of diplomas, employees can also earn certificates and enroll in boot camps. Target pays 100% of the cost for high school and select undergrad and certificate programs, and $10K per year for Master’s programs. Target also covers books and other fees for employees.

Career Development

In April 2023, Guild launched the Career Accelerator, an extension of the Career Opportunity Platform. The Career Accelerator focuses on the “hidden curriculum” — concepts and collective knowledge often assumed to be known by workforce members. In 2022 over 80% of over 5 million workers eligible for the platform were in frontline (public-facing) and entry-level positions, roles where career advancement knowledge is particularly critical to success. The Career Accelerator features support modules that help users with their professional development, as well as 1:1 coaching for a personalized growth experience. These support modules include building a resume, preparing for an interview, networking, and conducting a job search.

Value Proposition for Employers

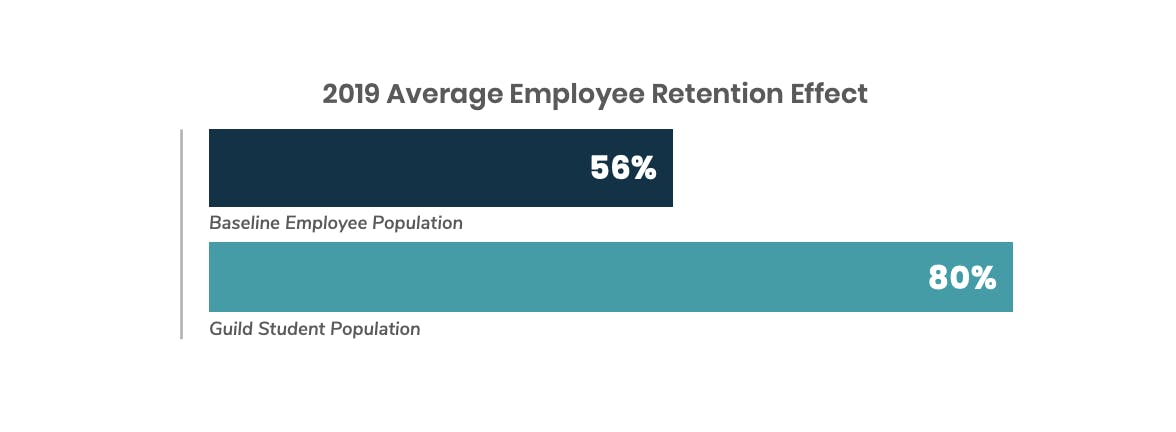

As of February 2024, Guild claimed that employees at participating employers were 30% less likely to leave their jobs. In addition, Guild claims that for every $1 invested through Guild an average of $3 of savings is generated, up from $2.84 in 2020. In the past, Guild has demonstrated other levers that drive this, including increased retention, a more skilled workforce, and easier recruiting.

Source: Guild

According to Guild’s 2024 report, “new hires who become Guild members are 2.5x less likely to leave in their first year than new hires who don’t engage with their benefit.” In past reports, Guild has claimed member retention numbers can be as high as 80%, compared to a baseline of 56%. Past reports have also found that increased retention led to savings for companies in the form of reductions to marketing budgets, time spent recruiting a new candidate, background check costs, new employee training costs, and costs of vacancy.

