Thesis

The online education market has seen significant expansion in the 2020s. For example, Coursera, an online learning platform, reported 142 million users in 2023, up from 118 million users in 2022 and 92 million users the year prior. More than 200 million people signed up for at least one massive open online course (MOOC) in 2023 according to one estimate, and globally 49% of students had completed some sort of online learning as of January 2024. Overall, the MOOC market was valued at $13.2 billion in 2024, up from $11 billion in 2022.

The demand for online education goes beyond formal online courses, with one-third of internet users in 2022 reporting watching a tutorial or how-to video in a given week. At the same time, platforms that facilitate engagement between celebrities and their fans are growing. The addressable market for the global creator economy was estimated at $250 billion in 2023. Platforms like Cameo have emerged as a means for public figures to access and monetize fanbases who are interested in more personal experiences.

MasterClass is a video-on-demand platform for entertaining educational content. It offers an online library of structured lessons from celebrities, industry leaders, and cultural icons. Its instructors cover a range of topics, from writing and acting to cooking, sports, and economics. With a focus on high-quality production and prestige talent, MasterClass has created a category that could be termed “aspirational learning”, giving subscribers broad insight into how famous people work, think, and create.

Founding Story

MasterClass was founded in 2015 by David Rogier (CEO) and Aaron Rasmussen (ex-CTO), who had previously met during a "friend date" years earlier. Rogier has a wide-ranging background in industries including supply chain logistics and government service. Rasmussen was a game designer and entrepreneur, and previously founded aerospace manufacturing company HarcoSemco.

When he was a child, Rogier’s grandmother told him her life story. As a holocaust survivor, she was forced to flee from her hometown in Poland to the US, where she and her mother worked in a factory line to save up for her own education. She told Rogier that "education is the only thing that someone can't take away from you". This sparked an interest in making expert-led education more accessible.

Throughout his education, Rogier struggled to adapt to a traditional curriculum. He preferred more personalized learning over traditional academics, resulting in many heated discussions with his teachers. He gained admission to Stanford's MBA program in 2009, where he initially sought to pursue politics or economics. After completing his MBA, he began working at Harrison Metal, a VC firm founded by one of his professors at the time, Michael Dearing. In 2012, Rogier left the firm to start his own company, despite not knowing what to build. Dearing offered him a $500K check, though Rogier struggled to find inspiration for a startup for over a year.

Rogier and Rasmussen attribute the inspiration for MasterClass to a small dinner they attended together with a group including computing pioneer Alan Kay. Rasmussen described it as "one of the most perspective-altering conversations we'd ever had... and it only happened for 10 people". Ultimately, it encouraged Rogier and Rasmussen to consider the potential value of bringing audiences into “teaching moments” with the world’s top talent.

That was the tipping point that motivated Rogier and Rasmussen to run their first courses. Rogier was friends with Dustin Hoffman's daughter and was able to bring the actor on board alongside fiction author James Patterson, one of the many experts he cold-called. MasterClass first launched in May 2015 with three instructors: Patterson teaching writing, Hoffman teaching acting, and Serena Williams teaching tennis. Marketed as a platform where "anyone can learn from the world's best", it received 30K signups in the first four months.

Over the next two years, MasterClass grew to a dozen classes, featuring more celebrities like Gordon Ramsay teaching cooking and David Mamet teaching playwriting. In 2017, Rasmussen left the company, attributing the move to being fulfilled with MasterClass's initial success. "I just wanted this product so I could use it for myself...we got the company to a spot where that was possible,” he said. Rasmussen would go on to start his own virtual education startup, Outlier, a year later.

In 2019, David Schriber, a Nike marketing VP of over 12 years, was hired as the CMO. Over the next three years, he helped expand MasterClass and quadruple the size of its course portfolio before his departure in 2022.

Product

MasterClass's product is educational, entertaining video content. Its high-production-value content is built around celebrities, experts, and public figures who share insights and knowledge about their profession. Though its instructors do not directly interact with subscribers on a day-to-day basis, users are given a window into many fields of expertise through MasterClass’s library of video lessons and additional study material.

