This market map is intended to be dynamic — login to Figma to leave comments and we'll update periodically.

Definitions & Exclusions

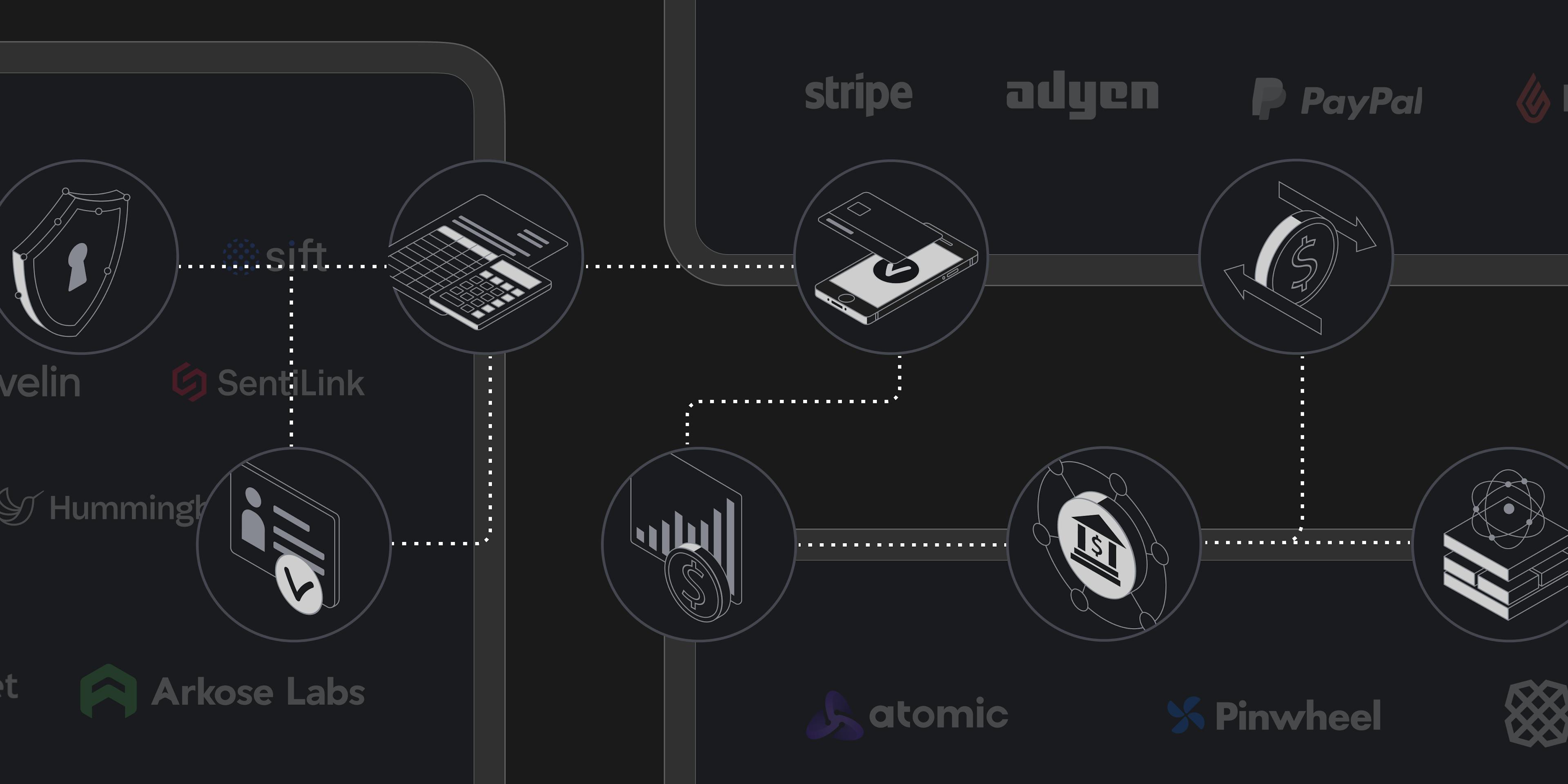

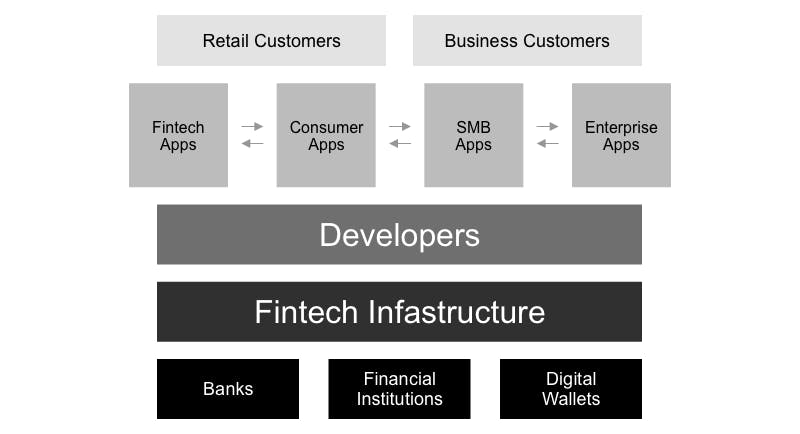

What is our view of fintech infrastructure?

Fintech infrastructure companies provide the underlying technology that enables fintech startups and traditional financial institutions to launch new products and services digitally (online or on mobile devices). Our market map excludes consumer applications unless the company also has a B2B or B2B2C solution.

What segments did we exclude?

We deliberately excluded crypto, insurance, healthcare, and CFO stack (e.g. finance and accounting). We believe those segments are financial institution adjacent and/or warrants a market map of its own.

Source: Chris McCann

Fraud Prevention & Compliance

Fraud Prevention

Forter: fraud prevention and detection for digital commerce, spanning fraud management, chargeback recovery, abuse prevention, payment optimization, and identity protection.

Sardine: an API platform for risk, compliance, and payment protection that provides KYC/AML compliance, customer onboarding, account funding fraud detection, and payment insights.

Verafin: an anti-financial crime platform spanning money laundering, fraud detection, and BSA compliance and process automation.

Shift: an AI platform for insurance decisions that supports underwriting risk detection, claims fraud, and compliance.

Riskified: a fraud management software for e-commerce companies to handle chargebacks, disputes, and PSD2 regulation.

Feedzai: an end-to-end platform for fraud and financial crime protection for retail banks, corporate banks, fintechs, and PSPs.