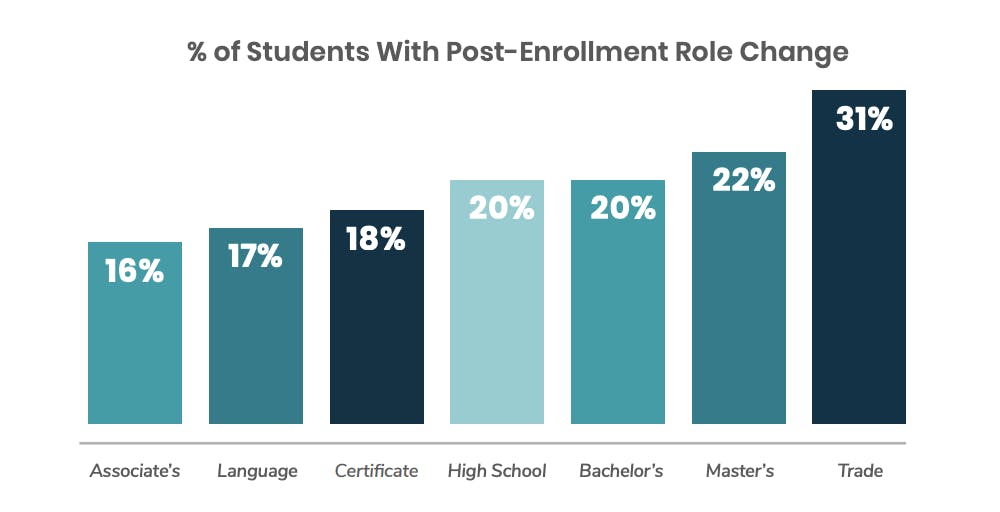

Guild’s past reports also found that employees with access to the Guild platform are more likely to get promoted or change roles when compared to employees without access, leading to lower training costs and onboarding costs for employers. One such example is Chipotle: in a December 2021 article, Guild announced that Chipotle crew members who had enrolled in a Guild program were 6X more likely to advance into manager positions. The same article found that, since instituting Guild as part of its offering, Chipotle had increased job applications by 46%.