Instructional Courses

Source: MasterClass

MasterClass subscribers are given access to a video library of over 180 different courses spanning 11 broad categories, including arts, business, music, and science. Each class includes a total of 2-5 hours of content split into 15-30 lectures of up to 30 minutes each, averaging 10 minutes per video.

MasterClass's video content typically features subject experts and public figures. For example, popular courses include Inclusive Leadership taught by former US president Bill Clinton, Cooking with Gordon Ramsay, and The Art of Negotiation with former FBI hostage negotiator Chris Voss.

Unlike traditional educational programs, MasterClass's videos are intended for a broad audience and are largely self-paced, with some courses providing a text-based "Instructor Guide" to supplement the videos. Subscribers can also access discussions below each video to share thoughts and experiences with the wider MasterClass community.

Given the relatively short length of these courses, many classes are limited in their capacity to comprehensively cover the material. Instead, the lessons are generally intended to provide broader insight into how the instructor approaches their profession, rather than specific technical instruction. Using Annie Leibovitz's course on portrait photography as an example, Rogier was quoted as saying: "if you want to learn how to use your DSLR camera, this is not the place for you".

While some have criticized MasterClass's lack of deep, technical instruction, the lessons are mostly intended to share the intuition behind the mindset of leading experts. “The impression that we’re trying to create is that you’re sitting on a couch with that person and they’re going to share everything they know,” Rogier noted in January 2019. “There’s something about the intimacy and bond with that person that excites me.”