Comply Advantage: an AI-driven fraud and AML risk detection platform that covers transaction risks and customer onboarding.

Sentilink: a fraud and risk management platform for financial institutions with synthetic fraud scores, ID theft scores, and first-party fraud flags.

Pagos: a payments intelligence platform covering real-time payment transaction monitoring.

Callsign: an authentication platform that utilizes deep learning to provide real-time risk intelligence.

Unit21: a no-code platform spanning AML monitoring, fraud detection, compliance and risk management, and financial crime detection.

Hummingbird: a CRM for compliance and risk teams that integrates with KYC data and activity monitoring tools to support customer diligence, transaction fraud, and lending complaints.

Ravelin: an online payments fraud detection platform.

Arkose Labs: provides businesses with bot prevention and account security tools to prevent financial fraud.

ClearSale: an e-commerce fraud protection platform.

DataVisor: AI-powered fraud detection for enterprises to manage financial crime, AML, and card fraud.

Featurespace: a real-time fraud and financial crime management software.

Fraud.net: an AI-powered, full-stack fraud detection, KYC, and AML platform.

Fraugster: provides online merchants with outsourced and in-house fraud prevention services.

NetGuardians: AI-powered solutions for financial crime, payment fraud, internal fraud, and AML transaction monitoring.

Signifyd: an e-commerce fraud protection platform that covers revenue protection, abuse prevention, and payment compliance.

Sift: a payment protection platform for fintech, PSPs, and retail customers.