Source: Guild

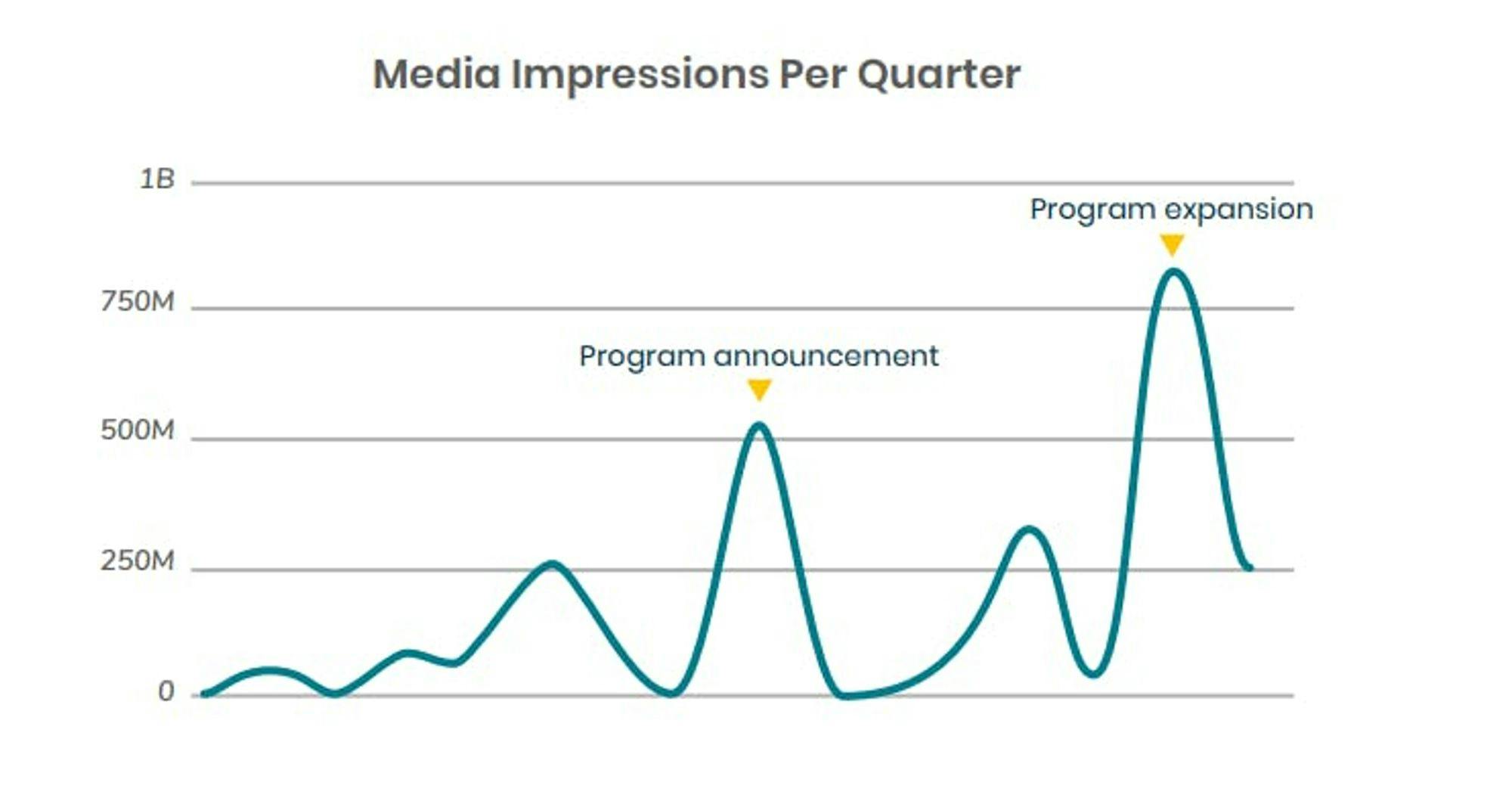

According to Guild’s past reports, 24% of applicants referenced the Guild program as a reason for applying to the employer, either because of the value of the educational opportunities provided or because of Guild’s impact on the employer’s overall brand and media image. For example, consumer survey data showed a 19% uplift in favorable opinions about companies after announcing a joint program with Guild.

Source: Guild

Value Proposition for Employees

The main benefit that Guild offers employees is the opportunity to enroll in educational programs that are paid for, at least partially, directly by their employers. This expands access in comparison to indirect reimbursement programs, which require employees to pay upfront capital that may limit accessibility for the lower-wage workers who might benefit the most. However, for employers with existing tuition reimbursement programs, Guild can help with the administration of this benefit. Guild provides eligibility checks, transcript and program review, and acceptance/rejection of reimbursement requests.

With Guild, the employer generally pays the learning provider directly through the back end. According to a past report by the company, eliminating upfront payments has led to a two times higher adoption rate among frontline workers. Additionally, employees get free one-on-one coaching through the Guild platform that they would not otherwise receive. As of February 2024, Guild offers Growth Coaching and Career Coaching. Madelyn T., a former Guild user, said the following about her coach:

“Every step of the way, Guild coaches have been there with me. That's one thing I can say has been such a help — no matter what time of the day, no matter what is going on, they have been there for me. … This support is overwhelming. I'm so thankful. I don't know what I would've done without them. I don't know if I would still have been on this path.”