Sessions

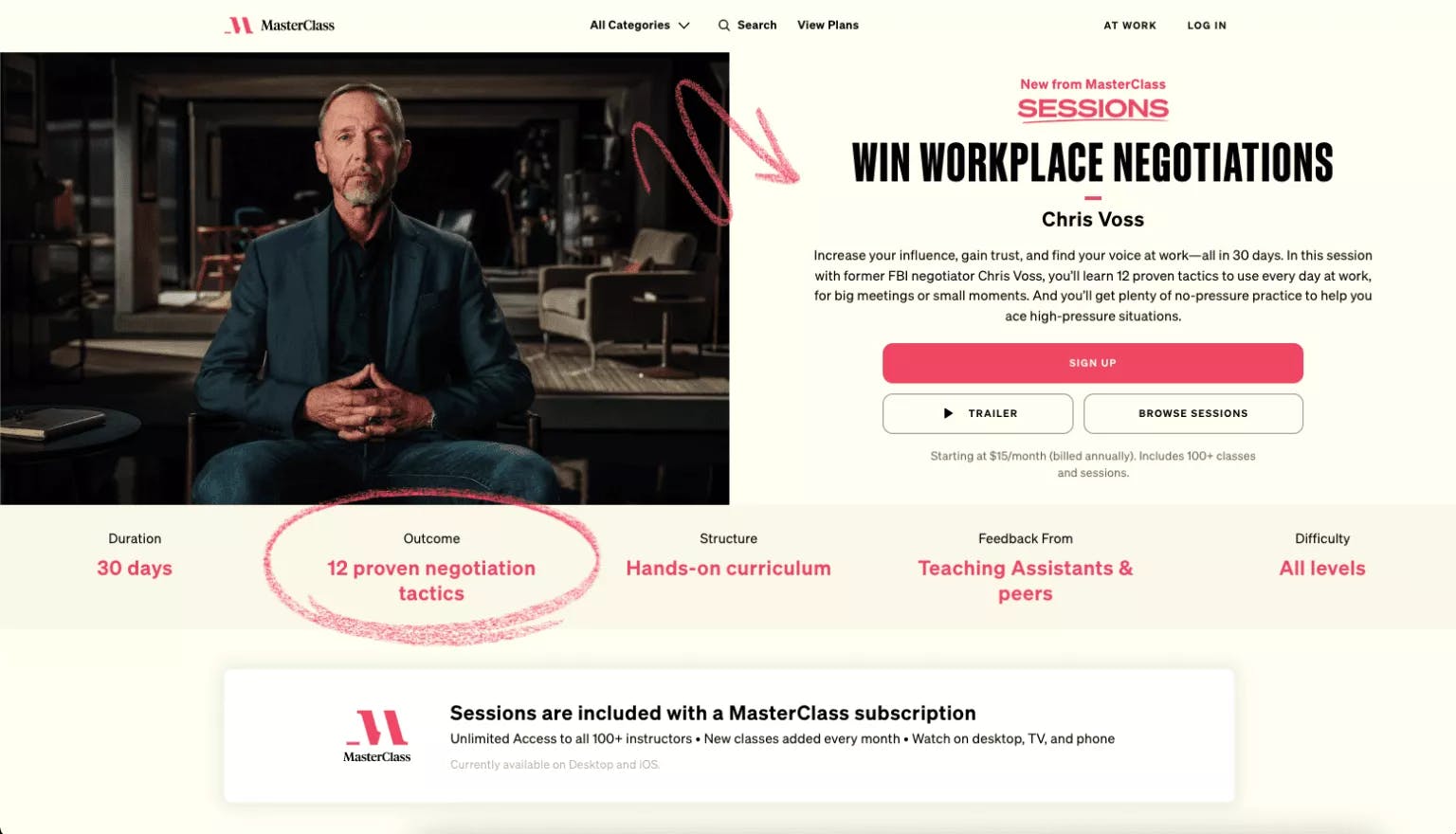

Source: MasterClass

In addition to the collection of expert-taught lessons, MasterClass previously hosted a community forum where users could interact, post questions, request feedback, and gain further insights beyond the videos. In late 2021, the forums were replaced by Sessions, MasterClass's "hands-on" program which is modeled more closely on traditional online education systems. Users are given a structured curriculum to follow with guided materials and projects to be completed over 30 days.

Sessions follow an asynchronous remote learning format with pre-recorded lessons. Students are expected to stay on track with due dates for projects. Courses are led by experts and supported by teaching assistants who are available to answer questions and provide actionable feedback to the community.

MasterClass at Work

Source: MasterClass

MasterClass at Work is the company’s business solution, giving teams access to the entire MasterClass platform, with additional reports and integrations covering employee engagement and usage figures for admins. The company pitches MasterClass at Work as both an employment perk and a way to upskill staff in key workplace competencies.

For small teams of 5-50 people, MasterClass charges customers $180 per seat annually, with a bulk discount of 5%-15%. Larger enterprises receive an undisclosed discount. The company serves major enterprise clients including Deloitte, PayPal, CapitalOne, Microsoft, and Square as of June 2024.

Short-Form Videos

In 2023, MasterClass began experimenting with shorter-form, entertainment-focused content in a departure from its usual format of long-form instructional videos that delve into one topic. According to the company, this was in response to the changing needs of consumers “as Covid restrictions were lifted.” However, it may also be a result of a slowdown in traction that the company experienced in the post-pandemic period.

Market

Customer

MasterClass serves two key segments: "lifelong learners" interested in developing broad or specific skills, and celebrity followers.

The education-focused consumers are often interested in learning more than one skill on MasterClass's platform. MasterClass reported the emergence of "multihyphenate" consumers, who are users open to learning across multiple subjects and thus take a broad range of classes. On the other hand, the celebrity-focused MasterClass subscribers are more likely to be interested in specific courses from instructors whose insights they personally value.

Amanda DoAmaral, the founder of study platform Fiveable, notes that "MasterClass is important for showing us why educational content should be treated more like entertainment". While many celebrities are often too busy to consistently create new content, many viewers are drawn to the prospect of intimate one-on-one lessons and occasional "office hour" videos. This, along with the public's appetite for the wisdom of successful experts, creates a heightened demand for celebrity partnerships in education.

With the launch of MasterClass at Work, the company now serves enterprise clients, which offer MasterClass content as a workplace perk and education offering.