Identity, AML/KYC

Alloy: a global identity risk solution for banks and fintech companies to manage onboarding, fraud and AML monitoring, and credit underwriting.

HAWK:AI: an AML and fraud surveillance platform that utilizes AI for transaction monitoring, screening, and customer risk rating.

Sora: an identity verification platform that links verified user identities to portable cryptographic credentials.

Socure: an AI/ML-powered identity verification platform that handles fraud risk, compliance, ID verification, account intelligence, and KYC.

Trulioo: a global online identity platform that supports KYC, KYB, watchlist screening, and ID verification.

Prove: an identification and digital authentication platform.

GBG: a digital identity verification platform that supports data and document verification, age verification, customer onboarding, fraud prevention, KYC, KYB, and address verification.

Plaid: a data network and payments platform that covers identity verification, auth, and payment initiation.

Sumsub: an identity verification and orchestration platform.

Onfido: an AI-powered digital identity solution for global KYC and AML compliance, age and ID verification, and user onboarding.

Jumio: provides eKYC and identity solutions, AML screening, authentication, risk signals, and document verification.

Persona: an identity verification solution that manages KYC/AML compliance, KYB, fraud prevention, age verification, and re-verification.

Mitek: a no-code identity platform that supports biometric authentication, fraud detection, and identity verification.

Incode: an identity verification and biometric authentication platform for financial services, gaming, hospitality, and the public sector.

Veriff: a document and identity verification platform focused on enabling streamlined onboarding.

Middesk: a business identity verification platform for US companies to verify their commercial customers.

Detected: a white-labeled, global KYB platform.

Lucinity: an AI-powered copilot that supports transaction monitoring, risk screening, regulatory reports, and data analysis of transaction behavior.

MetaMap: a fraud and identity verification platform for fintech companies spanning KYC compliance, customer onboarding, financial risk management, and authentication.

Paywallet: a payroll-linked payment and identity solution platform for financial companies to manage credit risk.

ThetaRay: an AI-powered AML transaction monitoring and screening platform for fintechs and banks.

Fourthline: an API-first AML and KYC platform for European companies.

NorthRow: an AML compliance software platform that handles digital identity verification, KYC/KYB, customer monitoring, and AML compliance.

Income Verification & Payroll

Atomic: a provider of payroll APIs that connects consumers to their financial data for verification of income and employment, direct deposit setup, and optimizing tax withholdings.

Salsa: an embedded payroll solution for developers to integrate payroll into their products.

Pinwheel: APIs linked to payroll, income, and employment data for neobanks and fintech companies.

Check: enables companies to build a payroll product through an API-first solution.

Argyle: provides income and employment data via permissioned payroll connections.

Plaid: a data network and payments platform that covers identity verification, auth, and payment initiation.

Finch: an API platform that helps companies with organization, pay, and benefits data from payroll and HRIS systems.

Zeal: an embedded payroll API solution that provides tax management, payment processing, and pre-built components.

Truework: an income verification platform that enables organizations (from mortgage lending to tenant screening) to automatically verify customers’ income.

Truv: allows applicants to verify income, employment, assets, and insurance.

Payscore: automated income verification for consumer lenders and the real estate industry.

Tartan: an API solution that provides income and employment verification, HR/Admin consented payroll, KYC, and earned wage access.

Bud: develops an open banking platform that enables users to access data from any financial product.

Payments

PSPs & PayFacs

Stripe: a developer-oriented payments platform that enables businesses to accept and process payments instantly

Paypal: enables merchants to receive and process online transactions, and offers solutions for customers to open accounts and transfer money globally.

Braintree (a subsidiary of PayPal): a developer-friendly payment gateway that provides merchants with the ability to accept online and mobile payments.

Checkout.com: lets online merchants accept digital payments through an end-to-end solution that handles identity verification, payment processing, risk management, card issuing, and payment routing.

Adyen: provides end-to-end payment processing services and supports card issuing and payouts.