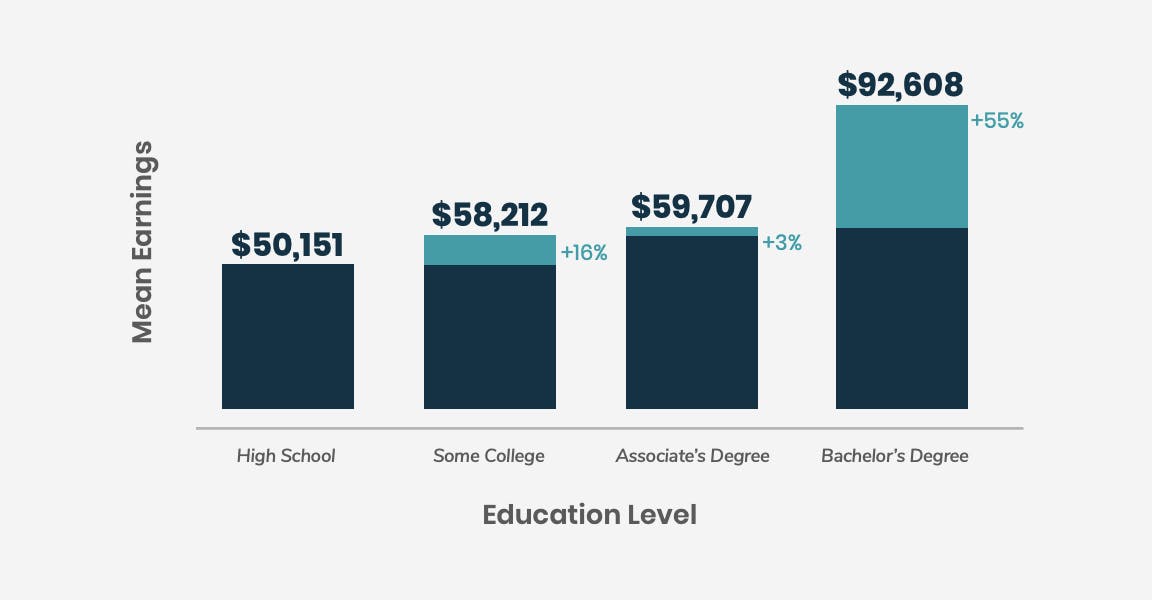

Upskilling via programs such as those offered by Guild has been shown to have a positive impact in terms of income mobility. Within the workforce, employees with a bachelor’s degree make 85% more than those with just a high school degree (a $42K / year difference) according to Guild’s past reports. Upskilling can also help employees progress in their career roles. In the same report, one employer concluded that its frontline employees who participated in the Guild platform were 7.5x more likely to be promoted into a management role compared to those not using the platform.

Source: Guild

Value Proposition for Learning Partners

One reason why colleges don’t serve more of the 88 million American workers without a college degree is the high cost of digital ad campaigns to reach working adults. By connecting learning partners with employers, Guild offers a direct pipeline of potential new students at a lower cost of acquisition reducing the need for learning providers to engage in expensive marketing to adult learners. Part-time adult learners that use Guild also have 15% higher program retention than the national average, which increases the lifetime tuition value per learner, simultaneously improving the LTV for customers of learning providers as well as lowering the CAC.

Market

Customer

Source: Guild

Guild’s core customers are large enterprises in the Fortune 1000. These are enterprises that are looking to retain employees, attract talent, and preserve brand image. As of February 2024, Guild lists enterprises such as Walmart, Target, Disney, Chipotle, and Pepsico among its customers. Such companies often have thousands of low-wage workers who want to upskill through high school, college, and master’s diplomas, or certificate programs.

While employers are the paying customers, employees are the end users of the platform. As of January 2023, over 5 million employees were eligible to use the platform through their employers in the last 12 months, 80% of whom were estimated to be frontline workers. As for learning providers, Guild has partnered with universities such as Purdue University, eCornell, and the University of Denver, as well as certificate programs such as Google IT and Salesforce Administration. As an example of the scale of learning providers accessible via Guild, Lowes offers its employers access to 200+ programs from 20+ schools, colleges, and universities via Guild as of February 2024.

Market Size

As of September 2021, US corporations spent nearly $28 billion annually on tuition reimbursement programs. More broadly, the addressable market size for formal employee education and training was $163.6 billion in 2022 and is estimated to grow to $487.3 billion by 2030. One survey in May 2023 found that 48% of employers offer undergraduate or graduate tuition assistance, while a 2021 survey found that 80% of large employers offer tuition reimbursement. However, less than 10% of employees at companies that offer these tuition reimbursement benefits take advantage of them as of 2018. This implies that the market has considerable room for growth if solutions like Guild can effectively increase adoption rates.

Competition

There are two categories of competitors for Guild: direct "education as a benefit" competitors, such as InStride, EdAssist, Edcor, and Multiverse; and adjacent competitors, which include education platforms like Coursera, 2U, Udemy, LinkedIn Learning, Udacity, and Pluralsight.

Direct Competitors

InStride: InStride partners with employers and learning providers to offer employees education services, with the employer paying tuition and fees upfront. The company was founded in April 2019 as a collaboration between Arizona State (ASU) and The Rise Fund, TPG’s global impact investing fund. InStride had at least 40+ corporate partners which have prevented at least $628 million in student debt as of October 2022. As of February 2024, the company website claims that 11K adult learners are enrolled in InStride programs. Notable customers include Adidas, Amazon, Carvana, and Labcorp.

Bright Horizons: Bright Horizons is a legacy player in the industry, working on employee benefits programs for employers since 1986. The company offers tuition assistance programs and student loan repayment programs. In addition to its core financial services offering, Bright Horizons is also the parent company of EdAssist, a professional development and education platform that it acquired in 2011. Similar to Guild, EdAssist offers customized program design, personalized coaching, individual education plans, exclusive discounts with accredited schools, and analytics on employee participation. Bright Horizons is publicly traded and has a $5.6 billion market cap as of February 2024.