Market Size

MasterClass primarily operates within the online learning market, an economy comprised of different edtech tools and remote education platforms. The commercial online learning market was valued at $210.1 billion in 2021 and is projected to grow at a CAGR of 17.5% to reach $848.1 billion by 2028. The market expanded significantly during the COVID-19 pandemic, with the number of students enrolled in Massive Open Online Courses (MOOCs) growing 100% between 2019 and 2021, from 110 to 220 million. Even after the pandemic, as in-person learning resumed, the popularity of online learning has continued its upward trajectory. Coursera, the most popular platform by registered learner count, representing nearly 50% of the market, reported 5.5 million new learners in the first quarter of 2023 alone.

The edtech industry has seen an influx of venture funding since the COVID-19 pandemic, from $1.3 billion in 2017 to $8.3 billion in 2021. Though this decreased 37% to $5.2 billion in 2022, the share of venture funding allocated to edtech (2.1% in 2022, 2.5% in 2021) has nearly doubled compared to the years preceding. Some have attributed the growth in this space to a larger paradigmatic shift. In particular, edtech has historically been centered around workflow efficiency and digitization; the next slate of opportunities may be driven by increased commercialization. Notably, the rise of centralized upskilling platforms has created opportunities to capture value among lifelong learners.

Competition

There are several companies competing with MasterClass in the education space, including learning platforms Udemy and Coursera, as well as the professional development organization Stride. Additionally, thanks to MasterClass’s unique stance within the “edutainment” space, it also competes both directly and indirectly with social platforms like YouTube and Cameo.

Education

Udemy: Udemy, founded in 2010, is an online learning and teaching platform utilizing a "marketplace" business model. It features over 11K online video courses as of June 2024, each with its own price. Users can also access selected content through an annual subscription of $199 per year for individuals and $360 per year for companies. Instructors on the platform come from a variety of backgrounds and levels of professional development relative to MasterClass's reliance on celebrities, public figures, and well-known experts. As of June 2024, Udemy’s market cap was $1.3 billion, and it served over 70 million students along with over 16K enterprise customers.

Coursera: Founded in 2012, Coursera offers an online library of job-ready certificate programs, with over 7K offerings as of 2023. Compared to MasterClass, its platform is more oriented towards technical professional development as opposed to expert insight. Like MasterClass, it also operates on an annual subscription of $399 per year. As of November 2023, Coursera’s market cap was $2.8 billion.

Stride: Stride, founded in 2000, is an education management organization (EMO) providing online learning solutions for various customer segments such as K-12 students, adults, and businesses. Stride's focus is less consumer-oriented than MasterClass and instead offers a more structured, traditional curriculum tailored towards larger educational institutions, namely school districts. As of November 2023, Stride's market cap was $2.5 billion.

Entertainment

YouTube: YouTube is an online video-sharing platform owned and operated by Google. It features over 800 million years of video content. Though most content falls outside MasterClass’ domain, it offers a significant library of edutainment video content. Channels such as Vsauce, CrashCourse, SmarterEveryDay, and Veritasium have garnered significant traction off YouTube alone, amassing a combined 60 million subscribers.

In September 2022, YouTube released the YouTube Player for Education, allowing educational channels to host priced courses on the platform. With this, YouTube offers both the bite-sized content and structured educational value offered by MasterClass. The key differentiator between the two is available talent and production values. As its content is significantly more specialized, MasterClass relies on high production values with lower volume than most large YouTubers. YouTube reached over $29 billion in revenue in 2022.

Cameo: Cameo, founded in 2017, allows users to request custom video clips from partnered public figures, including actors, athletes, comedians, musicians, and other celebrities. Like MasterClass, Cameo offers consumers exclusive celebrity-made content, with the intent of creating a personalized connection between the viewer and creator. Unlike MasterClass, the focus is far less aspirational, with the content being consumer-driven and personalized instead of educational. Since its founding in 2017, Cameo has raised over $165 million, with its $100 million Series C in early 2021 putting it at a $1 billion valuation. As of 2021, Cameo hosted over 2 million videos on its platform.