Block (formerly Square): enables brick-and-mortar business owners to accept credit card payments in-person (via its hardware processing terminals), online, or both.

NMI: a payment solution that offers an e-commerce payment gateway to support both online and card-present (retail) merchants.

Razorpay: a payment gateway and processing platform for Indian-based businesses.

Moov: an open-source acquirer processor, issuing processor, and program manager, providing ledger infrastructure with direct connections to card brands, The Clearing House, and the Fed.

Lemonway: a unified payment platform with modularized components built specifically for marketplaces.

Finix: a payment platform for merchants to create an embedded payment experience and start accepting payments via APIs.

Tilled: a PayFac as a service for online merchants spanning payments, enrollment, billing, and payment forms.

Infinicept: a payment facilitation platform that offers underwriting and merchant management solutions for vertical software companies.

Lightspeed: embedded payment processing built into POS terminals for retailers.

Rainforest: a payments-as-a-service platform (PaaS) that helps software companies “build and optimize” embedded financial services.

Bud: develops an open banking platform that enables users to access data from any financial product.

Tabapay: a payment orchestration and movement platform.

Forage: a payment processor that authenticates and processes EBT transactions.

Card Issuance

Lithic: card issuing infrastructure and creation for early-stage startups.

Marqeta: card issuing and processing for medium to large enterprises.

Highnote: a card issuing platform for debit, credit, and payroll.

Galileo: a card issuing, payments, and banking platform with integrations spanning payment processing, credit, analytics, risk management, card issuing, and lending.

Cardless: an embedded credit platform that enables companies to launch branded credit cards.

Apto: a developer-centric card issuing platform that powers physical debit cards, virtual cards, corporate cards, and crypto cards for fintech companies.

Deserve: a mobile-first credit card platform for financial institutions and fintech companies to build their own card programs.

Tandym: offers companies branded credit and debit cards.

Mercantile: partners with eye care and dental clinics to help them launch branded business cards that support group purchasing.

i2C: a no-code card issuing platform for financial institutions and fintech companies.

Wex: provides fuel cards and fleet management solutions that automate the expense tracking of fueling and service payments.

Treasury Prime: an embedded banking software that connects fintechs to a network of banks and product partners via an API to launch financial products.

Alviere: an embedded financing platform that enables customers to launch accounts, cards, global money transfers, and other financial products.

Thredd: a payment processing and card issuing platform.

International

Cross-border

Airwallex: a payments platform for businesses to manage their global payments and finances.

Payoneer: a cross-border online payments platform for freelancers and businesses.

Thunes: global payment infrastructure that enables businesses to accept and receive multi-currency payments via an API-first solution.

Nium: real-time payments infrastructure that covers global payouts, card issuance, local checkout, and global banking accounts.

Flutterwave: a payments platform that enables businesses to accept payments globally.

Wise Platform: a cross-border payments infrastructure platform for banks and non-banks to offer local FX rates to their customers to send and receive money.

Paytrix: an API-first payments infrastructure platform for businesses to accept payments locally and reduce FX exposure via a real-time rates API.

PingPong: a global cross-border payments platform.

TransferMate: global payments infrastructure for banks, fintechs, and software providers.

Brightwell: a cross-border payments solution that allows fintech companies and sponsor banks to enter or expand into the global remittance space.

Tazapay: a cross-border payments platform for global platforms that cover escrow, treasury solutions, and checkout.

Keeta: a payments platform for fintech companies and financial institutions to send and receive international payments via an API-first solution.

Payall: global banking infrastructure for cross-border payments designed for regulated banks.

Verto: a B2B payments platform for SMEs in Africa and the Middle East to make payments to their suppliers.

Local Payments

dLocal: cross-border payment processor that connects global merchants to emerging markets.

Rapyd: a fintech platform that enables businesses to accept, send, and hold funds globally.

PPRO: provides digital payments infrastructure to businesses and banks covering checkout, acquiring, and risk services.

NomuPay: enables local payment acceptance and payout disbursements in Southeast Asia, Europe, and Turkey.