Edcor: Edcor is also a legacy player in the employee education benefits industry. The company was founded in 1981 and helps enterprises offer tuition assistance, student loan assistance, scholarship administration, counseling, and tutoring. Edcor powers UPS’s Education Assistance Program. The company processed more than $238 million in tuition assistance payments and supported more than 1.7 million employees in 2018.

Multiverse: Founded in 2016 by Euan Blair, the son of former UK Prime Minister Tony Blair, Multiverse is a London-based employee reskilling and training platform. While the company originally focused on a variety of education offerings, including placing university dropouts in apprenticeships, Multiverse has since pivoted to focus exclusively on corporate upskilling. The company provides guided programs for technical training and has worked with employers such as Microsoft, Citi, KPMG, and Unilever.

Multiverse has raised $414 million in funding from investors like General Catalyst (also a major Guild investor), Index Ventures, Lightspeed, GV, and Bond. In June 2022, the company was valued at $1.7 billion. In March 2022, the same year as the company’s $1.7 billion valuation, the company generated ~$33 million in revenue. In 2023, revenue grew by 66% to ~$57 million.

Adjacent Competitors

Adjacent competitors compete with Guild because they are going after a similar market (e-learning) but in a different way. Online education platforms such as Coursera and 2U focus primarily on aggregating learning content. Unlike Guild, these adjacent competitors focus first on the consumer as their customer and then expand to other offerings. Despite some differences in offerings like Linkedin Learning and Coursera compared to Guild, the reality is that any employees using these online learning platforms are likely not also using Guild.

Linkedin Learning: The company previously known as Lynda.com was founded in 1995. The company was bootstrapped for nearly 20 years before raising over $200 million from investors like Accel, Meritech, and TPG. In April 2015, LinkedIn announced it would acquire Lynda.com for $1.5 billion. In October 2017, the Lynda content was merged into LinkedIn Learning, and in 2021 the Lynda brand was sunsetted. As of February 2024, the platform offers over 13K courses and 27 million users. While the majority of LinkedIn’s revenue is generated by its talent and recruiter offerings, based on an average user price of ~$20 per month, LinkedIn Learning could be generating up to $1 billion in revenue.

Coursera: Founded in 2012, Coursera has grown to 118 million registered learners as of December 2022. In 2023, the company generated $635 million in revenue, growing ~22%. As of February 2024, Coursera provides an enterprise offering that allows enterprises to access the catalog of learning products and pay for annual seat licenses. Some customers include P&G, L’oreal, and GE.

While its enterprise offering is smaller in total revenue than Coursera’s consumer offering, enterprise revenue was growing 51% YoY as of October 2022 — faster than the 17% growth in Coursera’s consumer offering at the same time. This illustrates how online education platforms may end up encroaching on the same domain that Guild is serving. However, when these platforms sell to enterprises, they are usually going after the learning and development (L&D) budget, not the benefits budget, so the competition remains indirect.

Business Model

Guild’s business model is similar to other marketplace models in that it charges a take rate on the overall tuition volume sent from the employer to the learning provider. According to a December 2021 article, Guild’s take rate ranges from 3-35% depending on the type of service, and likely on the negotiating power of the employer. For example, its take rate was 35.5% for out-of-state students that it sent to the University of Florida. On Guild’s platform, the average employer was spending between $3-5K per student on tuition as of October 2022.

Traction

In 2019, Forbes estimated Guild’s revenue would reach $50 million for the year. This prediction was based on the fact that Guild had processed more than $100 million in tuition benefits to workers in 2019. In August 2019, Guild investor Byron Deeter predicted the company would reach $100 million in yearly revenue in 2020. CEO Rachel Carlson confirmed that Guild hit the $100 million ARR prediction in 2020.

In June 2022, the company announced that the number of employees who had access to its platform had grown to nearly 5 million. The company also announced in June 2022 that the number of working adults utilizing the platform had grown 140% since June 2021. The number of working adults using Guild in 2021 was reportedly 310K, with student growth up 60% since the beginning of the year. As of February 2024, several unverified sources estimated Guild’s 2023 revenue to be ~$300 million.

In March 2023, Guild announced it would be laying off 172 employees, 12% of its workforce. According to a note posted by CEO Rachel Romer, this was “a part of a broader organization of the company around our 3-year strategy and 10-year goals.”