Business Model

Source: MasterClass

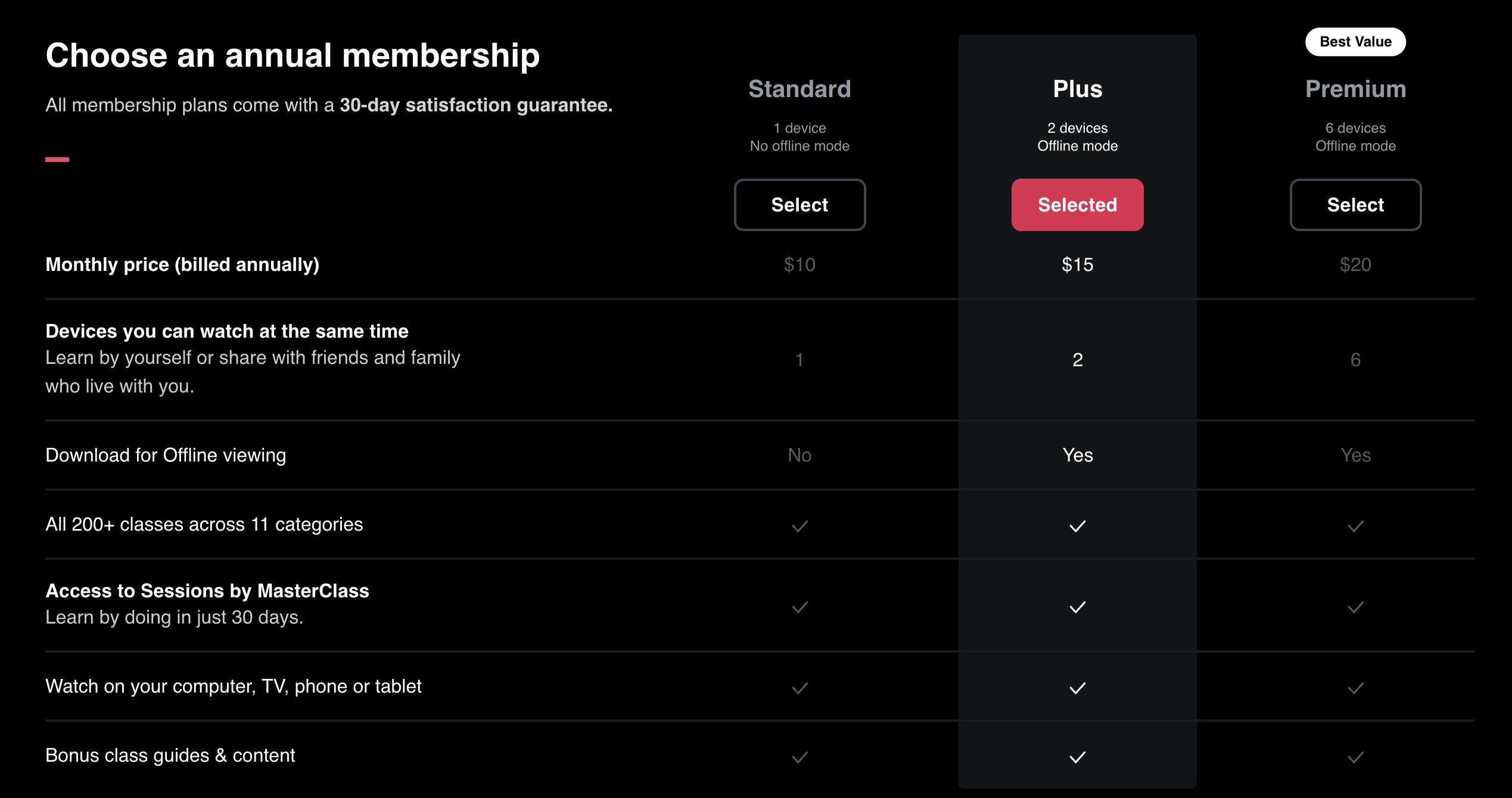

MasterClass offers its content via an annual subscription which gives users access to its library of content. In late 2022, it was reported that subscriptions accounted for 100% of MasterClass's revenue. MasterClass offers three different membership tiers as of June 2024: Standard, Plus, and Premium:

Standard: The cheapest option at $120 per year gives users access to MasterClass's entire platform, including its video library, Sessions, and class forums and guides.