Routefusion: global payments infrastructure for businesses to build financial products and internal treasury operations.

Lending

Embedded Lending

Lendflow: an embedded credit platform for fintech companies, lenders, and SaaS companies to build and embed credit products.

Jaris: a full-stack, embedded product that spans legal, compliance, licensing, underwriting, servicing, financing, and risk management.

Vaya: an embedded credit API that enables companies to offer contextualized credit products to customers.

Banxware: provides embedded lending technology that allows marketplaces and other aggregators like PSPs to offer financing to businesses.

Kanmon: an embedded lending platform that enables practice management firms to offer term loans and lines of credit.

Parafin: an embedded financing infrastructure for companies to manage merchant financing and growth capital.

YouLend: partners with e-commerce platforms, tech companies, and PSPs to offer embedded merchant financing.

Mambu: the platform enables customers to offer lending solutions, mortgage solutions, business banking, deposit solutions, and more.

R2: enables technology platforms to offer financing to their SMB buyers and sellers in Latin America.

Sivo: a debt and credit-as-a-service platform that provides up to $20 million in capital.

Defacto: embedded credit infrastructure that helps companies offer credit products to their customers.

Lentra: an embedded lending-as-a-service platform for commercial banks.

Working Capital

Resolve: a platform that enables B2B deferred payments for manufacturers, wholesalers, and distributors.

Balance: a provider of one-click checkout software for B2B marketplace payments that supports instant payouts, automatic reconciliation, compliance infrastructure, and credit + net terms management.

Slope: enables businesses to offer consumer-grade payments to business buyers and it handles payment acceptance, order tracking and lifecycle, and reconciliation.

Settle: payment products built for CPG brands to receive AI-powered underwriting and non-dilutive capital.

Capchase: a financing platform for SaaS founders to access revenue-based financing to offer customers flexible payment terms (monthly, biannually, or annually).

CreditKey: a BNPL option that provides businesses with instant credit decisions, 12-month installments, and POS integrations to offer customers.

Wisetack: enables businesses to offer financing solutions to customers in the in-person services industry.

Oatfi: empowers platforms with end-to-end infrastructure to embed working capital tools in payment flows.

Fundbox: an embedded working capital platform for small businesses, offering loans, financial products, and financial tools.

Hokodo: provides B2B buy now, pay later solutions to businesses in order to help companies manage their cash flow.

Billie: provides B2B marketplaces and other platforms with financing and insurance solutions.

Two: a B2B BNPL solution that enables businesses to offer credit at checkout with different payment options, including installments.

Kontempo: enables B2B businesses to offer BNPL and installment plans to customers via a white-label payment method solution.

Mondu: a BNPL for B2B solution for merchants and marketplaces to offer customers net terms and installment payments.

Rupifi: a B2B credit platform for marketplaces to offer their merchant partners working capital.

Origination & Servicing

DigiFi: an end-to-end loan origination system that streamlines the lending journey.

Vesta: a loan origination system that enables lenders to build customized workflows.

Scratch: a loan servicing platform to help borrowers understand and repay their loans while helping lenders with loan servicing.

Canopy: an API platform for loan management and servicing that handles loan processing and statements, callback automation, and disputes and reversals.

Peach: an API-first loan management and servicing platform.

Method: a loan management application providing services including debt repayment, mortgage underwriting, money transfer, personal finance, and mortgage originators.

Spinwheel: enables companies to embed consumer debt solutions in their applications.

Blend: a white-label software platform that powers mortgage applications by handling origination, verification, and closing.

Valon: cloud-based mortgage servicing that automates payments and allows borrowers to access information about their loans.

Vontive: an embedded mortgage platform for investment real estate that handles mortgage office, loan origination, and servicing.

Capital Markets

Trading

Apex: a suite of innovative technology solutions, including clearing and custody, institutional clearing, and crypto trading.

Drive Wealth: a brokerage platform that provides an API for global fintech companies, brokers, and advisors to access the US securities market.