Valuation

Guild has raised $643 million across seven funding rounds as of February 2024. The company raised a $175 million Series F round in June 2022, with investors including Wellington Management, Citi Impact Fund, Bessemer Venture Partners, General Catalyst, and ICONIQ Capital. This round set Guild’s valuation at $4.4 billion, up from the $1 billion valuation when the company raised its $157 million Series D round in November 2019.

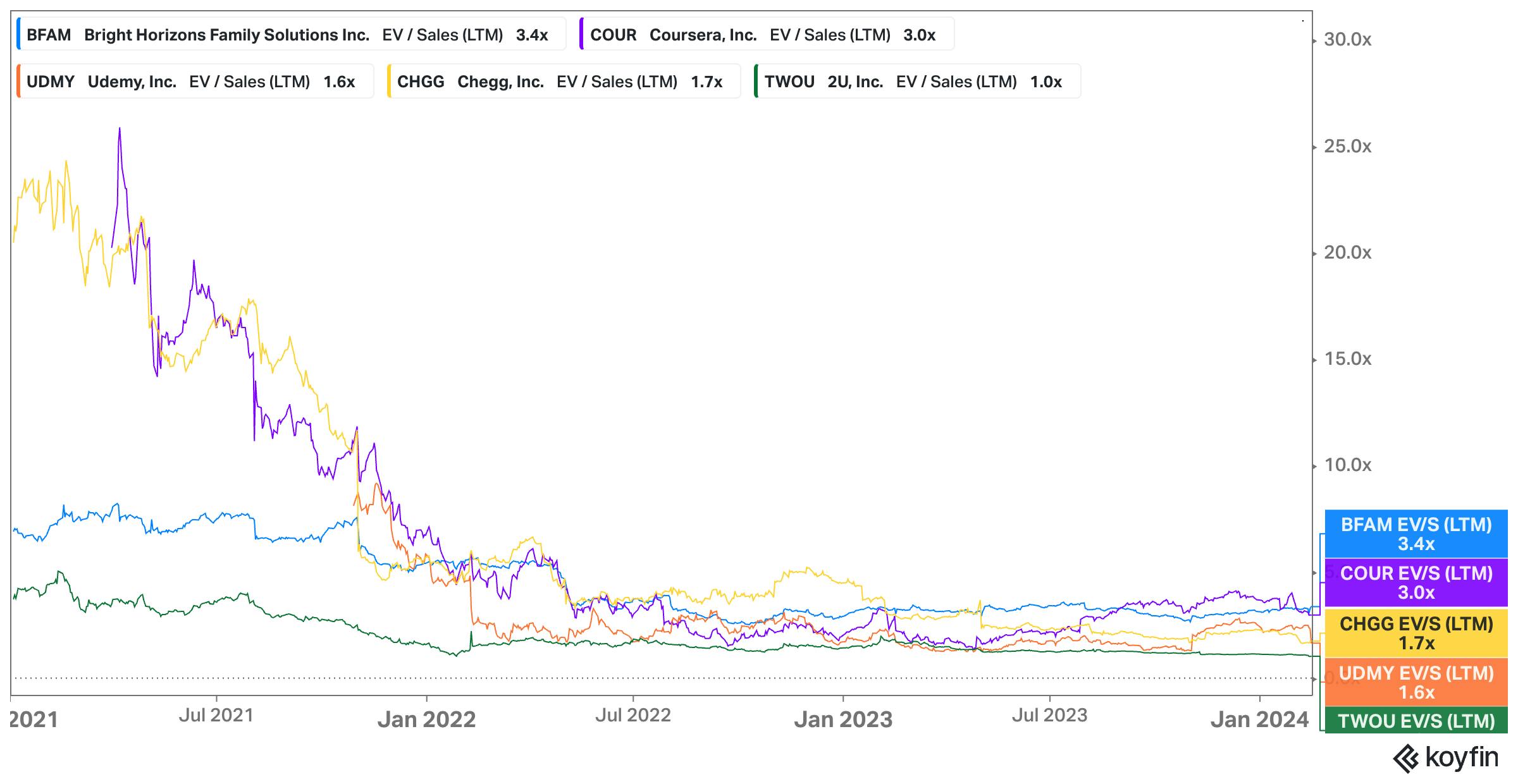

Based on the estimates of several unverified sources of $300 million in 2023 revenue, Guild’s $4.4 billion valuation would represent a 14.6x revenue multiple. While there are not many publicly traded EdTech companies and fewer still focused on reskilling and tuition support outside of Bright Horizons, adjacent education competitors, like Chegg, Udemy, 2U, and Coursera, typically trade at 1-3.4x revenue multiples.