Plus: For $180 annually, users can access MasterClass on two devices at the same time and are also given offline access to videos.

Premium: Users can access MasterClass's platform on up to six devices at $240 annually.

The major cost center for MasterClass is the compensation it provides for its instructors. In 2017, it was reported that instructors on the platform were paid $100K each plus 30% of revenue directly generated from their courses, with those costs likely to have increased in the years since.

Filming and editing also contribute significantly to MasterClass’s overhead costs. In late 2019, a MasterClass course shoot with Disney CEO Bob Iger reportedly cost MasterClass around $850K, not including the fee owed to Iger for the shoot. At peak, courses would average nearly $1 million in total production costs, including filming, editing, and instructor fees. In September 2023, it was reported that MasterClass had begun outsourcing the filming and production of its flagship courses to third-party production companies, reducing costs by a third.

MasterClass also spends heavily on marketing. In 2019, it spent $6.5 million on ads, a 3x increase from $1.9 million in 2018. The majority of MasterClass's marketing spending is on social media, including targeted ads on Instagram, Twitter, and YouTube. The company also invests in traditional media channels like Vogue, The New York Times, and podcast advertising. CMO David Schriber described its media spend approach as a "non-algorithmic way of finding audiences that have these special interests".

Traction

During the COVID-19 pandemic and its associated surge in online learning activity, MasterClass's content portfolio grew over 90%, with increased depth and breadth of coverage across different subjects. MasterClass has also partnered with various brands to increase the accessibility of its courses. Notable examples include MasterClass's integration into Delta's flights in 2022, and its partnership with Apple to enhance the MasterClass app for the Apple TV 4K in 2021.

In 2022, MasterClass reported its ARR to be $100 million, representing 270% growth from $27 million in 2021. As of 2023, it had over 2 million subscribers, with over 13 million monthly page visits.

However, MasterClass conducted significant layoffs in 2022 and 2023. A report in September 2023 stated that MasterClass had reduced its workforce “from over 600 to around 300” over several rounds of layoffs in the preceding 18-month period. Two of these layoff rounds occurred in April and November 2022. Speaking about the cuts, a MasterClass spokesperson told The Information that “over the past 15 months we have had to make difficult decisions related to headcount, and we have also focused on reducing costs and driving efficiencies within our business” and that “taken together, these actions have made MasterClass stronger—financially and strategically. Costs are down and our teams continue to innovate in content and formats.”

Meanwhile, there has been a slowdown in the launch of new courses compared to the company’s expectations. In 2021, CEO David Rogier said he expected the company to publish 75 new courses by year’s end; however, the company only launched 31 classes in 2021, 34 in 2022, and 31 in 2023.

In terms of partnerships, MasterClass signed deals with SiriusXM and Delta Airlines in 2021 which were intended to increase brand awareness; however, the partnerships did not end up in as many conversions to paid subscribers as was hoped. Nevertheless, MasterClass renewed its partnership with Delta in 2023 and was among Delta’s top-performing in-flight entertainment. MasterClass also entered into a similar partnership with T-Mobile in late 2021, but this partnership was canceled within a few months with Rogier having second thoughts about it, worrying that entailed that MasterClass was giving too much away for free.

Valuation

MasterClass has raised over $461.4 million in total funding as of November 2023. In May 2021, MasterClass announced a $225 million Series F round, led by Fidelity with participation from NEA and IVP, among others. This put its valuation at $2.8 billion. In April 2022, MasterClass received an undisclosed equity investment from AIkido Pharma, now trading as Dominari Holdings.