Atomic Invest: an integrated investment platform that allows fintechs, banks, and consumer-facing companies to offer investing experiences to their customers.

Clear Street: a prime brokerage platform that provides clearing and custody solutions for market participants.

Moment: fixed-income infrastructure via APIs that cover automated execution, risk management, and data and analytics.

Alpaca: APIs that allow developers and businesses to build apps and embed investing and trade algorithms.

Upvest: APIs that allow financial platforms to offer digital securities to retail investors.

lemon.markets: APIs that support creating and executing orders at the stock market and retrieving market data.

Tradier: offers a set of fully hosted APIs for stocks, options, ETF trading, and market data feeds.

Stockal: a brokerage platform that enables cross-border savings and investments for retail investors.

WealthKernel: an infrastructure-as-a-service platform that enables companies to offer digital investing experiences and handles client onboarding, trading, portfolio management, and custody.

Capitolis: a capital marketplace that drives financial resource optimization for market participants.

Credit & Deposits

Setpoint: an operating system for capital markets functions within real estate and asset-backed lending.

Finley: simplifies debt capital raise and management by automating due diligence, ensuring compliance, and streamlining ongoing reporting with capital providers.

CredCore: credit management for CFOs, treasurers, capital markets teams and debt and equity fund managers.

Percent: platform for sourcing, structuring, syndicating, monitoring, and servicing private credit transactions.

Modernfi: provides end-to-end deposit management to banks, helping institutions understand deposit stability, manage balance sheet size, and source funding on demand.

Alternative Investments

CAIS: platform connects independent financial advisors with alternative asset managers, enabling them to engage and transact.

iCapital: offers qualified investors access to a curated menu of strategies across the private equity life cycle.

The Coterie: lending and investment platform that provides financial products covering lending to investments to estate planning to secondary lending and pre-IPO company investing.

Allocate: digital investment platform that unlock access to a network of exclusive investment opportunities in the private markets.

Fundthrough: automates the subscription process for private funds.

+Subscribe: enterprise software solution providing electronic subscription document technology and an order management system for alternative product transactions.

Anduin: financial services platform that provides fund subscriptions and other cloud services to streamline, track, and expedite financial transactions in private markets.

Yubi: a platform that helps discover, trade, execute, and fulfill debt solutions for investors.

Calastone: solutions that automate steps in the trading process for funds, supporting fund managers, distributors and asset servicers.

Brassica: an API-first investment infrastructure platform for alternative assets.

Open Banking / Payment APIs

Plaid: a data network and payments platform that covers identity verification, auth, and payment initiation.

Modern Treasury: a payments operating system that utilizes APIs to help finance teams move money and streamline payment processes.

Truelayer: a payment network built on an open banking API that handles instant bank payments, payouts, variable recurring payments, and streamlined onboarding.

Yapily: an open banking platform that allows companies to initiate payments and offers financial data, account validation, payment, bulk payment, and virtual accounts.

Narmi: an API-driven platform that grants financial institutions access to financial products including consumer account opening, digital banking, business banking, and analytics.

Banked: provides an A2A payment software platform offering an alternative to card schemes.

Teller: APIs to verify account details, move money, make payments, and view transactions.

MoneyKit: platform designed for single-place financial profiles by connecting APIs and institutions.

Ibanity (a subsidiary of Isabel Group): APIs that allow businesses’ customers to initiate payments, fetch account information, send and receive digital invoices, and manage and use their corporate identity.

Saltedge: open banking API solutions that provide businesses with access to 5000+ banks globally.

NovoPayment: an API-based platform that provides digital banking, payment infrastructure, and card solutions throughout the Americas.

Moov: an open-source acquirer processor, issuing processor, and program manager, providing ledger infrastructure with direct connections to card brands, The Clearing House, and the Fed.

Sila: an API that enables the flow of funds through ACH payments, KYC/KYB verification, card-acquiring capabilities, settlements, and wire transfers.