Source: Koyfin

Key Opportunities

Fortune 1000 Penetration

In June 2022, the company claimed to have 5 million employees using the platform. Across the Fortune 1000, it's estimated that those companies employ 28 million people. That would represent ~18% penetration for Guild into its core market. Continued expansion into the relevant employee base of large companies can enable Guild to scale meaningfully.

Expansion Within Existing Customers

In addition to adding new customers, Guild can also generate more incremental revenue from existing customers. Although the percentage of customers’ employees utilizing Guild’s benefits is not publicly available, a June 2021 article stated that, generally, “between 1 and 10 percent of eligible workers use employer-provided education benefits.” In the same article, Mary Alice McCarthy, director of the Center on Education and Labor at New America at the time, was cited saying “that companies with a large share of low-wage workers have especially low utilization of education benefits.”

Through increased marketing, personalization of the employee experience, and continuously improving the overall platform — as it did with the April 2023 launch of the Career Accelerator — Guild has the opportunity to increase this penetration rate for its platform. An increase in penetration rate could result in better results for its customers, which would then incentivize new customers to join the platform.

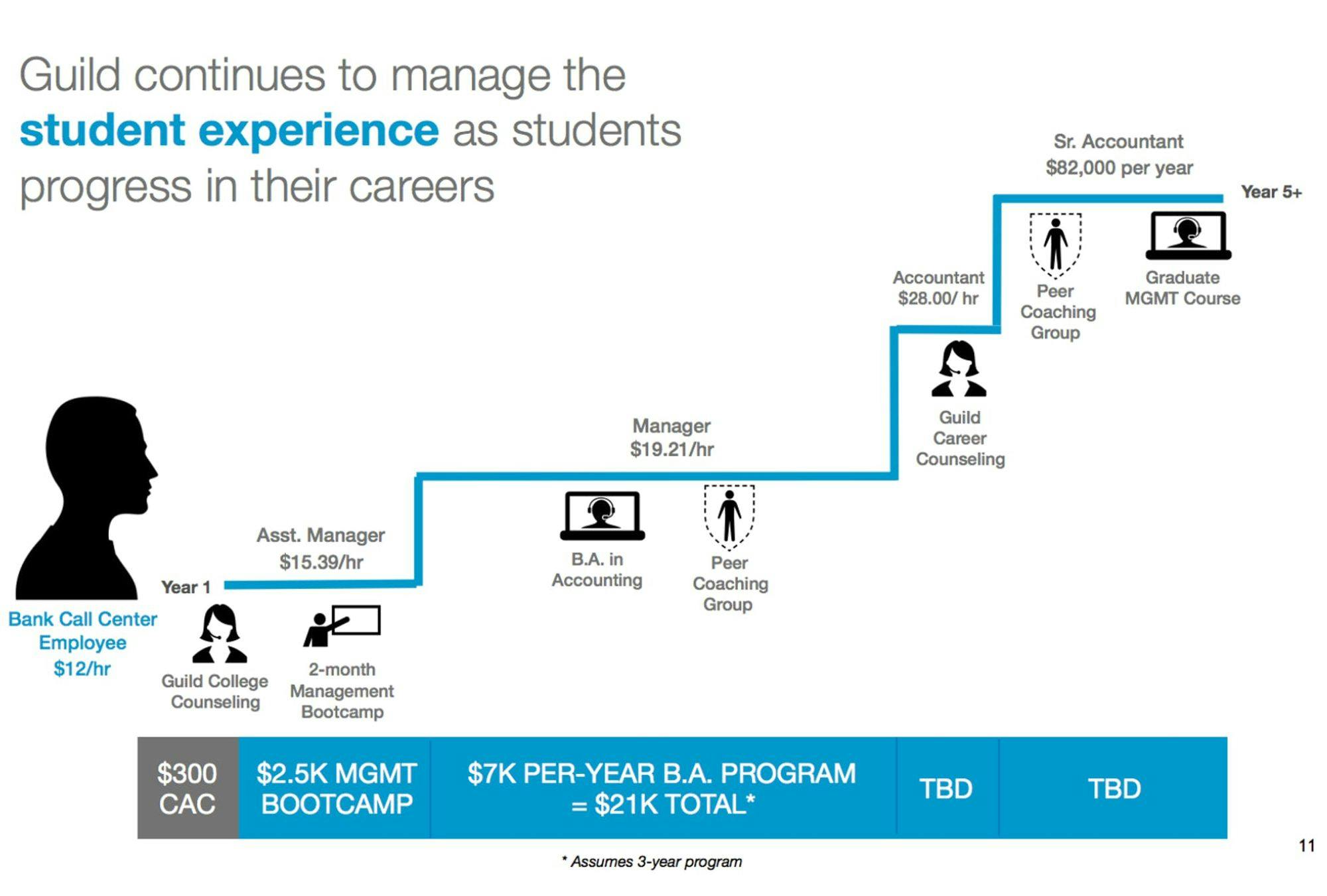

Serve the Full Employee Upskilling Journey

Upskilling doesn’t just have to be one destination such as getting an undergraduate degree. It can be a multi-step commitment from the employee to continue improving. If Guild offers a good experience on the first step, it has the opportunity to increase the value it creates for each employee by being the partner for additional steps.

Source: TechCrunch

Guild has already begun to expand to the higher steps with the launch of its Career Accelerator in April 2023. In light of its rebrand, it will likely continue to shift to help users beyond education towards greater economic and professional success. In the April 2023 press release announcing both the company’s rebrand and its Career Accelerator, CEO Rachel Romer stated:

“Since day one at Guild, we’ve talked about education and skilling as the means of opportunity creation, and economic mobility as the ends […] we're thrilled to be advancing our mission of unlocking opportunity to serve millions more U.S. employees seeking to advance their careers.”

Key Risks

Aligning Incentives with Multiple Stakeholders