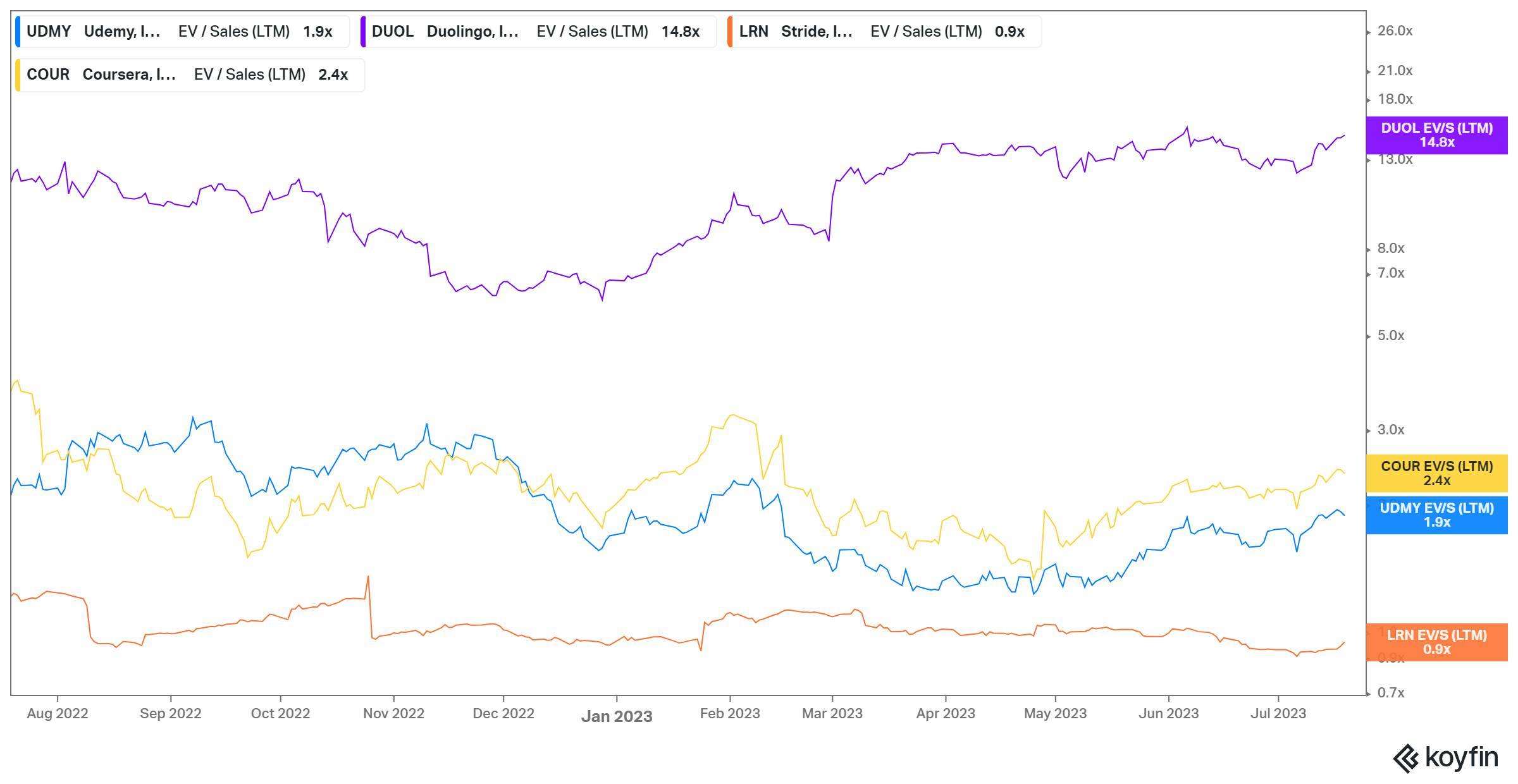

MasterClass's $100 million ARR puts it at a 27.5x revenue multiple as of 2021. In comparison, public competitors in the online learning space such as Udemy, Coursera, Duolingo, and Stride are traded at revenue multiples of ~1-15x as of July 2023.