Modulr: embedded payments platform for digital businesses to automate and embed payments

Fidel API: global financial infrastructure platform that enables developers to build programmable experiences when a transaction occurs.

Gr4vy: an API-based payments platform for businesses to deploy, manage, and customize their payments.

Dwolla: a white-label payment service provider that covers A2A payments, enabling businesses to automate money movement.

Volt: a real-time payment network that creates a single gateway to global A2A payments.

Orum: an API solution for payouts and A2A transactions that lets companies access RTP, FedNow, same-day ACH, and wires.

Kevin: a white-label, brand-agnostic A2A payments acceptance network.

Astra: an API-first solution that enables businesses to process transfers between bank accounts and cards.

Numeral: a payment automation API for financial institutions, digital firms, and businesses.

Transaction Enrichment

Spade: APIs that enrich transaction data to include locations, logos, normalized merchant names, and categories.

Prism Data: B2B data infrastructure and analytics that provides cash flow underwriting technology to build products and make credit decisions.

ntropy: financial data standardization and enrichment API.

Pave: cashflow intelligence technology designed to identify healthy borrowers, optimize credit limits, and improve collections outcomes.

Heron Data: APIs that enables lenders to underwrite small businesses by categorizing bank transactions with ML, enabling faster lending decisions.

MX: MXdata for Business leverages ML built to identify, cleanse and categorize business transaction data.

Plaid: a data network and payments platform that covers identity verification, auth, and payment initiation.

Saltedge: open banking API solutions that provide businesses with access to 5000+ banks globally.

Personetics: the company’s product uses AI to analyze bank's customer transaction data in real-time and use this analysis to deliver financial management information

Banking-as-a-Service

Licensed Bank

ClearBank: an intermediary platform that provides transactional solutions while acting as a functioning bank.

Column: an infrastructure bank that enables developers and businesses to launch new financial products.

Cross River: API-driven banking infrastructure embeds financial services across industries and provides support for regulatory compliance.

Green Dot: a platform that provides end-to-end infrastructure for managing a banking or payments program at scale.

BBVA: A digital banking platform that allows third-party platforms to access identity verification, account origination, and card issuance solutions

Griffin: a BaaS platform that enables companies to embed financial products into their apps via APIs.

Solaris: a BaaS platform for European companies to implement digital banking, payments, lending, and identification management.

Starling Bank: a BaaS platform that handles AML, KYC, and scheme compliance to enable companies to launch financial products.

Middleware

Treasury Prime: an embedded banking software that connects fintechs to a network of banks and product partners via an API to launch financial products.

Synctera: a BaaS platform for businesses to build and launch compliant bank accounts, debit cards, charge cards, and lending products.

Synapse: a BaaS platform that enables global companies to launch deposit and credit products.

Unit: a BaaS platform for tech companies to embed financial products and features into existing platforms.

Helix (by Q2): a BaaS platform that enables fintechs, technology companies, consumer brands, and financial institution partners to embed banking into their ecosystems.

Finastra (via FusionFabric.cloud): a BaaS provider offering FusionFabric.cloud, an open developer platform, and an app marketplace through its FusionStore.

Galileo: a card issuing, payments, and banking platform with integrations spanning payment processing, credit, analytics, risk management, card issuing, and lending.

Treezor: an API-based white-label core banking platform that operates both receiving and issuing payments and covers the full payments scope.

Bankable: a white-label and API-based payment platform covering virtual ledger manager, digital banking, payment card programs, and e-wallets.

Solid: BaaS infrastructure that enables companies to build and launch fintech products quickly.

Omnio: a BaaS platform that offers a modular solution that supports the accounts of record through to operations, regulatory reporting, and compliance for banks and corporates.

Productfy: a BaaS platform handling digital banking, branded card programs, secured charge cards, and disbursements.

Swan: a BaaS platform for companies to embed white-label banking features like accounts, cards, and payments via an API.

BKN301: Baas platform, Payments-as-a-Service, card issuing and digital wallet with a B2B2C business model.

Agora: provider of digital platform banking solutions.