The Guild marketplace requires that employers, employees, and learning platforms are all happy with the platform. If the experience deteriorates for any of the three stakeholders then the marketplace loses its value. Interviews with more than 30 current and former employees detailed in a December 2021 article offer perspective on some of the pain points. There were times when coaches needed to manage 1K students each, which made it nearly impossible to sit down and offer quality coaching.

Guild needs to find the middle ground between offering quality coaching and not over-hiring where it can’t be a scalable platform. Additionally, per the December 2021 article, the University of Florida argued that the company was sending unqualified adult learners to its programs. It’s possible that incentives aren’t fully aligned with student performance since Guild just needs to get students into programs to start generating revenue.

High Customer Acquisition Cost

A key risk to Guild involves managing high customer acquisition costs (CAC) in an environment characterized by intense competition and rapid market changes. The edtech market has seen significant growth and investment. For example, VCs invested $20.8 billion in the sector in 2021, 40x the amount invested in 2010.

To combat high CAC, companies are increasingly turning to mergers and acquisitions (M&A) as a strategy to achieve economies of scale and enhance their product offerings. In June 2021, for example, 2U acquired edX, a nonprofit run by Harvard and MIT, for $800 million. This acquisition gave 2U around 40 million users, hundreds of university partners, and access to a strong customer-facing brand.

Soft Macroeconomic Environment

One of the main value propositions of Guild is that the company helps employers attract and retain talent. That value proposition is magnified when labor conditions are tight and companies are having greater trouble with attraction and retention. If the market shifts to a loose labor environment (i. e. more underemployed or unemployed candidates than job openings), attracting and retaining talent may not be top of mind for enterprises anymore. The implications of that are potentially an inability for Guild to attract new customers.

Summary

Guild operates in the upskilling and reskilling market and is focused on driving ROI for enterprises by improving their ability to attract and retain talent. It has found success and gained traction by shifting upfront payment of tuition from employees to employers. The company has onboarded enterprise customers such as Walmart, Target, Disney, Chipotle, and Pepsico. There is direct competition from similar services to Guild, but the company is differentiating by onboarding large enterprises and partnering with learning providers. However, it’s important to monitor the macroeconomic situation, as it might change the backdrop to how Guild convinces employers to use the platform.