Source: Koyfin

Key Opportunities

MasterClass at Work

MasterClass is heavily reliant for revenue on its core consumer subscriber base, who are motivated to continue subscribing with the promise of new content. The company could improve revenue and reduce the threat of churn by establishing new revenue streams, including a more substantial B2B offering.

Following its Series F round, Rogier announced that MasterClass had received interest from organizations of all sizes for a business-oriented service. With the release of MasterClass for Work, MasterClass has begun to explore B2B opportunities. Unlike its consumer subscriptions, its enterprise-focused solutions may prove to be more sticky.

In 2021, MasterClass began investing more resources in its B2B offering for enterprises, MasterClass at Work. The company began creating courses with a professional development theme that could be packaged in a corporate subscription program, but that could also be of interest to other MasterClass users, in 2022 and 2023.

According to one report, this offering was described as a “potential lifeline for the company” at internal company meetings in 2022. As of June 2024, MasterClass at Work users include notable companies such as Deloitte, PayPal, CapitalOne, Microsoft, and Square. However, in 2022, MasterClass’s corporate partnerships team reportedly did not deliver as many sales as expected. If MasterClass is able to effectively scale its B2B offering, it may prove to be a significant source of revenue and a way to mitigate churn rates as high as 52% experienced by the consumer-facing side of the business.

International Expansion

With the entire content library only being provided in English, MasterClass has a substantial opportunity for international expansion. One-third of its users as of 2021 were accessing MasterClass from outside the US. The company already offers five classes with Spanish and German subtitles as of June 2024 and could expand this number to cater to a multilingual audience. By improving access to subtitled content, and producing content specifically for non-English speaking markets, the company could tap into and expand its international subscriber base.

Expanding Content Offering

MasterClass is built around its core subscription offering. The company can leverage and expand its audience by producing different genres and formats of content while maintaining its reputation for high production values.

For example, in December 2022, MasterClass released its first Original Series franchise, featuring engaging stories from top celebrities. Instead of educational courses, the show offers similar aspirational content in a more digestible manner. MasterClass has allocated top content and film producers to lead production, including their own Chief Content Officer Len Amato, former president of HBO Films. In May 2023, MasterClass also announced the release of a new episodic series, “Mastering the Markets”, a four-part series unpacking the approaches of four Wall Street investors.

Key Risks

High Leadership and Employee Churn

Since its founding, MasterClass has seen multiple consecutive C-suite executives leave the company. The first to quit was CTO and Creative Director Rasmussen, who left in 2017 for a “much-needed break”. In 2022, Schriber, the CMO at the time, quietly left the team.

Along with the 2022 layoffs, these executive departures represent a larger underlying shift in the education market. Taylor Nieman, the founder of the language app Toucan, argues that entertainment-centric education platforms such as MasterClass may encounter issues "as so many other consumer products that try to steal time out of people's very busy days". MasterClass may be forced to change its current strategy of straddling between providing entertainment and educational value for its consumers should it seek to gain footing in either market.

Educational Value

MasterClass has received negative reviews from some users which question its educational efficacy. For example, some consumers complained about Serena Williams's tennis course, arguing it lacks the engagement expected from a sports lesson. In the course, Williams is quoted as giving advice such as "make sure you get the racket under the ball", described by some as "just technical enough to be useless to a novice and inane to anyone who has taken a tennis lesson." If MasterClass continues to target breadth over depth in its content, it may encounter difficulty retaining users seeking high-quality education.

Summary

Described by GSV Ventures managing partner Deborah Quazzo as "Hollywood meets Harvard", MasterClass has established itself as a leader in the edutainment space with an extensive online course library. By leveraging the fanbases of celebrities and public figures along with a growing class of online education customers, MasterClass has garnered interest in its online courses. As it continues to expand its platform and international reach, it can improve its offering. However, it runs the risk of offering only surface-level insights to customers who are seeking deeper education and technical knowledge. MasterClass must continue to provide engaging, high-quality content for its users while expanding its revenue streams and improving its core product.